Introduction

The EU Import Control System 2 (ICS2) represents a significant modernization of customs security processes across the European Union and the United Kingdom. At the heart of this system lies a critical requirement: accurate, specific, and meaningful descriptions of goods, parties, and addresses in customs declarations. Generic or vague terms—known as “stop words”—are systematically rejected by the system, leading to declaration failures, delays, and potential penalties.

This comprehensive guide explains what stop words are, why they matter, how to avoid them, and provides the complete official list of unacceptable terms for goods descriptions and party information. Whether you’re filing import declarations, export declarations, or safety and security (ENS) declarations through platforms like Customs Declarations UK, understanding and avoiding stop words is essential for smooth, compliant cross-border trade.

Why Stop Words Matter: The Risk-Analysis Foundation

The legal requirement for precise goods descriptions stems from customs administrations’ need to conduct effective risk analysis on all consignments entering or leaving the EU and UK. According to the European Commission’s guidance (Commission Delegated Regulation (EU) 2015/2446), descriptions must be “precise enough for Customs services to be able to identify the goods.”

A vague description prevents customs from:

- Identifying potential security threats

- Detecting prohibited or restricted goods

- Assessing duty and tax liabilities accurately

- Prioritizing inspections effectively

When descriptions are too generic, customs must resort to physical examinations of consignments to determine their true nature—causing unnecessary delays, increased costs, and supply chain disruptions for compliant traders.

Key principle: If a commodity code is not provided (common in safety and security declarations), the plain-language description becomes the primary risk-assessment tool. Generic terms like “consolidated cargo,” “general goods,” “parts,” or “freight of all kinds” are explicitly prohibited.

Legal Framework and Official Guidance

The requirement for acceptable goods descriptions is established in:

- Commission Delegated Regulation (EU) 2015/2446 (Annex B and Annex D)

- Data Element 18 05 000 000 (‘Description of goods’)

- Data Element 6/8 (goods description for certain procedures)

The regulation states: “General terms (i.e. ‘consolidated’, ‘general cargo’, ‘parts’ or ‘freight of all kinds’) cannot be accepted. A non-exhaustive list of such general terms and descriptions is published by the Commission.”

Important note: The list of stop words is dynamic and non-exhaustive. As everyday customs practice reveals new unacceptable terms, the Commission updates the list in coordination with Member States. This means declarants must stay vigilant and apply the underlying principle: be specific, be clear, be accurate.

Examples: Unacceptable vs. Acceptable Descriptions

Let’s look at practical examples drawn from the official EU Commission guidance:

Complete ICS2 Stop Words Reference Table

Below is the comprehensive official list of stop words that are unacceptable in customs declarations. This list is based on the European Commission’s published guidance (TAXUD b.1(2021)1688480) and is updated regularly.

Goods Description Stop Words

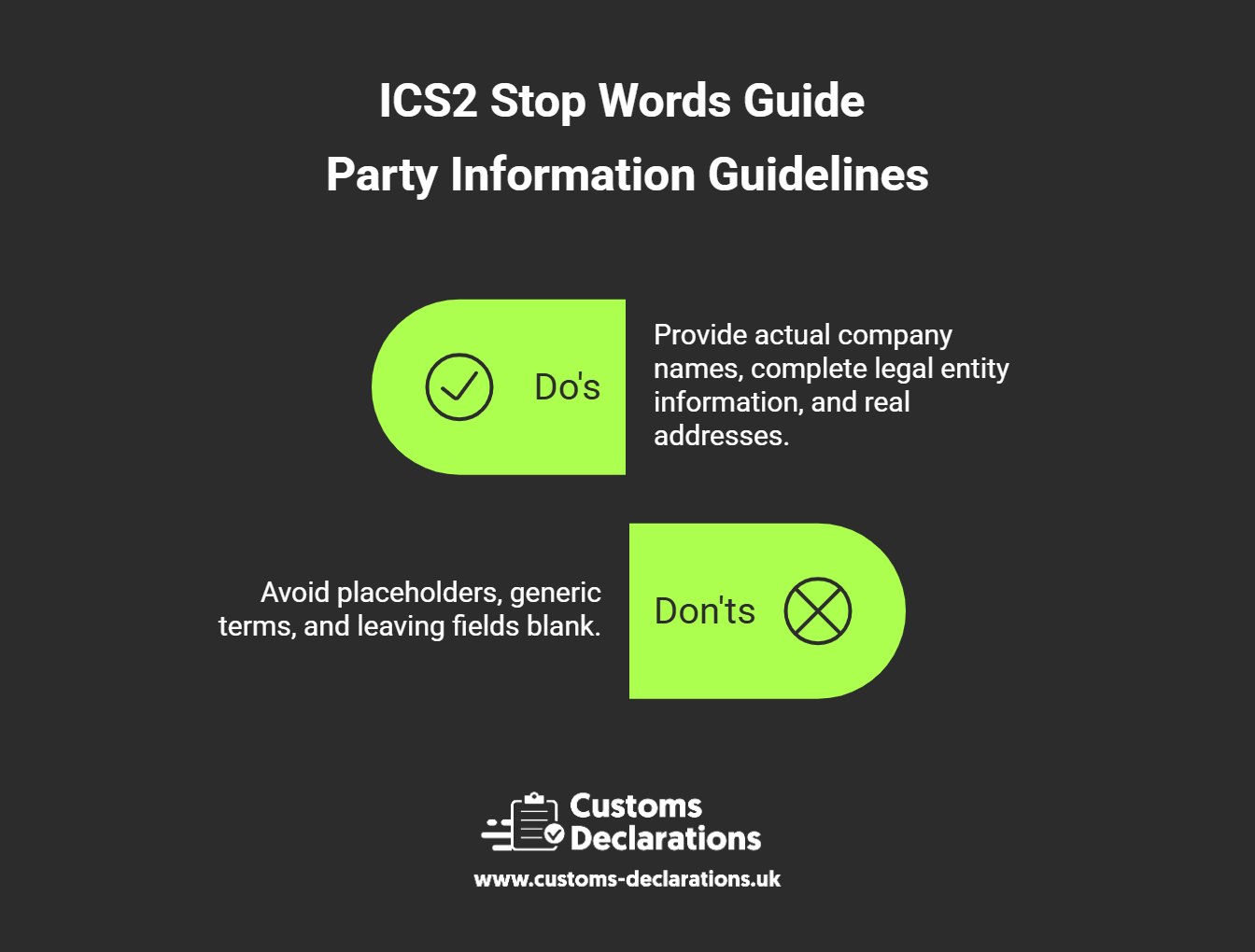

Party Name Stop Words (Consignor, Consignee, Notify Party, etc.)

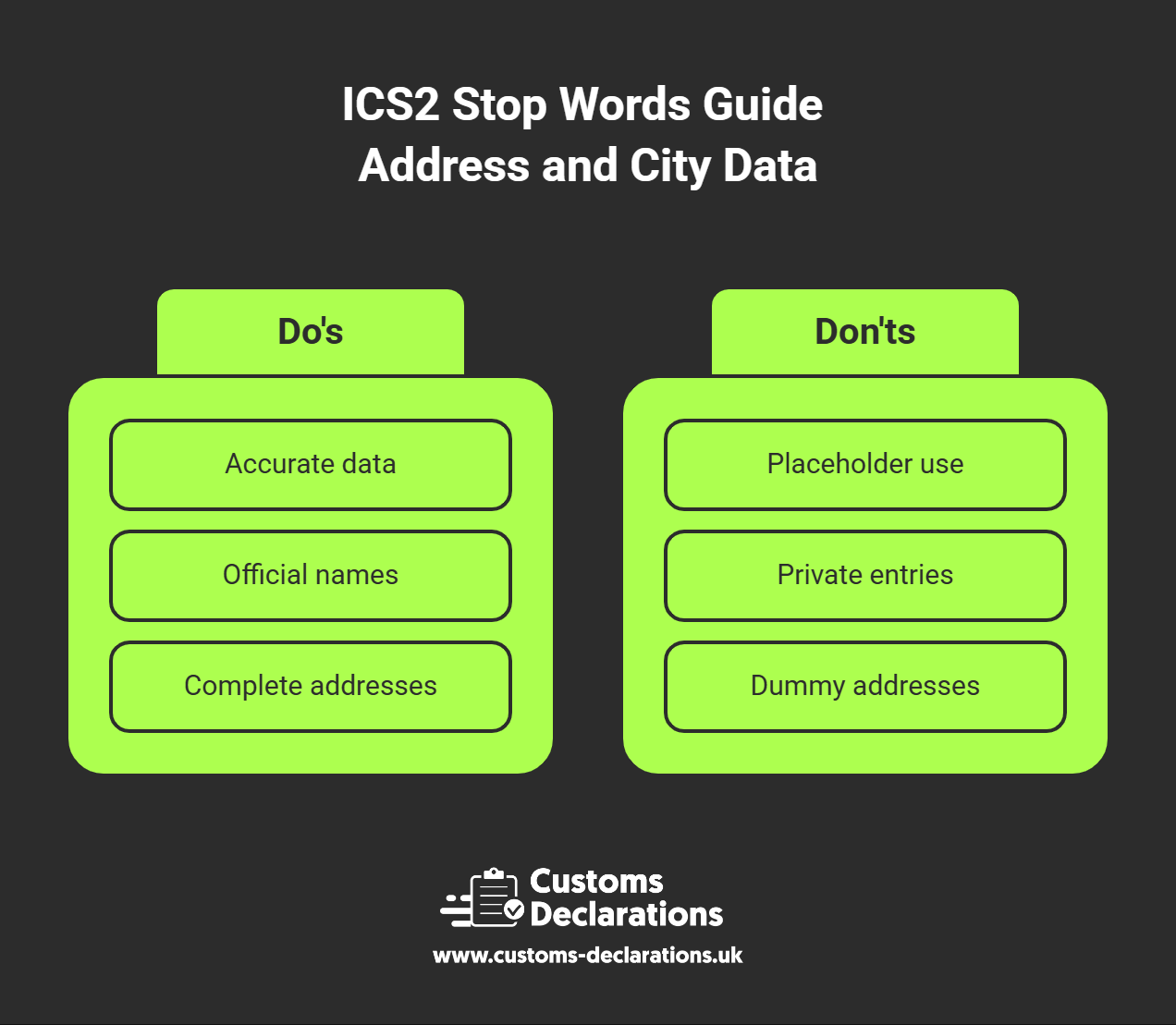

Party Address/City Stop Words

Unacceptable Characters in Descriptions

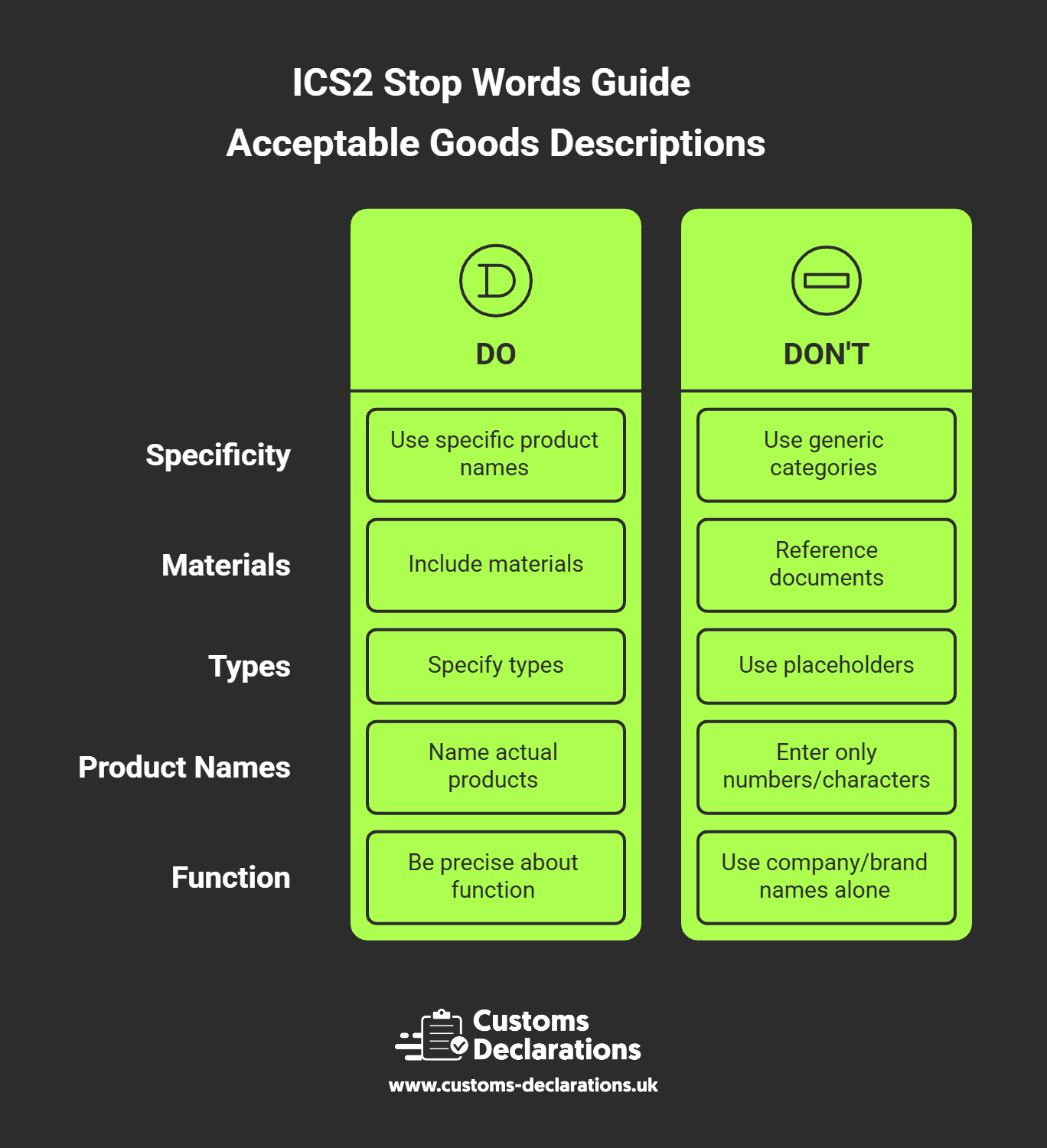

Acceptable Alternatives: How to Get It Right

The Commission’s guidance provides clear alternatives for each unacceptable term. Here are key examples:

Instead of Generic Terms, Use Specific Descriptions:

“Electronics” → Specify the actual items:

- Computer monitors

- Samsung Galaxy tablets

- Apple iPhone 13 Pro

- CD players

- Desktop printers

- LED televisions

“Chemicals” → Use ECICS database names or actual chemical names:

- Sodium hydroxide (CAS 1310-73-2)

- Acetone

- Hydrochloric acid

- Isopropyl alcohol

“Food” → Describe the actual food products:

- Packaged basmati rice

- Frozen chicken breasts

- Tomato pasta sauce

- Powdered whole eggs

“Parts” → Specify what parts and for what:

- Automobile brake pads

- Laptop replacement keyboards

- Industrial pump seals

- Aircraft engine components

“Textile goods” → Be specific about fabric and use:

- Cotton fabric in rolls (grey fabric, unbleached)

- Polyester curtains (ready-made)

- Cotton bed sheets (queen size)

- Men’s cotton T-shirts (HS 6109.10)

“Machinery” → Name the actual machines:

- CNC metal-working lathes

- Industrial sewing machines (lockstitch)

- Cigarette-making machines

- Offset printing presses