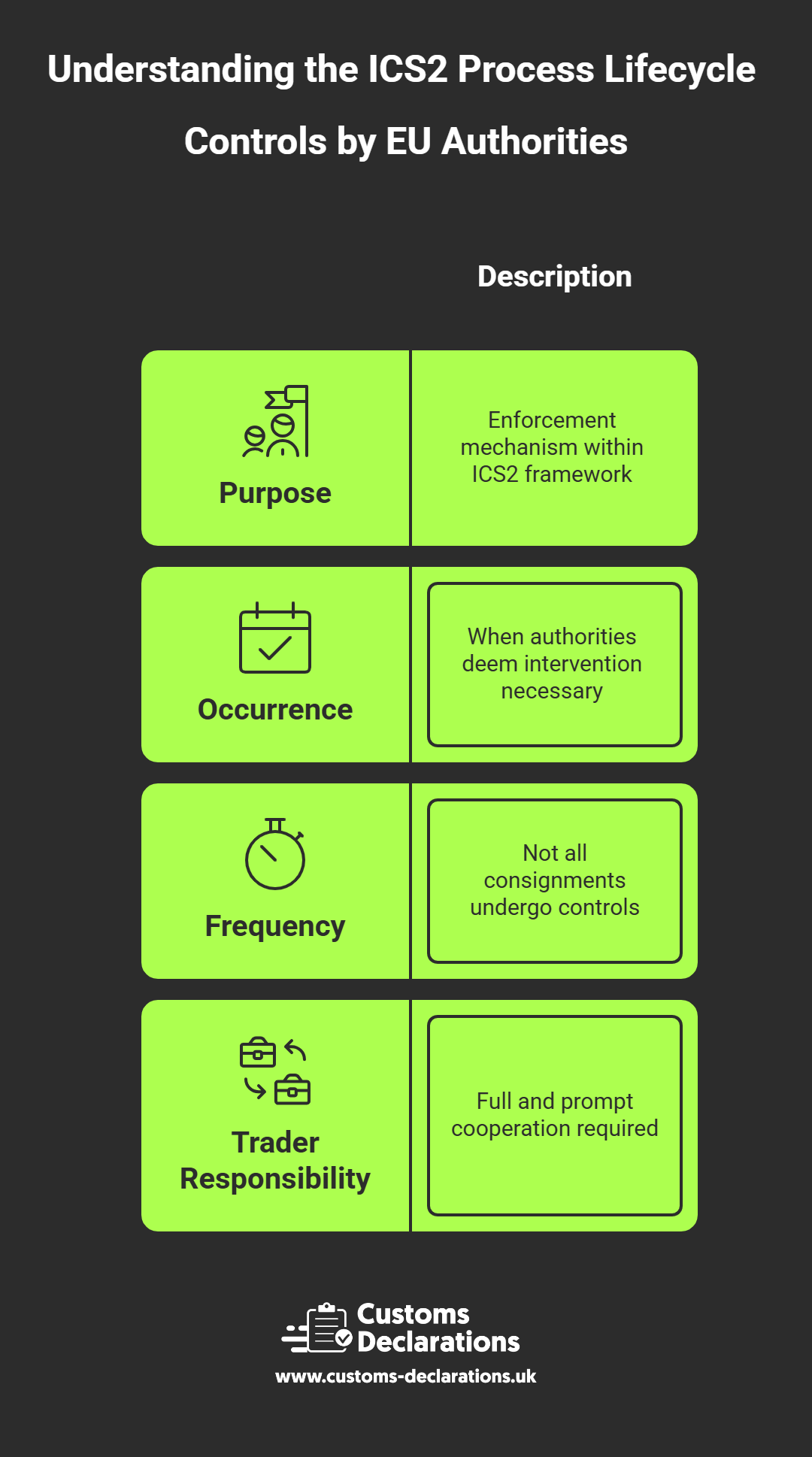

Stage 6: Controls (If Applicable) – Physical and Documentary Examination by EU Authorities

Controls represent the enforcement mechanism within the ICS2 framework and EU customs operations, occurring when customs authorities within EU member states determine that physical inspection, documentary verification, or other intervention is necessary before goods can be released into EU free circulation or other customs procedures. Not all consignments entering the EU proceed through this stage; indeed, the majority of imports are cleared without physical controls, reflecting both the effectiveness of risk-based targeting through ICS2 and the economic necessity of maintaining trade flow into the EU. However, when controls are imposed by EU customs authorities, traders must cooperate fully and promptly to avoid extended delays and additional costs.

Physical controls at EU borders typically involve customs officers from the relevant member state attending the location where goods are presented and conducting hands-on inspection of the cargo. This may range from simple visual verification that goods match their description to detailed examination of individual items, laboratory analysis of samples by EU-approved facilities, or complete unpacking and repacking of containers. The intensity of control depends on the specific concerns that triggered the intervention in the EU context, which might relate to commodity classification under EU tariff nomenclature, valuation accuracy for EU import duty purposes, product safety and conformity with EU regulations, prohibited or restricted goods under EU law, intellectual property concerns under EU enforcement programmes, or general verification of declaration accuracy for EU customs purposes.

Documentary controls focus on paperwork rather than physical goods, requiring traders to produce and explain supporting evidence for their declarations to EU customs authorities. EU customs officers may request commercial invoices, contracts of sale, packing lists, certificates of origin establishing preferential treatment under EU trade agreements, product specifications and technical documentation demonstrating EU conformity, licences or permits for restricted goods under EU regulations, transport documents, or correspondence with suppliers. The examination seeks to verify that declarations accurately reflect the commercial reality of the transaction and that all EU regulatory requirements have been satisfied.

From a practical standpoint, controls introduce delay and cost into the import process at EU borders. Goods remain under EU customs control until examination is complete and officers are satisfied with the results, which can take hours, days, or even weeks depending on complexity and the specific requirements of the member state authority conducting the control. Storage charges accumulate at EU facilities, delivery schedules to EU customers are missed, and additional staff time is required to respond to customs requests from EU authorities. For perishable or time-sensitive cargo entering the EU, controls can result in significant commercial losses. Businesses should factor this possibility into their supply chain planning for EU shipments and maintain relationships with customs brokers who can respond quickly when controls are imposed at EU entry points.

The key to minimising the impact of controls by EU customs authorities is cooperation and responsiveness. When EU customs officers request additional information or access to goods, providing it promptly and professionally usually results in faster resolution. Defensive or obstructive responses, on the other hand, tend to extend examinations and may trigger more intensive scrutiny by EU authorities. Traders should also learn from control experiences at EU borders; if particular product lines or suppliers consistently attract intervention when entering the EU, this may indicate underlying problems with declarations, product compliance with EU standards, or supplier reliability that need addressing.