Importing toys from China to the United Kingdom represents one of the most significant trade flows in the global toy industry. China manufactures approximately 86% of the world’s toys, offering UK importers competitive pricing, extensive product variety, and established manufacturing capabilities. However, toys remain one of the most heavily regulated product categories in the UK due to stringent safety requirements designed to protect children. Successfully importing toys requires understanding complex regulatory frameworks, maintaining rigorous compliance standards, and managing accurate customs procedures. This guide provides UK businesses with an end-to-end roadmap covering product safety, conformity marking, customs classification, import costs, and the critical process of filing customs declarations through modern platforms.

Understanding the UK Regulatory Framework for Toys

The foundation of toy regulation in the UK rests on the Toys (Safety) Regulations 2011, which governs all toys designed or intended for use in play by children under fourteen years of age. These regulations establish comprehensive requirements covering mechanical and physical properties, chemical composition, flammability, electrical safety, hygiene, and radioactivity. As the UK importer, you assume the legal responsibility of the manufacturer under UK law, meaning liability for unsafe products rests entirely with your business regardless of where the goods were manufactured. This principle places immense importance on supplier verification, documentation retention, and conformity assessment procedures. Failure to comply with these regulations can result in goods being detained at the border, product recalls, financial penalties, and in severe cases, criminal prosecution. Market surveillance authorities actively monitor compliance through document checks, physical inspections, and post-market surveillance activities, making regulatory adherence not merely advisable but legally essential.

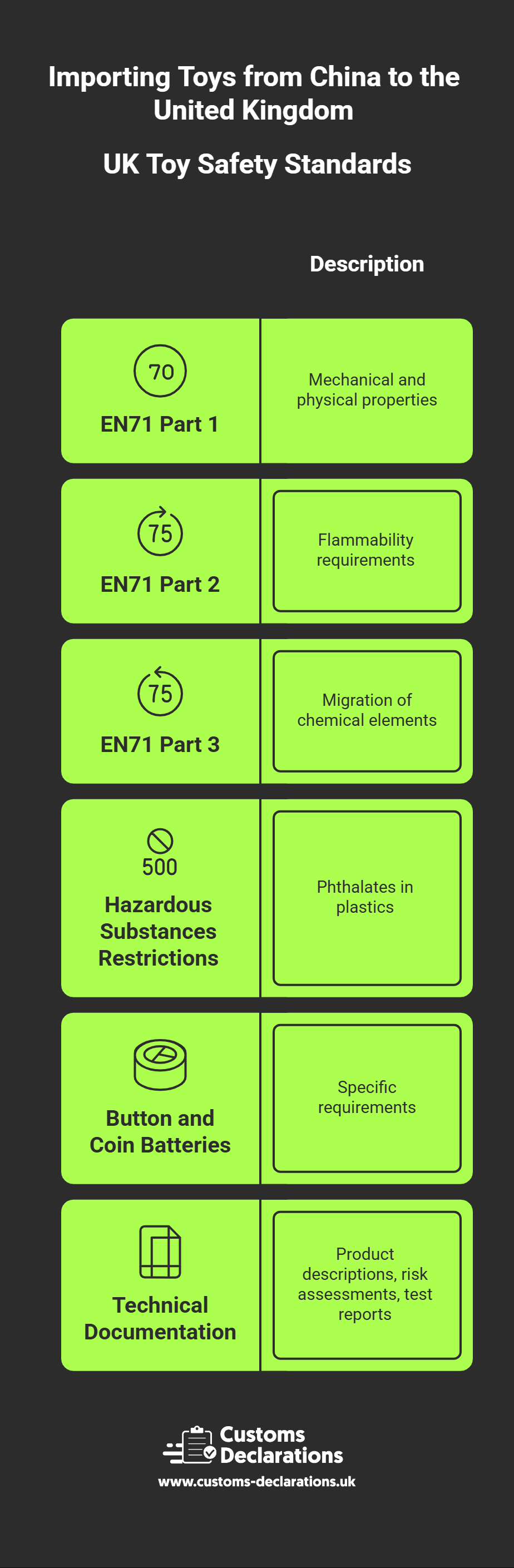

Product Safety and Compliance Requirements

UK toy safety standards are built on the EN71 suite of standards, which constitute the technical foundation for demonstrating compliance with essential safety requirements. EN71 is divided into multiple parts, each addressing specific hazards associated with toy products. Part 1 covers mechanical and physical properties, ensuring toys do not present choking hazards through small parts, sharp edges, or points that could injure children. Part 2 addresses flammability requirements, establishing strict criteria for how quickly materials can ignite and burn. Part 3 deals with the migration of certain chemical elements including lead, arsenic, cadmium, mercury, and other toxic substances that could transfer to a child’s body through normal play activities. Additional parts cover chemical toys, electrical properties, and specific product categories such as finger paints and activity toys. Beyond EN71, toys must also comply with restrictions on hazardous substances including phthalates in plastics, and must meet specific requirements for button and coin batteries, which present significant ingestion hazards to young children. The technical documentation supporting these standards must include detailed product descriptions, risk assessments, test reports from accredited laboratories such as SGS, Intertek, or TÜV, and manufacturing process information. This documentation must be maintained for ten years after the toy is placed on the market and made available to UK authorities upon request.

CE Marking and UKCA Marking: Current Requirements

One of the most significant developments for UK toy importers concerns conformity marking requirements. Following Brexit, the UK introduced the UKCA marking to replace the CE marking for products placed on the Great Britain market. However, in August 2023, the UK government announced a critical policy reversal that fundamentally changed the compliance landscape. The government now recognizes CE marking indefinitely for toys and seventeen other product categories, removing the previous December 2024 deadline for mandatory UKCA adoption. This means UK importers have permanent flexibility to use either CE marking or UKCA marking when placing toys on the Great Britain market. The indefinite recognition applies specifically to toys covered under the Toys (Safety) Regulations 2011 and provides businesses with significant operational flexibility. Importers can continue accepting CE-marked toys from Chinese suppliers without requiring separate UKCA certification, reducing compliance costs and simplifying supply chain management. However, it remains important to note that Northern Ireland continues to follow EU rules under the Windsor Framework and requires CE marking for toys placed on the Northern Ireland market. The conformity assessment procedures for both CE and UKCA marking remain substantially similar, involving hazard analysis, testing against designated standards, compilation of technical documentation, and issuance of a Declaration of Conformity. The importer must ensure their UK business name and address appears on the product, packaging, or accompanying documentation, fulfilling traceability requirements that enable authorities to identify responsible parties should safety issues arise.

Sourcing Reliable Suppliers from China

China’s toy manufacturing sector is geographically concentrated in specialized industrial clusters that offer distinct advantages for different product categories. Chenghai in Shantou is renowned as the “Toy Capital of the World” and specializes in remote control vehicles, plastic toys, and electronic gadgets. Yangzhou focuses on soft toys and plush products, offering sophisticated textile manufacturing capabilities. Yiwu hosts the world’s largest wholesale market for small commodities including novelty toys and low-cost items, though importers should exercise heightened due diligence when sourcing from this market due to variable quality standards. When evaluating potential suppliers, importers should request existing EN71 test reports that demonstrate the supplier’s experience manufacturing for European markets. Verification of business licences, factory certifications such as ISO 9001, and customer references provides essential insight into supplier reliability and capability. Physical factory inspections or third-party audits through organizations like SGS or Bureau Veritas offer independent verification of manufacturing conditions, quality control systems, and compliance infrastructure. Importers should also clarify whether they are dealing directly with factories or through trading companies, as each arrangement carries different implications for pricing, minimum order quantities, and communication effectiveness. Establishing clear contractual terms that specify UK compliance requirements, testing protocols, and liability provisions protects importers from suppliers who may lack full understanding of UK regulatory obligations.

Classification and Commodity Codes

Accurate customs classification forms the foundation of compliant import procedures and directly determines applicable duty rates, import controls, and statistical reporting requirements. Toys are primarily classified under Chapter 95 of the UK Integrated Tariff, specifically under heading 9503 for toys other than dolls and reduced-scale models. The commodity code system extends to ten digits in the UK, providing granular classification for different toy types including wheeled toys, dolls representing human beings, puzzles, construction sets, electronic toys, and other toys. Classification depends on the toy’s principal function, construction materials, and intended use. For example, plush toys are classified differently from electronic learning toys, and remote-controlled vehicles fall into distinct subheadings from simple construction blocks. Misclassification represents one of the most common errors in toy imports and can trigger customs delays, post-clearance audits, and financial penalties. When classification is uncertain, importers should request a Binding Tariff Information ruling from HMRC, which provides legally binding classification guidance valid across all EU member states. Maintaining detailed product descriptions, technical specifications, and images in your compliance files supports consistent classification decisions and provides defensible evidence during customs inspections or audits. The classification drives not only duty calculations but also determines whether specific import licences, certificates, or additional documentation may be required for specialized toy categories.

Customs Valuation and Import Costs

Understanding the full landed cost of toy imports requires careful calculation of multiple cost components that together determine the final price of goods delivered to UK warehouses. Customs valuation begins with the transaction value method, which uses the price actually paid or payable for goods sold for export to the UK. This customs value must include the cost of goods from the supplier, international freight costs to the UK border, insurance costs, packing materials, and any other charges that are conditions of sale. Costs incurred after the goods arrive in the UK, such as domestic delivery, installation, or training services, should be excluded from the customs value. Most toys imported from China benefit from zero percent customs duty under the UK Global Tariff, making imports financially attractive compared to products from countries facing higher duty rates. However, importers must verify the specific duty rate applicable to their precise commodity code, as rates can vary for specialized toy categories. Import VAT applies at the standard UK rate of twenty percent and is calculated on a duty-inclusive base comprising the customs value plus any applicable customs duty and other charges. For VAT-registered businesses, Postponed VAT Accounting offers significant cash flow advantages by allowing importers to account for import VAT on their VAT return rather than paying it upfront at the border. This mechanism eliminates the need for substantial cash outlays that would otherwise tie up working capital between import and VAT recovery. Importers should prepare detailed valuation worksheets showing the breakdown of all cost components, ensuring transparency and consistency across commercial invoices, shipping documents, and customs declarations.

Shipping and Logistics Considerations

Selecting appropriate shipping methods balances cost efficiency, speed, and product protection throughout the journey from Chinese factories to UK distribution centers. Sea freight remains the standard choice for most toy imports, offering favorable economics for bulk shipments despite longer transit times of thirty-five to forty-five days. Importers can choose Full Container Load arrangements when order volumes justify dedicating an entire container, typically resulting in the lowest per-unit shipping costs. Less than Container Load options allow smaller importers to share container space with other shippers, making sea freight accessible for lower volume orders at moderately higher cubic meter rates. Air freight provides rapid delivery of three to seven days, making it suitable for high-value items, urgent Christmas stock replenishment, or products with short life cycles. However, air freight costs significantly exceed sea freight rates and is generally reserved for specific strategic situations rather than routine shipments. Rail freight via the Eurasian land bridge offers a middle option with transit times around twenty days and costs between sea and air options. Incoterms define the precise allocation of costs, risks, and responsibilities between buyer and seller throughout the shipping process. FOB (Free on Board) represents the most balanced arrangement for many importers, with the Chinese supplier responsible for export clearance and delivery to the departure port, while the UK importer controls international freight, insurance, and import procedures. EXW (Ex Works) gives importers maximum control but maximum responsibility from the factory gate onwards, while DDP (Delivered Duty Paid) arrangements should generally be avoided as they complicate VAT recovery and reduce the importer’s visibility over customs procedures.

Documentation Requirements for Toy Imports

Complete and consistent documentation enables efficient customs clearance and provides essential evidence for regulatory compliance throughout the product lifecycle. Every toy import requires a commercial invoice detailing the seller’s and buyer’s information, complete product descriptions, quantities, unit prices, total values, and agreed Incoterms. The packing list specifies the contents of each carton or pallet, including gross and net weights, dimensions, and package markings that correspond to physical labeling on the shipment. Transport documents including the bill of lading for sea shipments or air waybill for air cargo establish the contract of carriage and provide proof of shipment from origin to destination. The Declaration of Conformity issued by the manufacturer confirms that the toys comply with relevant UK safety regulations and must reference the specific standards against which conformity has been assessed. Test reports from accredited laboratories demonstrating compliance with EN71 standards provide the technical evidence supporting the Declaration of Conformity. Certificates of origin may be required depending on the nature of the goods and applicable trade agreements, though no preferential tariff arrangements currently exist between the UK and China. Product labeling must include warnings appropriate to the age range, usage instructions, the importer’s UK business name and address, and the CE or UKCA marking as applicable. Batch or serial numbers enable product traceability in the event recalls or safety investigations become necessary. Maintaining organized documentation systems with clear links between commercial documents, compliance certificates, and customs declarations significantly improves response times to customs queries and regulatory audits.

Filing Customs Declarations Using Customs Declarations UK

The Customs Declaration Service operates as HMRC’s electronic platform for processing all import and export declarations in the UK. Filing accurate import declarations represents a critical step in the import process, determining whether goods clear customs smoothly or face delays, inspections, and potential penalties. The Customs Declarations UK platform provides UK importers with a sophisticated yet accessible solution for managing the entire customs declaration process. Unlike traditional customs brokers who charge per-declaration fees, the platform enables businesses to file their own CDS declarations through intuitive wizard-based workflows that guide users through each required data element. The system prompts for essential information including importer and exporter identities, precise commodity classifications, customs values broken down by component, country of origin, transport details, and the specific customs procedure codes that determine the type of import being declared. Real-time validation checks flag missing information, inconsistent data entries, or values that fall outside expected parameters before submission to CDS, dramatically reducing rejection rates and the rework required to correct errors. The platform integrates with HMRC’s systems to submit declarations electronically and receive acknowledgment responses including the Movement Reference Number that authorizes customs clearance and release of goods. For businesses importing toys regularly, template functionality allows previous declarations to be cloned and updated with new shipment details, accelerating repeat filings while maintaining consistency in commodity descriptions, valuation methods, and procedural codes. The system automatically archives all declaration data, supporting documents, and correspondence for the statutory six-year retention period required by HMRC, ensuring audit readiness without additional administrative burden. The Customs Declarations UK platform also provides tools for managing ENS declarations, the safety and security filings required before goods arrive at UK borders. By maintaining both customs and security declarations within a single integrated system, importers ensure consistency across all regulatory submissions while reducing the coordination burden with freight forwarders and carriers.

Common Mistakes to Avoid When Importing Toys

Even experienced importers frequently encounter avoidable issues that create delays, increase costs, and generate regulatory risk. Assuming supplier compliance without independent verification represents one of the most dangerous errors, as many Chinese manufacturers may claim EN71 certification without maintaining current test reports or properly implementing quality control systems. Importers should never accept supplier assurances alone but must obtain and verify actual test reports from recognized laboratories with recent testing dates. Relying on outdated test reports from several years ago provides minimal protection, as manufacturing processes, material sources, and component specifications may have changed significantly since the original testing. Misclassification of toys under incorrect commodity codes frequently occurs when importers provide generic descriptions rather than precise functional and material details. Undervaluation of customs value, whether intentional or through misunderstanding of includable costs, attracts substantial penalties when discovered during post-clearance audits. Missing or incorrect CE or UKCA marking prevents goods from being legally placed on the UK market regardless of their actual safety characteristics. Inadequate English-language instructions, missing age warnings, or absent importer identification details violate labeling requirements and can result in enforcement action. Filing incomplete customs declarations that omit required data elements or contain inconsistent information across different documents triggers rejections, delays, and increased scrutiny on future imports. Failing to maintain comprehensive documentation including technical files, declarations of conformity, test reports, and customs records leaves importers vulnerable to regulatory inquiries without the evidence needed to demonstrate compliance. Poor coordination between commercial invoices, packing lists, transport documents, and customs declarations creates discrepancies that customs officers interpret as potential fraud or negligence.

Conclusion

Importing toys from China to the United Kingdom offers UK businesses access to the world’s largest toy manufacturing base, competitive pricing, and extensive product variety across all toy categories. Success requires disciplined attention to product safety requirements, conformity assessment procedures, accurate customs classification, and transparent valuation practices. The indefinite recognition of CE marking provides UK importers with valuable flexibility in sourcing products that already meet EU standards without requiring separate UKCA certification. Understanding EN71 standards, maintaining comprehensive technical documentation, and selecting reliable Chinese suppliers with demonstrated UK market experience form the foundation of compliant toy imports. Accurate customs declarations filed through modern platforms such as Customs Declarations UK enable efficient border clearance while maintaining full audit trails that protect businesses during regulatory reviews. By combining supplier due diligence, rigorous compliance verification, detailed documentation systems, and validated customs procedures, UK importers can transform toy imports from complex regulatory challenges into reliable, profitable business operations that deliver safe products to children throughout the United Kingdom.