Introduction

An Entry Summary Declaration (ENS) is a pre-arrival electronic notification required for most goods entering Great Britain. It provides UK customs authorities with essential information about the goods, allowing them to assess safety and security risks before the goods arrive. The ENS is submitted via HMRC’s Safety & Security GB (S&S GB) system and is separate from the import customs declaration – it contains no duty/tax assessment, focusing only on safety and security data.

Effective 31 January 2025, HMRC has reduced the ENS data requirements. The dataset now consists of 20 mandatory fields (always required) and 8 conditional fields (required only in specific circumstances). The remaining fields are optional. This guide, intended for freight forwarders, customs agents, logistics professionals, and software providers, explains each data element field-by-field, including its purpose, required format, examples, common mistakes, and validation rules.

How to use this guide: The fields are grouped into mandatory, conditional, and optional sections. Under each field name, we outline key details:

Requirement (whether the field is Mandatory “M”, Conditional “C”, or Optional “O”)

Level (whether it’s provided at the declaration header or for each goods item)

Format (allowed data format/length)

Guidelines for optimal completion

Examples

Common mistakes to avoid.

Tables and code lists are referenced for fields that require specific coded values. Following these guidelines will help ensure your ENS submissions are correct and avoid delays or rejections.

Mandatory Fields (Core ENS Data Elements)

These 20 fields must be provided in all ENS submissions for S&S GB (Great Britain). They cover critical information about the consignment, parties, transport, and goods. Accurate completion of these fields is required for every ENS declaration.

Local Reference Number (LRN)

- Requirement: Mandatory (each ENS must have one LRN).

- Level: Header-level (one per declaration).

- Format: Up to 22 characters, alphanumeric (an..22).

- Guidelines: The LRN is a unique reference you, as the declarant, assign to the declaration. It is used by HMRC to identify the ENS prior to issuing an MRN (Movement Reference Number). Each ENS you submit should have a unique LRN (unique per “Person Lodging”/declarant EORI) – do not reuse LRNs for different declarations. If you later send an amendment, use the original declaration’s MRN as the LRN in the amendment message.

- Example: GB20250701ABC12345 (e.g. incorporating date and a unique sequence).

- Common mistakes: Re-using an LRN for multiple ENS filings (violates uniqueness), or not recording the LRN. Remember that if you need support or to query a submission, you’ll be asked for the LRN, so ensure you keep a record of it. Avoid including spaces or special characters; use a simple alphanumeric string.

Note: If you are filing your declaration via the Customs Declarations UK platform, LRN is automatically generated or populated by the system. You do not need to enter this manually, as the platform ensures it aligns with HMRC’s technical and regulatory requirements.

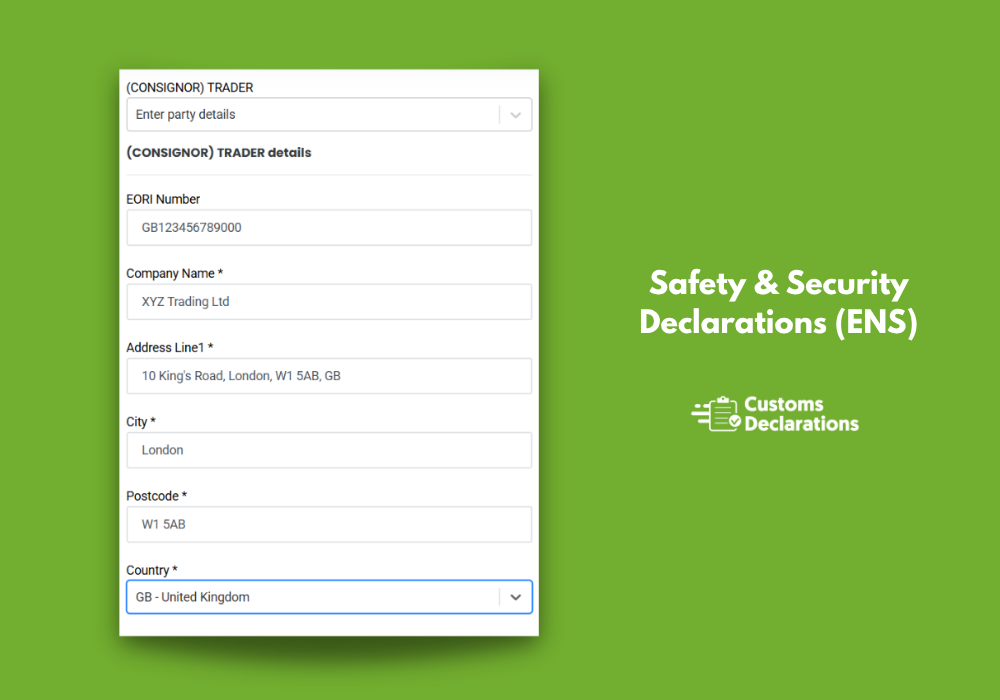

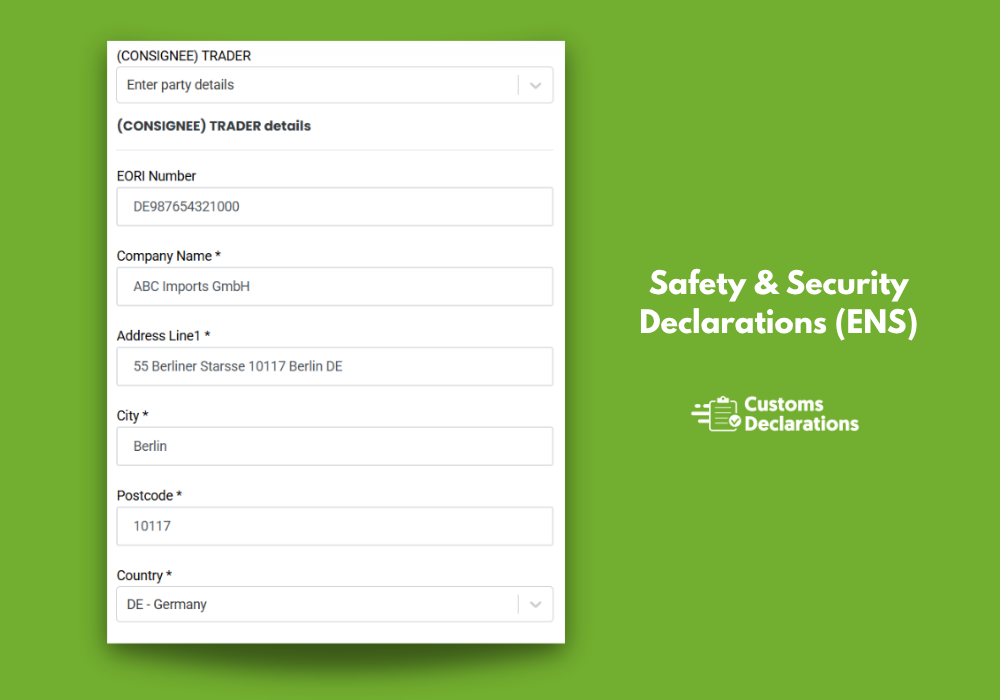

Person Lodging the Summary Declaration

- Requirement: Mandatory (must always be provided).

- Level: Header-level (single identification of the lodger).

- Format: EORI number of the person lodging (an..17, typically 12-15 characters including country code). Must be a GB EORI for S&S GB.

- Guidelines: This is the party submitting the ENS – often the carrier or its representative. You must enter the GB EORI of the entity lodging the declaration. (For goods into NI via ICS, an XI or EU EORI would be used, but for S&S GB it must be GB.) Ensure the EORI is valid and belongs to the entity authorized to lodge the ENS. The S&S GB system will validate that the LRN is unique under this EORI, and certain fields (like Specific Circumstance “E” for AEO) depend on this party’s status. No name or address is needed here – just the EORI.

- Common mistakes: Using an incorrect EORI (e.g. an EU EORI or a GB EORI that isn’t associated with the carrier/filing company). Also, ensure you have the carrier’s knowledge and consent if you (as an agent) are lodging on their behalf, and that the EORI you use is that of the actual carrier or agreed filer.

Note: If you are filing your declaration via the Customs Declarations UK platform, this field is automatically populated by the system based on your user profile. You do not need to enter this manually.

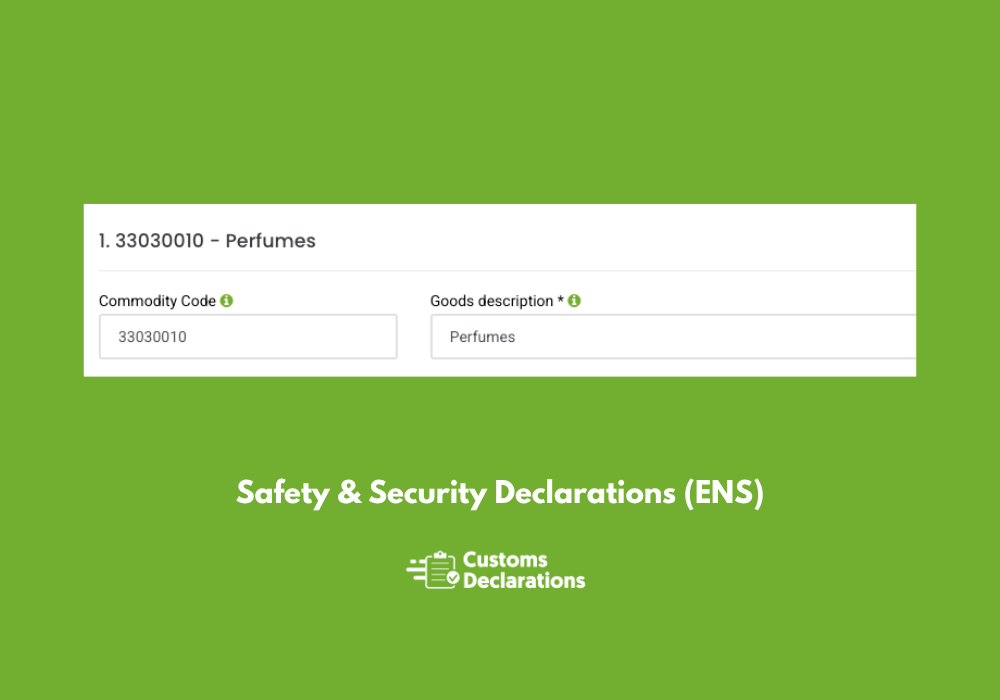

Goods Item Number

- Requirement: Mandatory (for each item).

- Level: Item-level (each goods item in the ENS is numbered).

- Format: Numeric, up to 5 digits (n..5). Typically this will be a simple integer like 1, 2, 3, etc.

- Guidelines: This is the sequential count of the item within the declaration. Every ENS can contain multiple “items” (goods items), each representing a distinct commodity or consignment under the declaration. The first item is numbered “1”, the second “2”, and so on, up to the total number of items. The item number in each item’s data should correspond to its sequence. In practice, if you’re submitting an ENS with, say, 3 distinct items (perhaps 3 house bills in one master or 3 different types of goods), you will have item 1, item 2, item 3. The “Total number of items” (a header field, if provided) should equal the highest item number. Each item’s data block in the ENS message will include this item number. It’s mostly for structure and reference (e.g., if an error is reported on item 2, you know which item’s data to check).

- Example: If an ENS contains two items – one for electronics and one for furniture – the first would have Goods item number = 1, the second = 2. If you have 10 items, they should be numbered 1 through 10. (Typically the software will handle numbering automatically, but you should ensure no duplicates or gaps.)

- Common mistakes: Skipping or duplicating item numbers when constructing the ENS message. Each item must have a unique sequential number. Another mistake is misunderstanding this field’s purpose – it’s not a count of pieces or packages, just an index. Users don’t manually enter this in forms (software usually assigns it), but if building an XML, ensure you number properly. Inconsistent numbering can lead to rejections or misinterpretation of “Number of items” vs “Item number concerned”. For clarity, always also double-check the Total Number of Items field (if used) matches the count of item numbers provided.

Note: If you are filing your declaration via the Customs Declarations UK platform, this field is automatically populated by the system. You do not need to enter this manually.

Declaration Date and Time

- Requirement: Mandatory (system-provided by declarant’s software).

- Level: Header-level.

- Format: 12 numeric digits, YYYYMMDDHHMM (same format as arrival time). GMT time zone.

- Guidelines: This is the date/time when the ENS is issued (lodged) by you. Effectively, it’s the timestamp of when your system created/sent the declaration. It serves as a digital “signature” timestamp. Your software or the HMRC system will often populate this automatically, but if you need to provide it, use the current date/time (in GMT) at the moment of submission. It must be in the specified format and in GMT.

- Ensure this time is equal to or earlier than the actual submission time (you wouldn’t post-date it).

- This field is largely for record and to fulfill the requirement that the declaration be “signed or otherwise authenticated” with date/time.

- In amendments, a separate amendment timestamp is used, but for the original ENS, this is the one.

- If you are using the HMRC API or system, it will likely insert this for you. If manually filing (via a third-party interface), it might be filled behind the scenes. Just be aware it exists.

- Example: If submitting on 2025-07-03 at 02:30 GMT, the field would be 202507030230.

- Common mistakes: Time zone confusion – it must be GMT, not local time (especially important if you’re filing from a different time zone). Another mistake is not updating this field on each new declaration (re-using an old timestamp or a static value can cause errors). Generally, let your software handle it if possible. Also, the format is strict, so ensure zero-padding (e.g. January is “01” for month, 1 AM is “01” for hour, etc.). Missing this field will lead to rejection as it’s mandatory that each ENS has a date/time of declaration.

Note: If you are filing your declaration via the Customs Declarations UK platform, this field is automatically populated by the system. You do not need to enter this manually.

Conditional Fields (Required in Specific Situations)

The following 8 fields are only required if certain conditions apply to the shipment. If the conditions are met, these fields become mandatory; otherwise they can be omitted. It’s important to understand when to include them to ensure compliance:

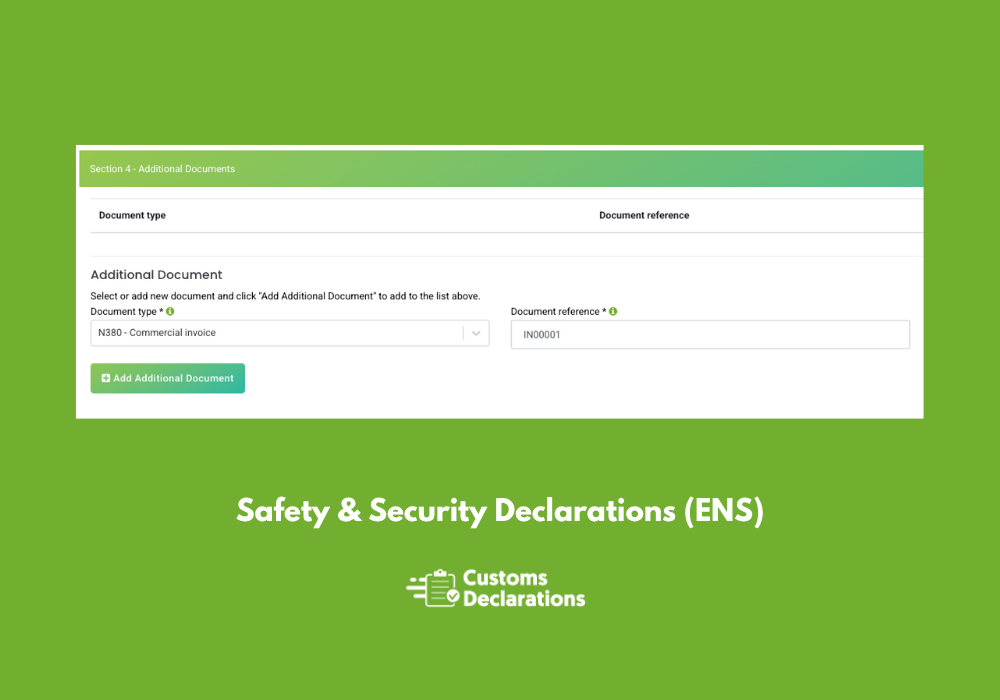

Optional Fields (Additional Information, Provided If Available)

These 9 fields are optional – you are not required to supply them for ENS acceptance, but providing them when relevant can add clarity or fulfill specific business needs. If you have the information readily, it can be good practice to include it. However, leaving them blank has no negative effect on compliance (except where their absence might lose some benefit, like identifying special status).

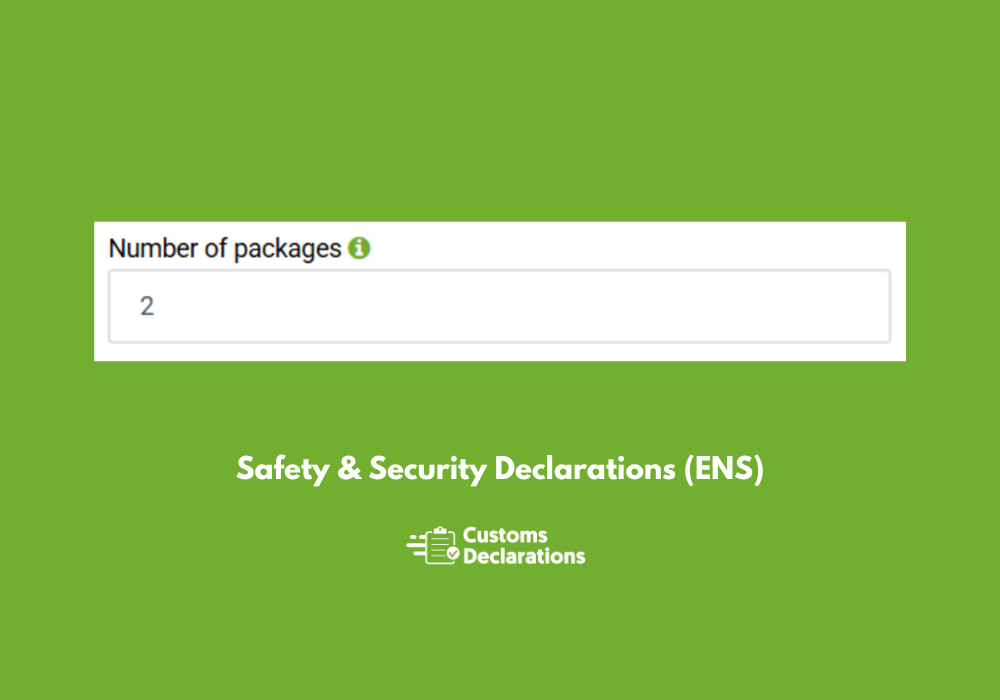

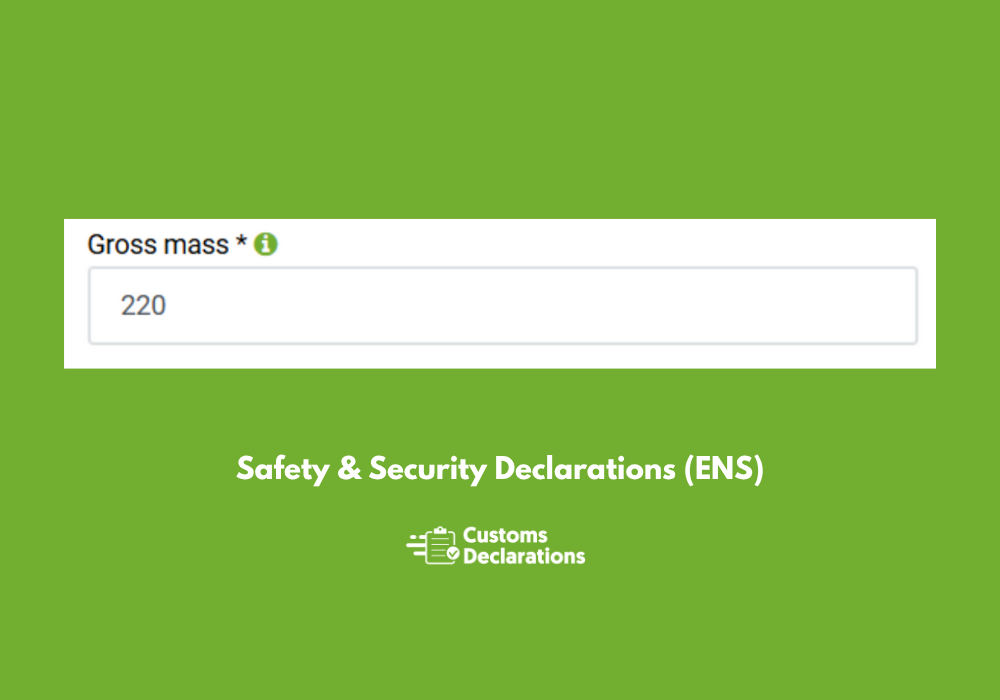

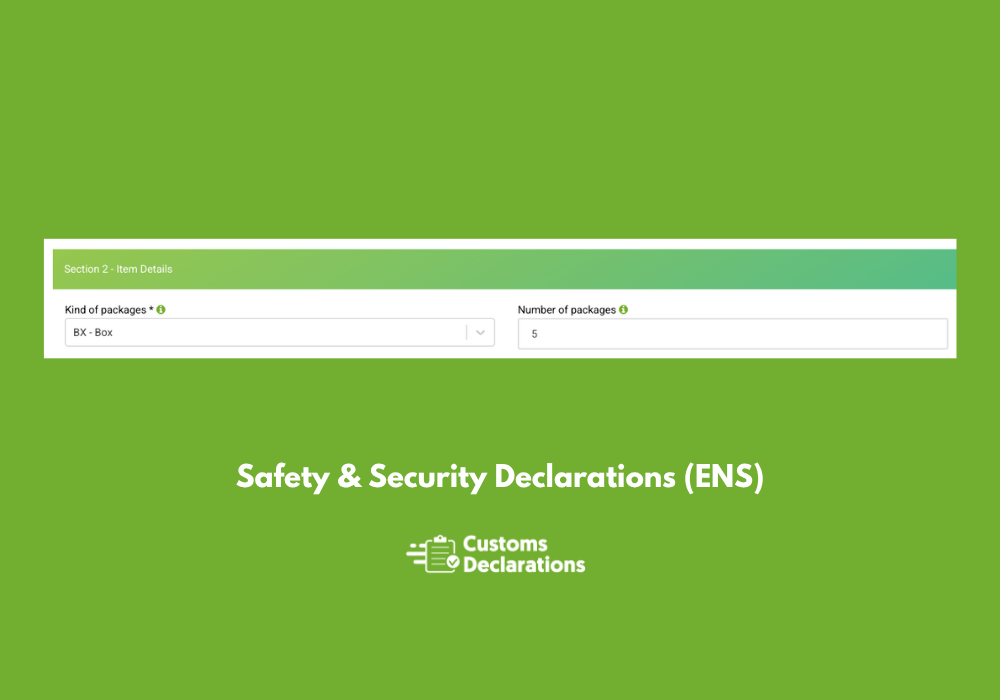

Total Number of Packages (Header)

- Requirement: Optional.

- Level: Header-level.

- Format: Numeric, up to 7 digits (n..7).

- Guidelines: This is the aggregate count of all packages in the entire ENS declaration (summing across all items). If you choose to provide it, it should equal the sum of the “Number of packages” (and pieces, where applicable) of all items on the declaration. Specifically, if you have 3 items with 10, 5, and 2 packages respectively, the total number of packages would be 17 (assuming none are bulk). If some items are bulk with no packages, see bullet two:

- When calculating, for bulk items (no packages) that are in containers or such, count each unit of transport or grouping as per guidance. HMRC notes: if present, this number must equal the sum of all ‘Number of packages’ + ‘Number of pieces’ at item level, +1 for any goods declared as bulk. This implies if you had an item declared as bulk (no packages, no pieces, just bulk weight), you still count that as 1 for the purpose of total packages count. So bulk item counts as one “package” conceptually.

- Also, no leading zeros allowed (don’t do 00017, just 17).

- Providing this field can be a nice cross-check; customs or your own system can verify the consistency. The system might throw an error if the total doesn’t match the sum of items when it is provided. If you’re not confident to maintain it, you can omit it since it’s optional. Many modern systems auto-calculate it if needed.

- Example: If ENS contains items with package counts 5, 3, and one bulk item, total number of packages = 5 + 3 + (bulk counts as 1) = 9. If just two items with 100 and 50 packages, total = 150.

- Common mistakes: Providing a total that doesn’t match the detail. If you put a total, double-check sums. Another mistake is misunderstanding the “+1 for bulk” rule – it’s a bit counterintuitive, but basically bulk still occupies space so they count it as a unit. If you had all bulk and you put 0, that would conflict (they expect at least 1 if an item exists). If you omit this field entirely, then no issue arises. If your software auto-fills it, ensure it updates when you add/remove items. And do not include containers or vehicles in this count (only packages/pieces as defined). If you had provided Number of Pieces for unpackaged items, include those in sum.

Note: If you are filing your declaration via the Customs Declarations UK platform, this field is automatically populated by the system. You do not need to enter this manually.

Total Number of Items

- Requirement: Optional.

- Level: Header-level.

- Format: Numeric, up to 5 digits (n..5).

- Guidelines: This is simply the count of goods items declared in the ENS. In other words, how many separate item entries (with their own descriptions etc.) are in the declaration. If provided, it must equal the actual number of item data groups included and have no leading zeros. Typically, if you have item 1, item 2, item 3 in the ENS, Total number of items = 3. This is usually obvious from the structure of the message, so providing it is redundant but can serve as a check. Many systems automatically derive it. It’s optional to explicitly state it.

- Example: If you’re declaring a consolidated ENS with 10 items (perhaps 10 House bills), you could put 10. If a single-consignment ENS, you could put 1.

- Common mistakes: Not matching the actual count. If you list 5 items but mistakenly put 6, that’s an inconsistency. This might cause an error or at least confusion. Another trivial mistake could be including leading zeros (“05” instead of “5”). Given it’s optional, some choose not to include this field at all; that avoids any risk of mismatch. If you do include it, update it whenever items are added or removed prior to submission.

Note: If you are filing your declaration via the Customs Declarations UK platform, this field is automatically populated by the system. You do not need to enter this manually.

Conclusion and Best Practices

Filing an ENS accurately is crucial for compliance with UK safety and security regulations. By completing all mandatory fields and the relevant conditional fields (only when required), and using the optional fields to provide additional clarity when available, carriers and filers can ensure smooth processing of their Entry Summary Declarations. Remember the following best practices:

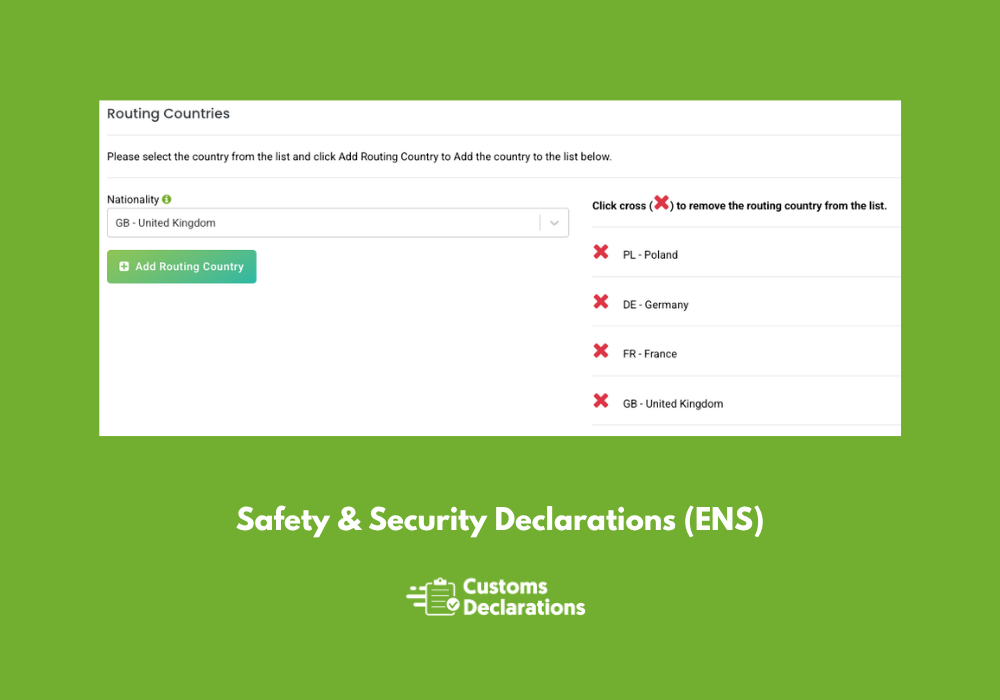

- Double-check codes and references: Ensure all codes (country codes, document type codes, package codes, etc.) are valid and up-to-date from HMRC’s published lists. Small typos (e.g., using “UK” vs “GB”, transposing letters in container or EORI numbers) can lead to rejections or misrouting.

- Use specific and accurate information: The more precise your data (goods description, routing, etc.), the better customs can assess risk without needing to intervene. Avoid generic terms that could trigger manual checks.

- Consistency is key: Totals should match the sum of parts (items vs. total items, packages vs. total packages) whenever those optional fields are used. Also, information in ENS should be consistent with other documents (for example, the MRN you receive back will tie to the info provided – inconsistencies with manifests or transit declarations can cause issues).

- Timeliness: Submit the ENS within the legal timeframes before arrival (e.g. 2 hours before for short sea, 4 hours for long haul air, etc., as summarized in HMRC guidelines). Late submissions can result in penalties or “Do Not Load” messages.

- Amend when necessary: If you realize any detail is incorrect or has changed (and goods haven’t arrived yet), submit an amendment with the corrected data. Use the same LRN (now MRN) when amending, and include all original data plus changes. Note you cannot change certain key identifiers (like Person Lodging) via amendment.

- Retention of evidence: Keep copies of the ENS data (or at least the LRN/MRN and key info) for audit purposes. You may need to provide evidence of ENS filing to carriers or port authorities (e.g., via GVMS you might link ENS MRNs).

- Compliance and support: Be aware that failure to submit ENS or providing incorrect data can lead to delays, fines, or goods being refused loading or entry. If you encounter technical issues, HMRC’s ICS helpdesk can assist. Always provide the LRN or MRN when querying a specific declaration.

By following this comprehensive field-by-field guidance, freight forwarders, carriers, and logistics professionals can confidently prepare UK ENS submissions that meet HMRC’s requirements and contribute to a secure and efficient supply chain. Each data element, when optimally provided, helps paint a complete picture of the shipment for customs – reducing uncertainties and facilitating smooth clearance. Compliance with these guidelines ensures you fulfill the legal obligations while minimizing the risk of customs interventions or penalties.