Understanding the customs implications of shifting trade volumes

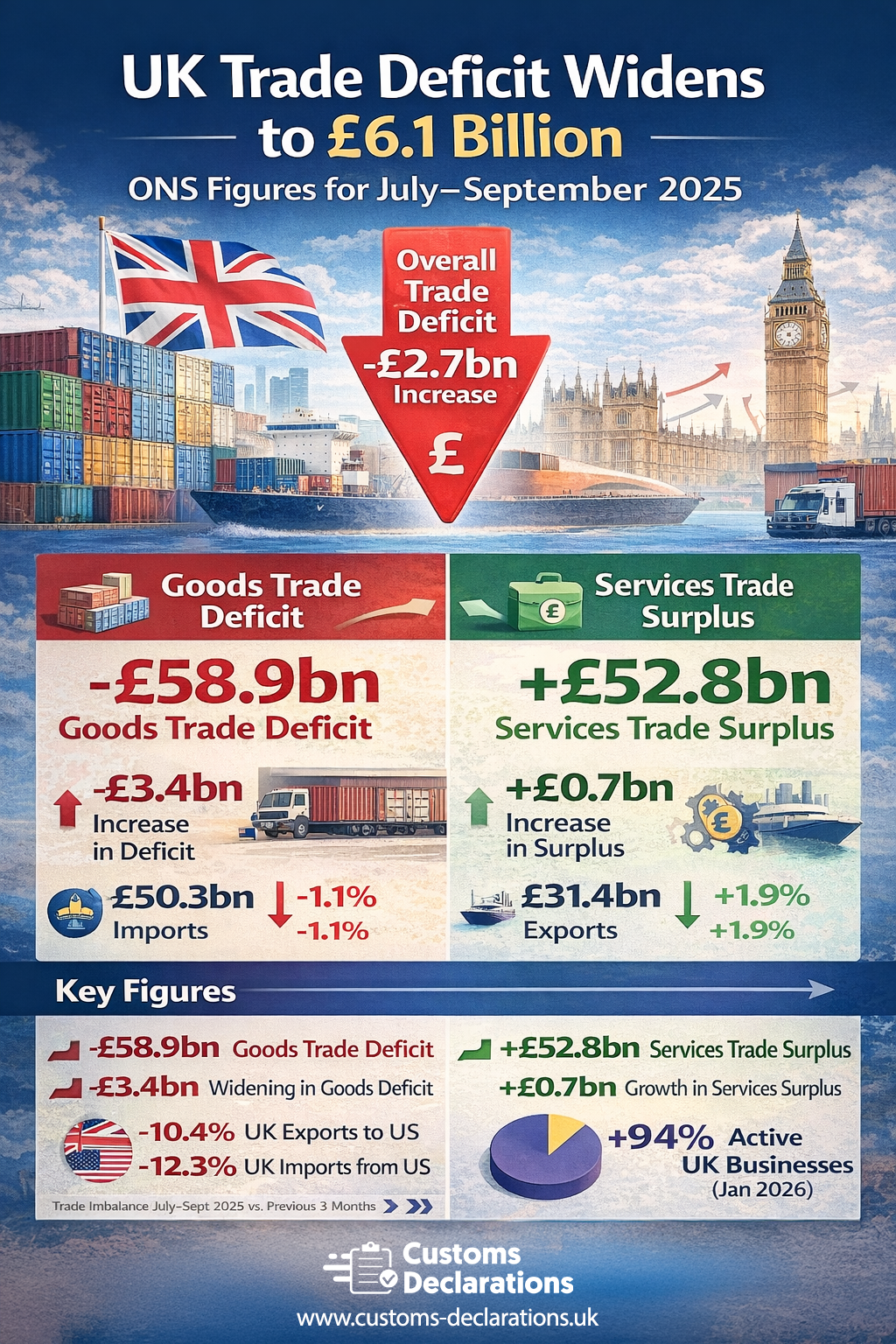

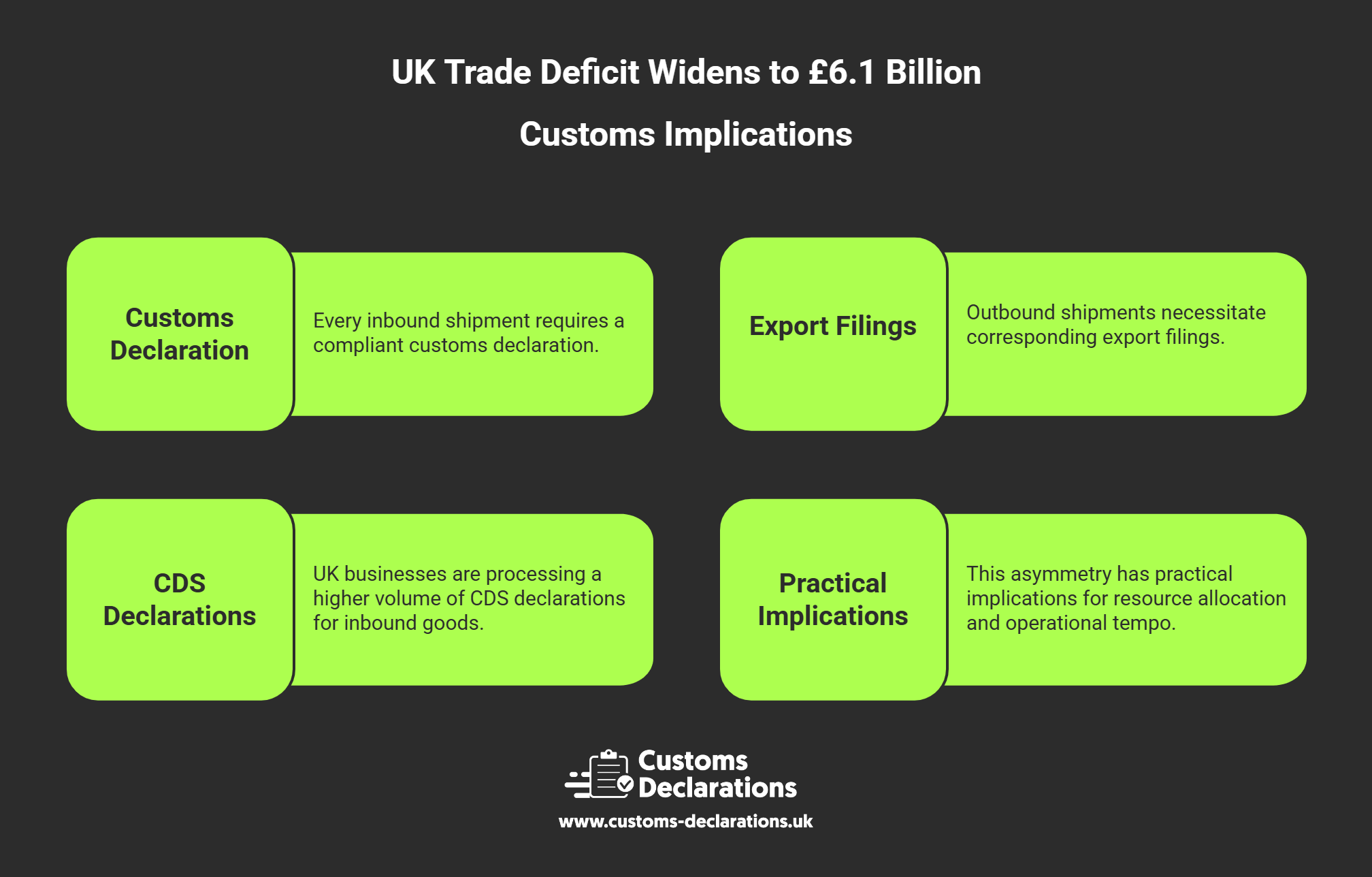

Trade deficits of the magnitude reported by the ONS translate directly into customs administration workloads and compliance obligations for importers and exporters. Every inbound shipment contributing to the £50.3 billion in November goods imports required a compliant customs declaration lodged with HMRC’s Customs Declaration Service. Similarly, outbound shipments forming part of the £31.4 billion export figure necessitated corresponding export filings. The widening goods deficit indicates that import volumes continue to outpace exports significantly, which in turn means that UK businesses, freight forwarders, hauliers, and customs intermediaries are processing a higher cumulative volume of CDS declarations for inbound goods than for outbound movements. This asymmetry has practical implications for resource allocation, systems capacity, and the operational tempo of customs clearance processes at UK ports and inland clearance sites.

For businesses operating in this environment, maintaining accuracy and timeliness in import declarations is not merely a regulatory formality but a critical determinant of supply chain reliability. Delays or errors in customs filings can cascade into inventory shortages, contract penalties, and reputational damage, particularly in sectors dependent on just-in-time logistics models. The formal requirements for an import declaration encompass commodity classification, customs valuation, origin determination, applicable duty and VAT calculations, and the provision of supporting documentation such as commercial invoices, transport documents, and certificates of conformity. Each of these elements must align precisely with the physical goods and the commercial terms of the transaction. Misalignment between declared values and actual transaction prices, for instance, can trigger post-clearance audits, duty reassessments, and financial penalties.

The trade data also highlights the continuing importance of export declarations as a compliance obligation and a strategic business consideration. While export volumes remain lower than imports in aggregate terms, the 1.9 percent increase in November exports suggests that some UK businesses are successfully navigating international markets despite economic uncertainty. Exporters must ensure that their CDS declarations accurately reflect the goods being shipped, including correct commodity codes, destination countries, and any preferential tariff claims under free trade agreements. The UK’s network of trade agreements, including the Trade and Cooperation Agreement with the EU and bilateral agreements with countries such as Japan, Australia, and Canada, offers tariff relief for qualifying goods, but only when origin can be substantiated through compliant documentation and accurate declaration data.

The role of safety and security declarations in international trade flows

Beyond the core customs declarations required for goods clearance, businesses must also contend with safety and security filing obligations. ENS declarations, or Entry Summary Declarations, are required for goods being imported into the UK to provide advance cargo information to customs and border authorities. These filings are designed to enable risk assessment and targeting before goods physically arrive at the border, thereby enhancing border security without unduly impeding legitimate trade. The ENS regime applies to shipments arriving by sea, air, road, and rail, and the timing and content requirements vary depending on the mode of transport and the routing of the goods.

For importers managing the volumes reflected in the ONS data, ensuring that ENS declarations are lodged accurately and on time is essential to avoid border holds and associated costs. Missing or incomplete ENS filings can result in goods being refused entry or held for inspection, disrupting supply chains and incurring demurrage and storage charges. The complexity of ENS compliance is compounded when shipments involve multiple legs, consolidations, or transhipment through third countries, all of which require careful coordination between shippers, carriers, freight forwarders, and customs agents. Businesses that operate in high-volume import lanes benefit significantly from automated systems that integrate ENS filing with core customs declaration processes, allowing data to be captured once and reused across multiple submission types.