Cross-border trade is no longer just about containers, pallets, and stamps. Increasingly, what moves is data—software updates instead of discs, electronic bills of lading instead of paper originals, signed PDFs instead of wet-ink contracts. Over 2024–2025, negotiators at the World Trade Organization (WTO) converged on a stabilised text for a new e-commerce agreement that many are calling a global “digital rulebook”. For internationally focused companies—especially in the UK, where digital services are a major export—the implications are practical and immediate: fewer paper requirements, lower risk of new digital tariffs, and a faster, clearer path for legally valid electronic contracts and documents across borders.

This guide explains what the agreement actually covers, how it dovetails with the UK’s own digital trade reforms, and—critically—what steps businesses should take now. We keep the focus on operations: contracting, onboarding, documentation, and filings (from customs declaration workflows to CDS declarations, import declarations, export declarations, and ENS declarations) so you can turn policy into predictable, day-to-day process.

What the WTO e-commerce agreement is—and why it matters

The WTO’s e-commerce talks sit under a “Joint Statement Initiative” (JSI) joined by a large group of economies that together account for the vast majority of world trade. The stabilised text agreed among participants focuses on making cross-border electronic transactions more seamless and predictable. Think of it as a harmonised baseline that addresses the realities of digital trade without forcing every country to adopt identical systems.

The central promise is simple: do not discriminate against the digital form. If a contract or signature would be valid on paper, the digital version should receive equal legal respect. If a message, invoice, or document is sent electronically, you should not face arbitrary rejection purely because it is not paper. And if a product is transmitted electronically—software, designs, media—the transmission itself should not become a new target for customs duties among participating countries.

For companies that move at internet speed, this is more than legal housekeeping. It translates into fewer courier runs, shorter sales cycles, faster cash collection, fewer disputes about “real” originals, and reliable pricing for digital exports that will not be undercut by new border taxes.

The pillars you need to understand

1) A binding “no customs duties on electronic transmissions” rule among parties.

Since 1998, WTO members have renewed a temporary moratorium on customs duties applied to electronic transmissions. The new agreement aims to make a no-duties commitment binding among its participants. That provides long-term certainty for software downloads, streaming, digital blueprints, CAD files, and other digitised products. Bottom line: no “surprise tariffs” on the transmission itself in participating markets, which stabilises international pricing and margins for digital products and content.

2) Legal recognition of e-signatures, e-authentication, and e-contracts.

Parties commit not to deny legal effect or enforceability solely because a signature is electronic or a contract was concluded online. This doesn’t eliminate performance or assurance standards (e.g., advanced/qualified signatures for certain high-risk contexts), but it means the format is no longer a reason to refuse. It removes a persistent source of friction in cross-border deals.

3) Paperless trading, e-invoicing, and Single Window interoperability.

The agreement encourages governments to accept trade documents electronically, align e-invoicing with international standards, and improve interoperability of national “single window” systems for border submissions. The practical effect: fewer format disputes, less rekeying, faster throughput at the border when your data is correct and machine-readable.

4) Trust, safety, and inclusion.

Provisions address consumer protection (misleading practices, spam), cybersecurity cooperation, and support for MSMEs. None of these replaces domestic law; rather, they encourage compatible baselines so the internet remains a viable market for smaller exporters and service firms.

5) Respect for domestic regulatory safeguards.

The agreement is pragmatic. It does not erase national rules on privacy or security; it seeks a workable balance that enables digital trade while allowing governments to uphold legitimate public-policy objectives. For businesses, that means opportunity plus responsibility: you get a more open playing field, but you still need strong compliance and data-governance.

How the global rulebook meets UK law—and why UK firms can move first

The UK is unusually well-placed to benefit. Two domestic reforms are especially important:

- Electronic Trade Documents Act 2023 (ETDA): puts specified trade documents (e.g., bills of lading, warehouse receipts) in digital form on the same legal footing as paper, as long as they’re created and managed by a “reliable system.” In practice, that unlocks paperless high-value trade documents under English law—something the WTO e-commerce text explicitly encourages through “paperless trade” commitments.

- UK eIDAS framework and established e-signature law: e-signatures (from simple to advanced/qualified) are recognised in UK law, with trust-service providers supervised to clear standards. This aligns with the agreement’s “no denial of legal effect” principle for e-signatures.

Together, these measures mean UK companies can implement the benefits of the WTO rulebook today—internalising the efficiencies before the agreement even enters into force among a first wave of participants.

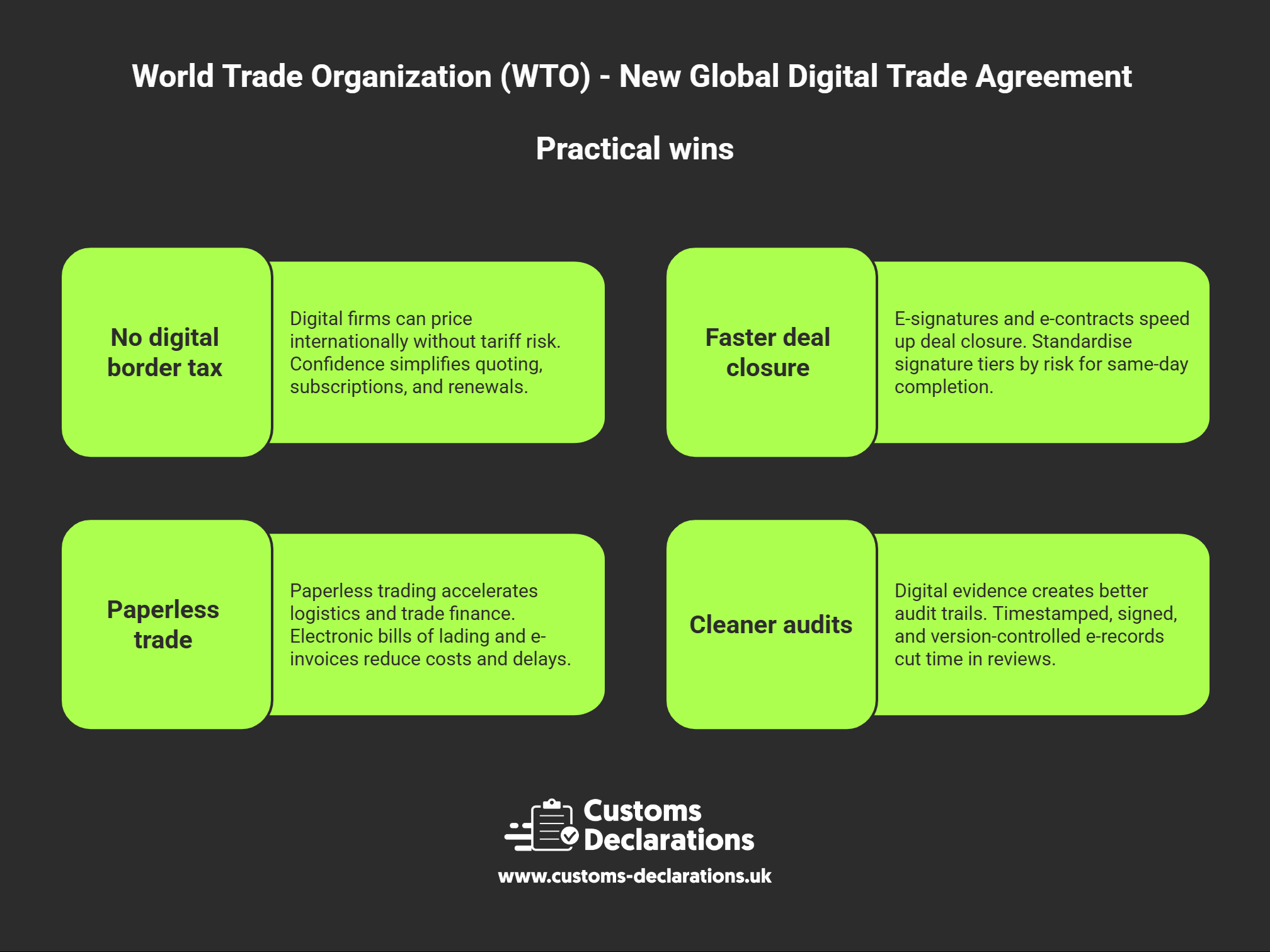

Practical wins you can bank—contracting, onboarding, and cash

No digital “border tax” risk in participating markets.

Digital firms (SaaS, gaming, media, design, consultancy) can price internationally without building tariff risk into contingencies for the transmission itself. That confidence simplifies quoting, subscriptions, and renewals.

Faster deal closure with cross-border clients.

When a client’s legal team cannot reject e-signatures or e-contracts purely for being digital, cycles compress. Your contract lifecycle management (CLM) can standardise signature tiers by risk (simple for NDAs, advanced for commercial agreements, qualified for regulated activities) and move to same-day completion across time zones.

Paperless trade for the physical leg.

As paperless trading spreads, logistics and trade finance accelerate. ETDA-compliant electronic bills of lading can be transferred instantly; e-invoices ride structured rails; single windows accept digital submissions. For importers and exporters, that reduces courier costs, document loss, and mismatch delays in letters of credit.

Cleaner audits with digital evidence.

Timestamped, signed, and version-controlled e-records create better evidential trails for compliance, tax, and customs audits—cutting time in reviews and disputes.

Turning policy into process: where to upgrade your operating model

1) Contracting and signature policy.

Map contract types to signature assurance levels and identity checks. Build that logic into your CLM. Train commercial teams to default to e-signatures with clear exceptions. Use time-stamps, sealed evidence bundles, and audit logs to support enforceability.

2) Trade documentation and record-keeping.

Digitise the “operating spine” of trade paperwork. Adopt ETDA-compliant platforms for negotiable documents, standardise e-invoices in a machine-readable format, and align master data (counterparty identifiers, product catalogues, quantities, units) so what the warehouse, finance, and customs teams see is identical.

3) Customs and border filings by design.

Move to structured, validated data flowing straight into your customs declaration submissions. The easiest way to cut holds and rework is to eliminate inconsistent data at source. If your team needs a practical system for CDS declarations, import declarations, export declarations, and ENS declarations, the CDUK digital customs platform is designed to capture data once and reuse it across filings; the CDUK Knowledge Base offers step-by-step guidance that aligns with UK practice.

4) Evidence and identity.

For higher-risk contracts or sensitive exports, step up identity proofing around e-signatures (e.g., advanced/qualified signatures, verified identities, multi-factor authentication). Store hashes and certificates with the executed document for future audits.

5) Interoperability and partner enablement.

Agree formats with suppliers and customers for e-orders, e-invoices, shipping notices, and proofs of delivery. Interoperability today determines your speed tomorrow.

Frequently Asked Questions

What does a “ban on customs duties on electronic transmissions” actually cover?

It covers the transmission itself (the bits, not the boxes): software downloads, media streams, e-books, training modules, CAD files, and similar. Physical goods ordered online are still subject to normal customs and VAT rules at the border.

Are e-signatures now valid everywhere for everything?

The agreement prevents parties from rejecting a signature just because it is electronic. Countries can still set assurance levels for specific contexts (e.g., government tenders, high-risk financial contracts). In the UK, e-signatures are already lawful; apply more robust assurance where the risk warrants it.

Will this change how we handle customs for goods?

No. Goods follow existing border requirements. The agreement helps with paperless processes (accepting electronic documents), which indirectly speeds physical trade, but it does not zero-rate duties on goods. You still need accurate import declarations, export declarations, and ENS declarations filed on time and in the correct data structure.

How does this help small and medium-sized enterprises?

SMEs suffer most from courier costs, wet-ink delays, and legal uncertainty across borders. Recognised e-contracts and paperless trading compress timelines and costs, lowering the barrier to exporting services or digitised products.

A focused 90-day plan to get ready

Week 1–2: Baseline and policy.

Inventory your contract types, trade documents, and border filings. Draft an e-signature policy mapping assurance to risk. Identify which documents can move under ETDA and which require upgrades.

Week 3–6: Pilot paperless trading on one lane.

Select a predictable import or export route. Use e-invoices, e-signatures, and a digital bill of lading where appropriate. Pre-lodge clean CDS declarations and ENS declarations directly from your source data. Track cycle time, rework, and courier spend.

Week 7–10: Scale contract digitisation.

Roll your e-signature policy across sales and procurement; embed standard evidence packets (signing certificates, timestamps, hash values). Update terms and conditions to recognise e-documents and set evidential expectations.

Week 11–13: Harden the spine.

Automate checks for master-data consistency (names, addresses, HS codes, units). Ensure storage, access control, retention, and encryption meet your audit and regulatory requirements.

Week 14+: Industrialise.

Extend to adjacent lanes and product families. Refresh SOPs, train teams, and formalise a governance cadence (monthly metrics for cycle time, rejection rate, and audit findings).

What to watch in 2025–2026

Agreement ratifications and first-wave entry into force.

Monitor which partner countries lock in the e-commerce agreement first. If you sell digital products or services, prioritise those markets for expansion: your margin risk from digital duties falls to near-zero and contract acceptance becomes smoother.

Single window and paperless-trade implementation.

As government systems accept and prefer electronic documents, early-mover traders will enjoy faster clearance—provided their data are clean, structured, and pre-lodged.

Corporate policies catching up with law.

Your counterparty’s legal team may have legacy templates requiring paper signatures “just in case”. Use the agreement’s logic—and the UK’s ETDA—to push for digital-by-default with risk-based exceptions.

Customs automation gains.

As public systems modernise, traders who already standardised and validated their filing data will see fewer interventions. Embedding a robust process for customs declaration data today is the fastest route to benefits tomorrow.

The big picture: Speed, certainty, and trust—by design

The promise of the new WTO digital rulebook is not theoretical. It is a practical shift from form to function: if the contract is authentic, if the document is reliable, if the transmission can be verified, then the format should not slow you down or add cost. For global businesses, that means speed (shorter cycles), certainty (no digital transmission tariffs among signatories), and trust (consistent acceptance of e-signs and e-docs).

But the rulebook is only half the story. The other half is execution: cleaning master data, adopting reliable e-document systems, and automating your border submissions so filings (from import declarations and export declarations to CDS declarations and ENS declarations) are accurate the first time. When you do that, the policy tailwind becomes a measurable P&L impact—less friction, less rework, more sales closed, and cash collected sooner.

For an operational head start, explore the CDUK digital customs platform for automated declarations and the CDUK Knowledge Base for practical guidance that aligns with UK rules. If you want to follow the multilateral track, the WTO’s e-commerce page is the canonical reference for the agreement’s scope and progress.