The United Kingdom and United States reached a landmark agreement on December 1, 2025 that fundamentally reshapes the commercial landscape for pharmaceutical and medical technology exports. Under this three-year Economic Prosperity Deal, all UK-origin pharmaceuticals, pharmaceutical ingredients, and medical technology exported to the United States will enter duty-free, while the UK commits to increased investment in innovative medicines. The agreement protects billions of pounds in existing trade, secures market access for tens of thousands of NHS patients who depend on cutting-edge treatments, and positions the UK life sciences sector for accelerated growth in the world’s largest pharmaceutical market.

For UK exporters, this deal creates immediate commercial opportunities, but realizing those gains demands precision in customs treatment, origin substantiation, and export declaration filing. Zero tariffs are not automatic. They require documentary proof that goods meet UK originating status, accurate commodity classification under US Harmonized Tariff Schedule rules, and compliant submissions to both HMRC’s Customs Declaration Service and US Customs and Border Protection systems. Businesses that treat this deal as a tariff holiday without addressing the compliance architecture beneath it will face delays, penalties, and lost preferential treatment. Those that build robust origin evidence, streamline their export declarations, and maintain audit-ready records will convert policy advantage into sustainable competitive edge.

The core terms of the UK-US Economic Prosperity Deal

The Economic Prosperity Deal centers on mutual commitments in the pharmaceutical and medical technology sectors. The United States agrees to waive all tariffs on UK-origin pharmaceutical products, active pharmaceutical ingredients, and qualifying medical devices for a three-year period. In exchange, the UK government commits to increased expenditure on new, innovative medicines within the National Health Service, supporting both patient access and the broader development pipeline for breakthrough therapies.

Government estimates suggest the agreement will protect billions of pounds in annual pharmaceutical exports and safeguard investment across research, manufacturing, and supply-chain infrastructure. The deal does not alter non-tariff regulatory requirements on either side. UK pharmaceutical exports to the US must still satisfy Food and Drug Administration approval pathways, Good Manufacturing Practice standards, and product-specific licensing. What changes is the duty treatment at the US border for goods that meet UK origin rules. The arrangement is structured as a time-limited preferential framework rather than a permanent free trade agreement, meaning businesses should monitor renewal negotiations and plan for potential changes beyond the three-year horizon.

Customs treatment and the importance of accurate classification

Pharmaceuticals entering the US market fall under multiple chapters of the Harmonized Tariff Schedule, depending on formulation, active ingredients, dosage form, and intended use. Finished pharmaceutical preparations are typically classified under Chapter 30, while active pharmaceutical ingredients and intermediates may fall under Chapter 29 for organic chemicals. Medical devices and diagnostic equipment are found in Chapters 90, 84, or other machinery and precision instrument headings. Accurate classification is the foundation of compliant zero-tariff treatment because the preferential rate applies only when the declared tariff line matches the product’s objective characteristics and the US importer uses the correct procedure code to claim preference.

Misclassification is a frequent source of duty reassessment and penalties. A product described generically as “pharmaceutical preparation” without specificity on active ingredient, dosage form, or therapeutic category may be assigned an incorrect code, leading to duty charges even when zero-tariff treatment was available. UK exporters should confirm the US tariff classification for each product line before the first shipment under the deal, consulting technical specifications, FDA documentation, and if necessary obtaining a binding ruling from US Customs and Border Protection. This classification work informs not only the tariff treatment but also any regulatory measures, quota restrictions, or special documentation requirements that attach to specific headings.

The UK export declaration filed on HMRC’s Customs Declaration Service must reflect the same product description and commodity code that the US importer will declare on entry. Discrepancies between the UK export data and the US import filing can trigger holds, audits, and loss of preferential treatment. Maintaining aligned data across both jurisdictions is essential for frictionless clearance and sustained tariff relief.

Origin requirements and the evidence that proves eligibility

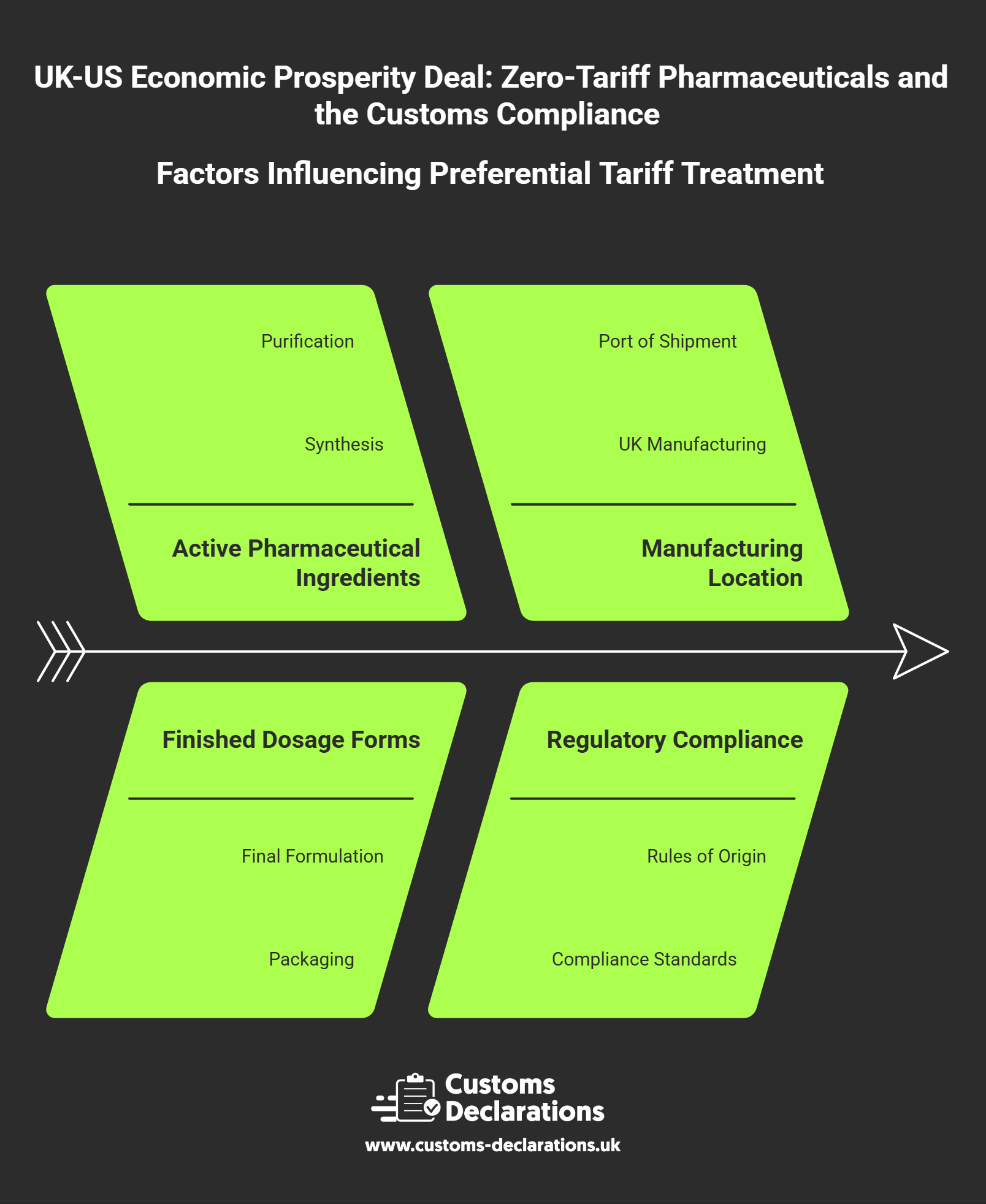

Preferential tariff treatment under the Economic Prosperity Deal is not based on the location of the seller or the fact that goods shipped from a UK port. It depends on whether the pharmaceutical product meets defined origin criteria that establish substantial UK manufacturing or processing. While the specific rules of origin for this agreement have not been published in full detail as of early December 2025, standard pharmaceutical preference regimes typically require that active pharmaceutical ingredients be synthesized, purified, or significantly transformed in the originating country, and that finished dosage forms undergo final formulation, filling, and packaging within that territory.

UK exporters must gather and retain evidence that demonstrates UK origin for each product line. This evidence package generally includes manufacturing process documentation showing where chemical synthesis or biological production occurred, batch records indicating UK facility locations, and bills of materials that trace the sourcing of active ingredients and excipients. Where active pharmaceutical ingredients are imported from third countries and then formulated into finished medicines in the UK, the origin determination depends on whether the UK processing constitutes substantial transformation under the agreement’s product-specific rules.

The US importer will claim zero-tariff treatment by referencing the Economic Prosperity Deal and providing origin certification or a statement on origin from the UK exporter. UK businesses should prepare standardized origin declarations that specify the agreement, the product’s tariff classification, and a clear statement that the goods meet UK originating status. These declarations must be signed, dated, and retained for at least five years to satisfy both HMRC and US Customs audit requirements. Exporters that cannot substantiate origin with credible manufacturing evidence risk having their shipments charged standard US Most Favored Nation duty rates, which for pharmaceuticals can range from zero to several percentage points depending on the product.

Practical preparation steps for UK pharmaceutical exporters

Realizing the benefits of zero-tariff treatment begins with an internal audit of current product portfolios and supply chains. UK pharmaceutical companies should map which products are manufactured domestically, which rely on imported active ingredients, and which undergo final packaging or labeling in the UK versus third countries. This mapping exercise identifies which product lines clearly qualify for UK origin and which may require supply-chain adjustments or deeper origin analysis.

Once origin eligibility is confirmed, businesses should align their commercial and compliance documentation. Commercial invoices should include clear product descriptions, the applicable US Harmonized Tariff Schedule codes, and a statement indicating that goods are of UK origin and eligible for zero-tariff treatment under the Economic Prosperity Deal. Packing lists should reconcile exactly with invoice line items to avoid discrepancies that delay clearance. Certificates of analysis, batch records, and regulatory compliance documentation should be readily available to support origin claims if requested by US authorities.

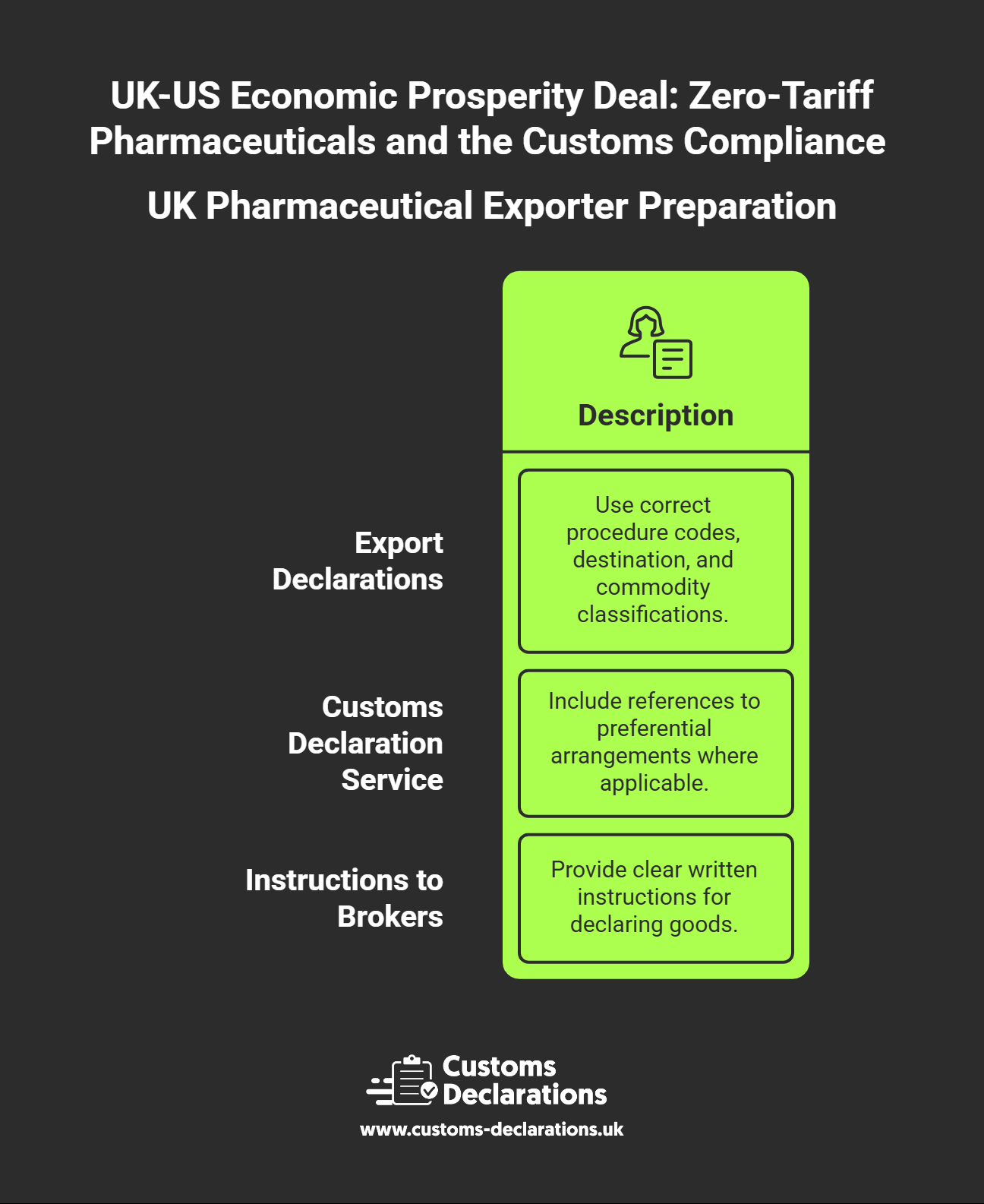

Export declarations filed with HMRC must capture the correct procedure codes, destination, and commodity classifications. UK exporters should verify that their Customs Declaration Service entries include references to the preferential arrangement where applicable, ensuring that HMRC export statistics and US import data align. For businesses using freight forwarders or customs brokers, clear written instructions on how to declare goods under the Economic Prosperity Deal are essential. Ambiguity in instructions leads to filing errors that cascade into duty charges and compliance gaps.

How Customs Declarations UK supports pharmaceutical exporters under the new deal

The Customs Declarations UK platform provides a structured, validated pathway for preparing and submitting export declarations that align with the requirements of preferential trade agreements. Within CDUK, pharmaceutical exporters can set up product profiles that capture the commodity code, origin status, and regulatory references for each medicine or medical device. These profiles are reusable across shipments, ensuring consistency in how goods are described and declared.

When preparing an export declaration for US-bound pharmaceuticals, CDUK guides users through plain-English workflows that capture the commercial description, customs value, destination, and any preferential treatment claims. Real-time validation checks flag missing data, incorrect procedure codes, or commodity classifications that do not align with declared origin before the entry is transmitted to HMRC’s Customs Declaration Service. On acceptance, CDUK stores the Movement Reference Number and archives the full submission set for the required retention period, creating an audit trail that pairs seamlessly with origin statements and manufacturing records.

Looking ahead: positioning for sustained advantage beyond the three-year term

The Economic Prosperity Deal is structured as a three-year arrangement, meaning that UK pharmaceutical exporters should prepare for potential changes when the agreement comes up for renewal or renegotiation. Businesses that build strong origin documentation, streamline their export filing processes, and establish clean audit trails during the initial term will be well-positioned to adapt to any future modifications in tariff treatment or origin rules.

Monitoring policy developments is essential. The UK government and US administration may issue joint statements, technical guidance, or amendments to the agreement’s scope as implementation proceeds. UK pharmaceutical companies should designate internal compliance leads who track official announcements, participate in industry consultations, and ensure that internal procedures stay aligned with evolving requirements.

Conclusion

The UK-US Economic Prosperity Deal represents a significant commercial opportunity for UK pharmaceutical and medical technology exporters, eliminating tariffs on billions of pounds in annual trade and securing access to the world’s largest healthcare market. However, zero-tariff treatment is not automatic. It requires compliant export declarations, credible origin documentation, accurate commodity classification, and disciplined record-keeping that satisfies both HMRC and US Customs audit requirements.

UK businesses that approach this deal as a compliance discipline rather than a simple tariff waiver will convert policy advantage into sustained competitive edge. By confirming product origin, aligning export data with US import requirements, and filing validated declarations through platforms such as Customs Declarations UK, pharmaceutical exporters can achieve predictable clearance, full tariff relief, and long-term audit readiness. With the right systems and evidence in place, the Economic Prosperity Deal becomes not just an immediate cost saving but a foundation for scalable, compliant growth in the US market.