What this means for your day-to-day operations

Whether you sell one parcel per day or one pallet per hour, the mechanics of compliance are similar. The winners will be those who standardise data at source and design a great buying experience around the new reality.

- A) Get serious about classification and valuation

Correct HS code assignment, transparent valuation (price, discounts, assists) and consistent origin statements are now non-negotiable. The fastest way to reduce interventions is to eliminate inconsistency between your product catalogue, invoices and shipping data. If your UK processes for export declarations and your US broker’s import data are fed from different masters, fix that now.

- Build a controlled HS catalogue with owner approvals and version history.

- Tie products to evidence (rulings, supplier specs) to defend your choices.

- Break out charges (freight, insurance) as US valuation rules require.

Shift from DDU/DAP to DDP

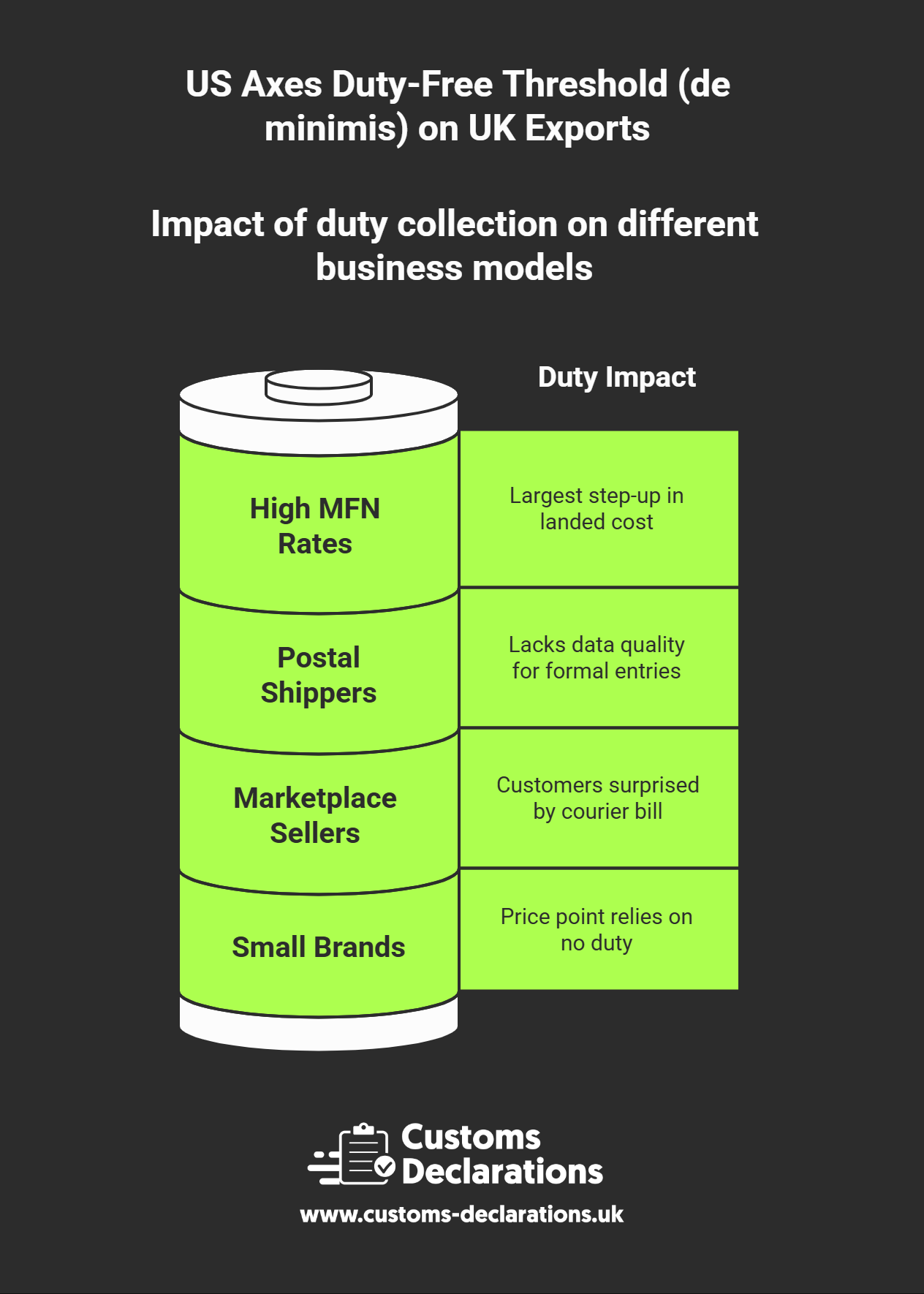

“Duties unpaid” might have been tolerable when 90% of parcels slipped through. In the new world, it translates into surprise fees, delivery holds and customer dissatisfaction. A Delivered Duty Paid (DDP) model—where you calculate and collect duty and taxes at checkout and pay them on the buyer’s behalf—is the most customer-friendly path.

- Use a checkout module that supports reliable landed-cost calculation.

- Integrate with your carrier or broker so the correct duty is remitted seamlessly.

- Display the total price transparently at checkout to protect conversion rates.

Consider US fulfilment for scale

Brands with sustained US demand should revisit 3PL fulfilment inside the United States. Importing inventory in bulk on a formal entry and then shipping domestically removes per-parcel duty interactions and compresses delivery times. It also improves returns processing. This is not a free lunch—you will pay duty on the inbound bulk shipment and hold inventory in the US—but for volume sellers it often improves experience and unit economics versus thousands of dutiable cross-border parcels.

Upgrade your customs tech stack

Even if a broker submits your US entries, your source data determines whether filings are accurate. Standardise and validate the data you create in the UK for customs declaration workflows so it can be reused for US filings with minimal rework. For the UK side, modern tools that handle CDS declarations, import declarations, export declarations and even ENS declarations will raise data quality across your whole operation. If you need a practical place to start, explore the CDUK digital customs platform and the CDUK Knowledge Base.

Educate customers—fast

Update product pages, shipping FAQs and order confirmation emails. Tell US buyers what will happen at checkout, whether you are collecting duties (DDP), and what delivery timelines look like under the new system. Clear communication reduces cancellations and supports review scores.