Introduction

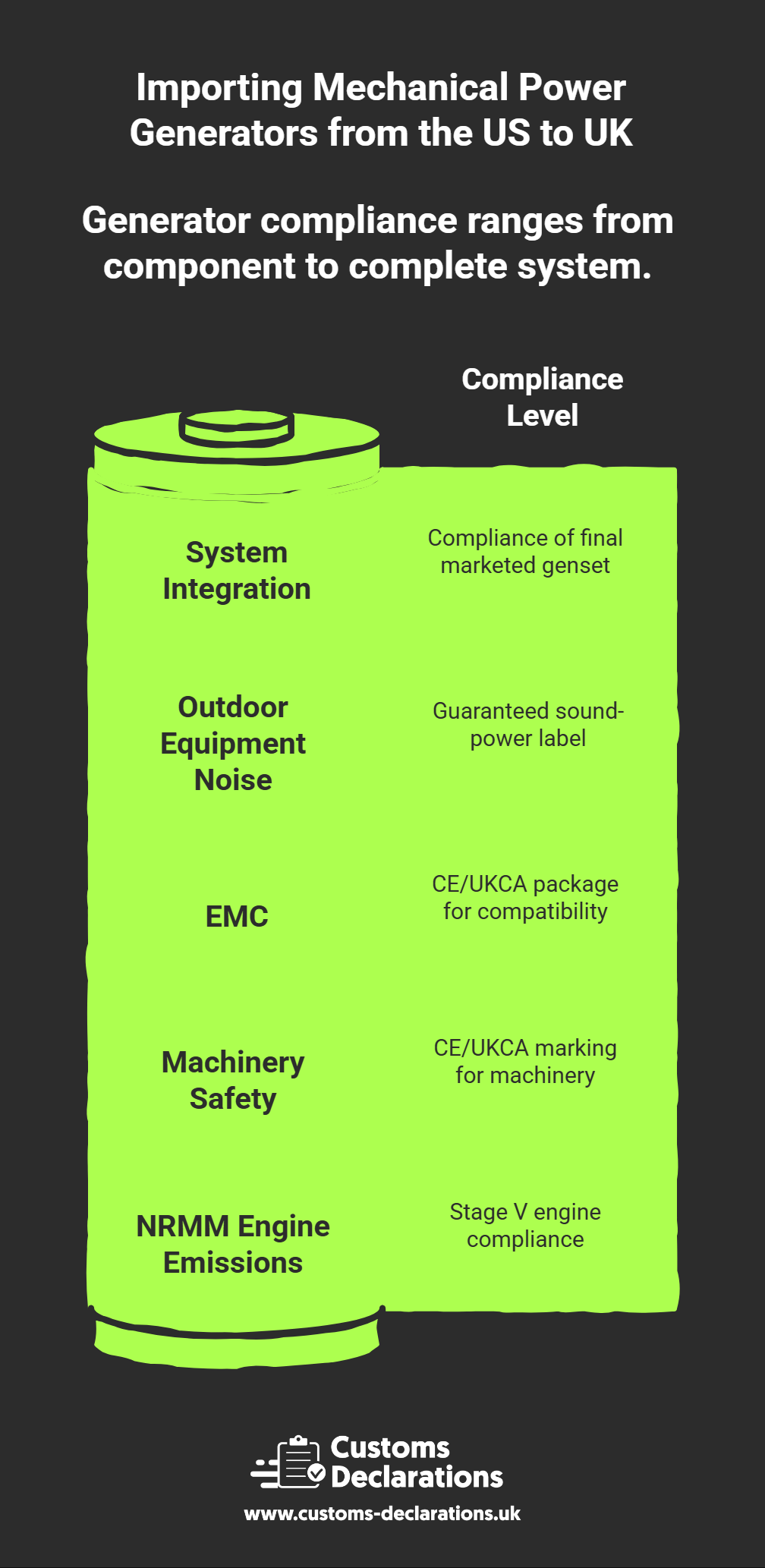

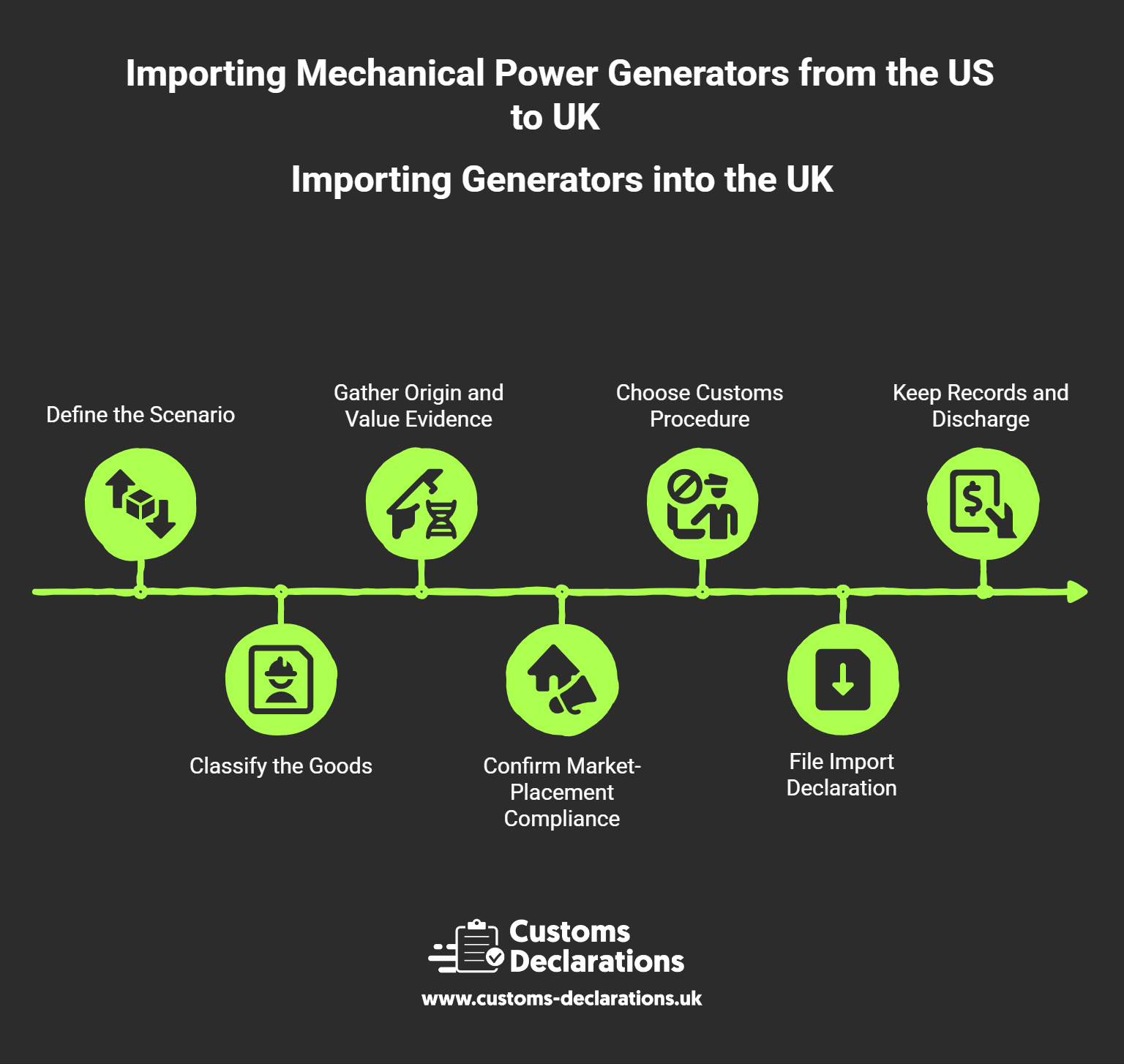

Mechanical power generators—complete generating sets, diesel and gasoline prime movers, alternators, and spare parts—are indispensable across construction, healthcare, data centres, and emergency response. Bringing these units from the United States into Great Britain (GB) is entirely manageable when approached as a single, evidence-led workflow. That workflow has three pillars: (1) accurate customs treatment built on sound classification, origin and valuation; (2) product-compliance readiness spanning machinery safety, electromagnetic compatibility, non-road engine emissions, and outdoor noise; and (3) a clean, validated import submission through HMRC’s Customs Declaration Service (CDS), ideally prepared in Customs Declarations UK (CDUK) for audit-grade consistency. This guide walks that sequence step by step, highlights reliefs for test and demonstration units, and concludes with practical controls that keep your programme on time and inspection-ready.