Filing Customs Declarations Using Customs Declarations UK

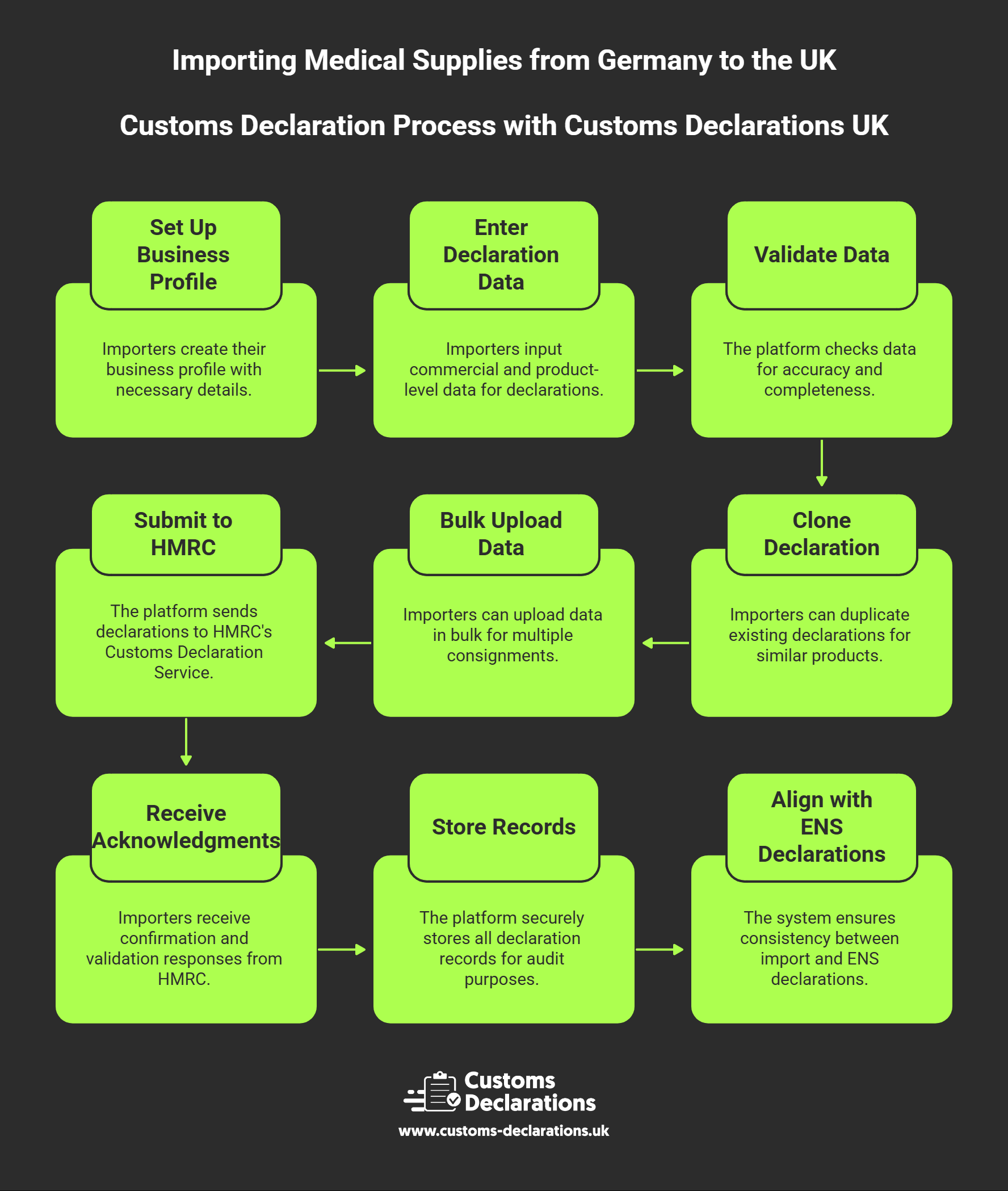

The process of submitting accurate, compliant customs declarations is streamlined through the use of modern cloud-based platforms such as Customs Declarations UK, which provides importers with a structured, validated pathway into HMRC’s Customs Declaration Service. Rather than navigating complex government portals or relying entirely on third-party brokers, importers can manage their own import declarations through an intuitive, wizard-based interface that guides users through each data element required by HMRC.

Using Customs Declarations UK, importers begin by setting up core business profiles, capturing EORI numbers, addresses, and contact details for reuse across multiple declarations. The platform then presents guided workflows for each declaration type, prompting users to enter commercial information such as supplier and consignee details, invoice values, and Incoterms. Product-level data is captured through dedicated sections where users specify commodity codes, commercial descriptions, quantities, packaging types, and net and gross masses. Real-time validation checks ensure that mandatory fields are completed, codes are formatted correctly, and declared values reconcile with supporting documentation before submission to CDS declarations systems.

For importers managing regular flows of similar medical devices, the platform’s cloning functionality significantly accelerates data entry. Once a declaration for a particular product line is created and accepted, future shipments can clone the original entry, with only variable elements such as quantities, values, and transport references requiring updates. This approach reduces manual keying, minimizes transcription errors, and ensures consistency in how products are described and classified over time. Bulk upload capabilities also support high-volume importers, allowing customs declaration data to be imported via CSV or Excel files for rapid processing of multiple consignments.

Upon submission, Customs Declarations UK communicates directly with HMRC’s Customs Declaration Service, receiving acknowledgments, validation responses, and ultimately the Movement Reference Number that confirms acceptance. These references are stored securely within the platform, creating an audit-ready archive of all submissions that satisfies HMRC’s six-year record retention requirement. The system also enables alignment between import declarations and ENS declarations, ensuring that safety and security data lodged by carriers matches the customs entry, thereby preventing common causes of border delays.