Conclusion: A Defining Moment for UK Customs Modernisation

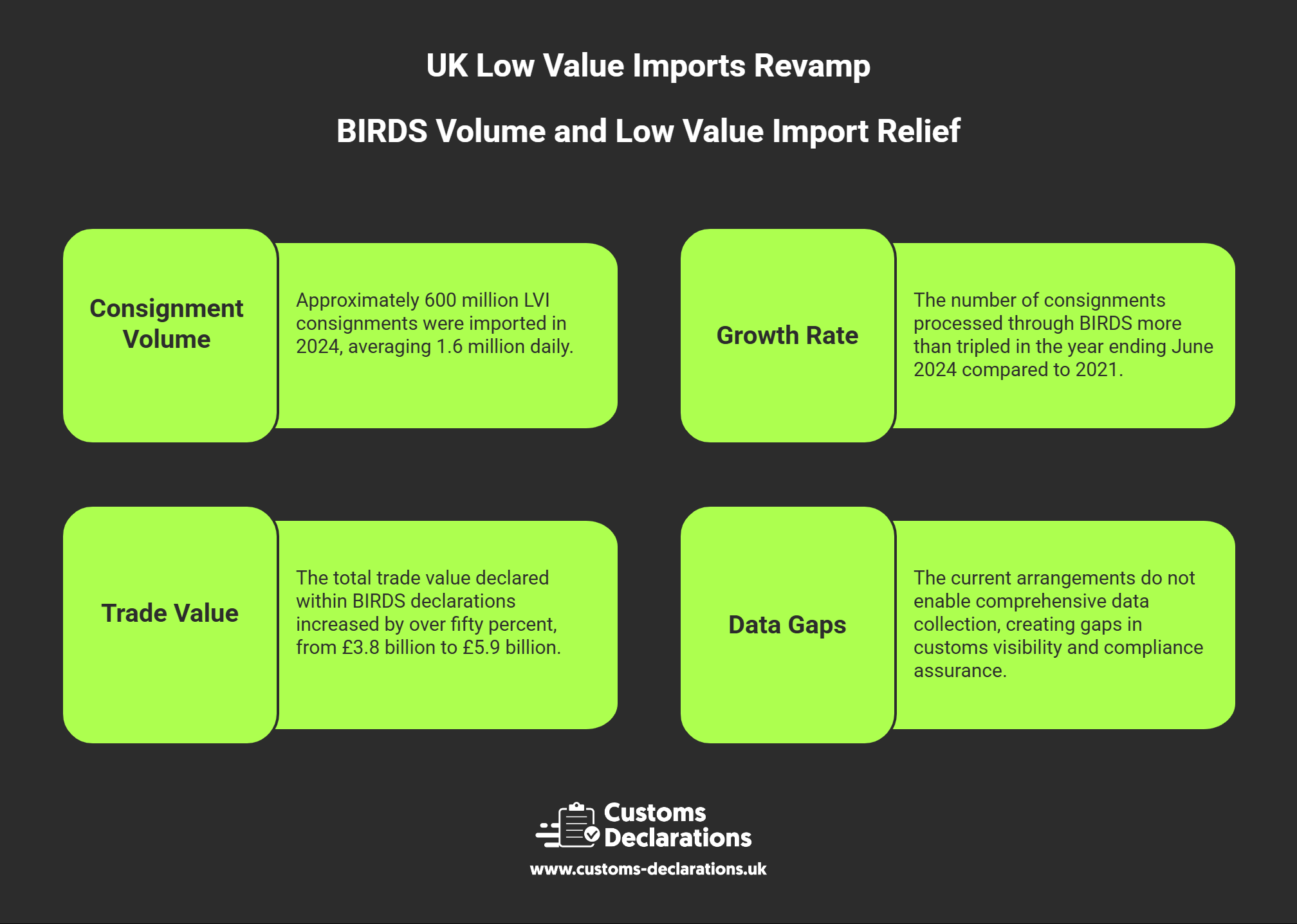

The consultation on reforming the customs treatment of low value imports represents a defining moment in the evolution of the UK’s post-Brexit customs framework. With 600 million annual consignments, billions of pounds in trade value, and profound implications for consumer experience, retail competition, and border integrity, the stakes are exceptionally high. The government’s decision to remove the Low Value Import relief and introduce new, data-rich customs arrangements signals a clear recognition that incremental adjustments to the existing system are insufficient—fundamental reform is necessary to meet the demands of modern cross-border commerce.

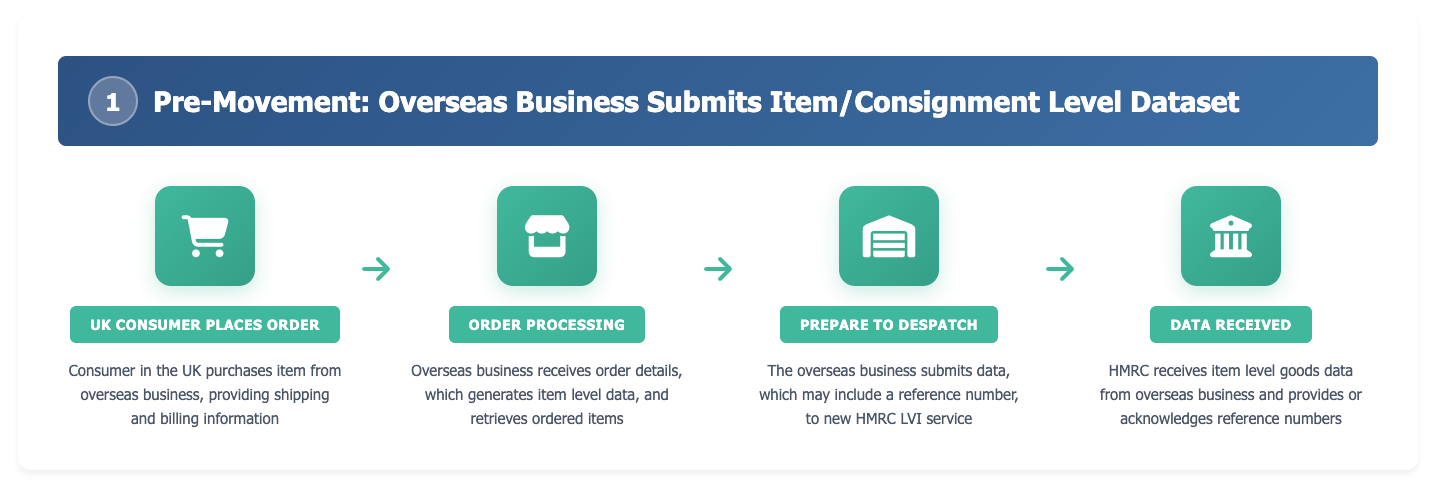

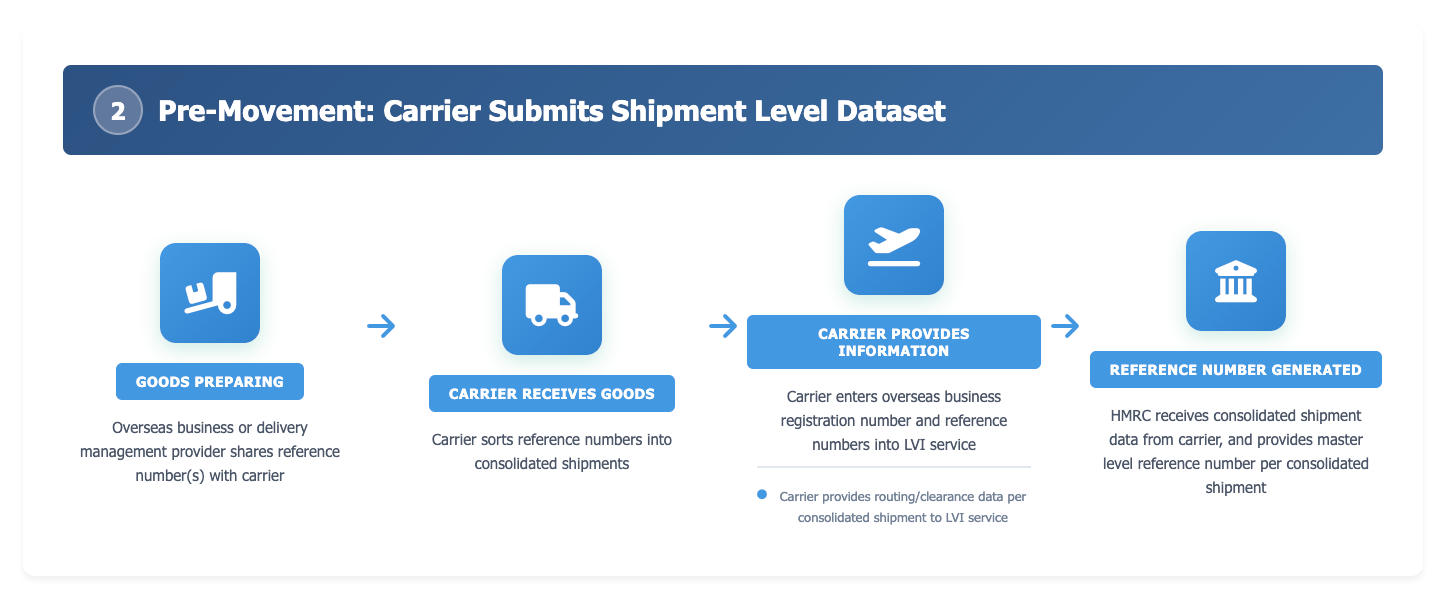

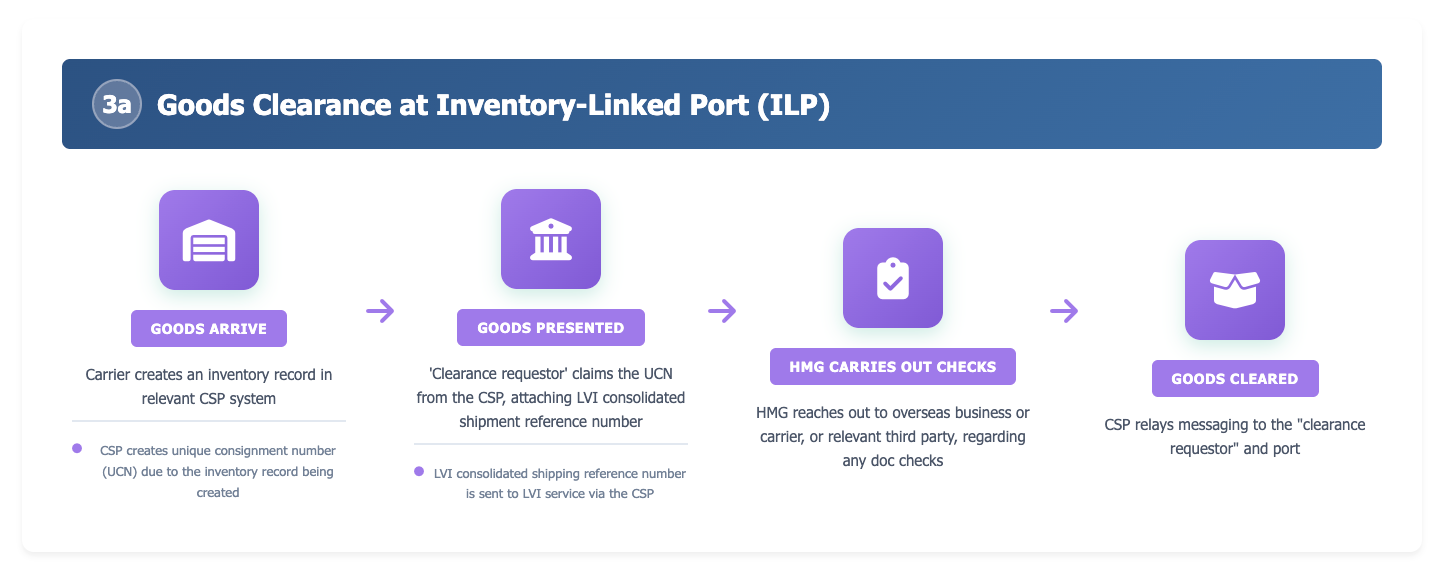

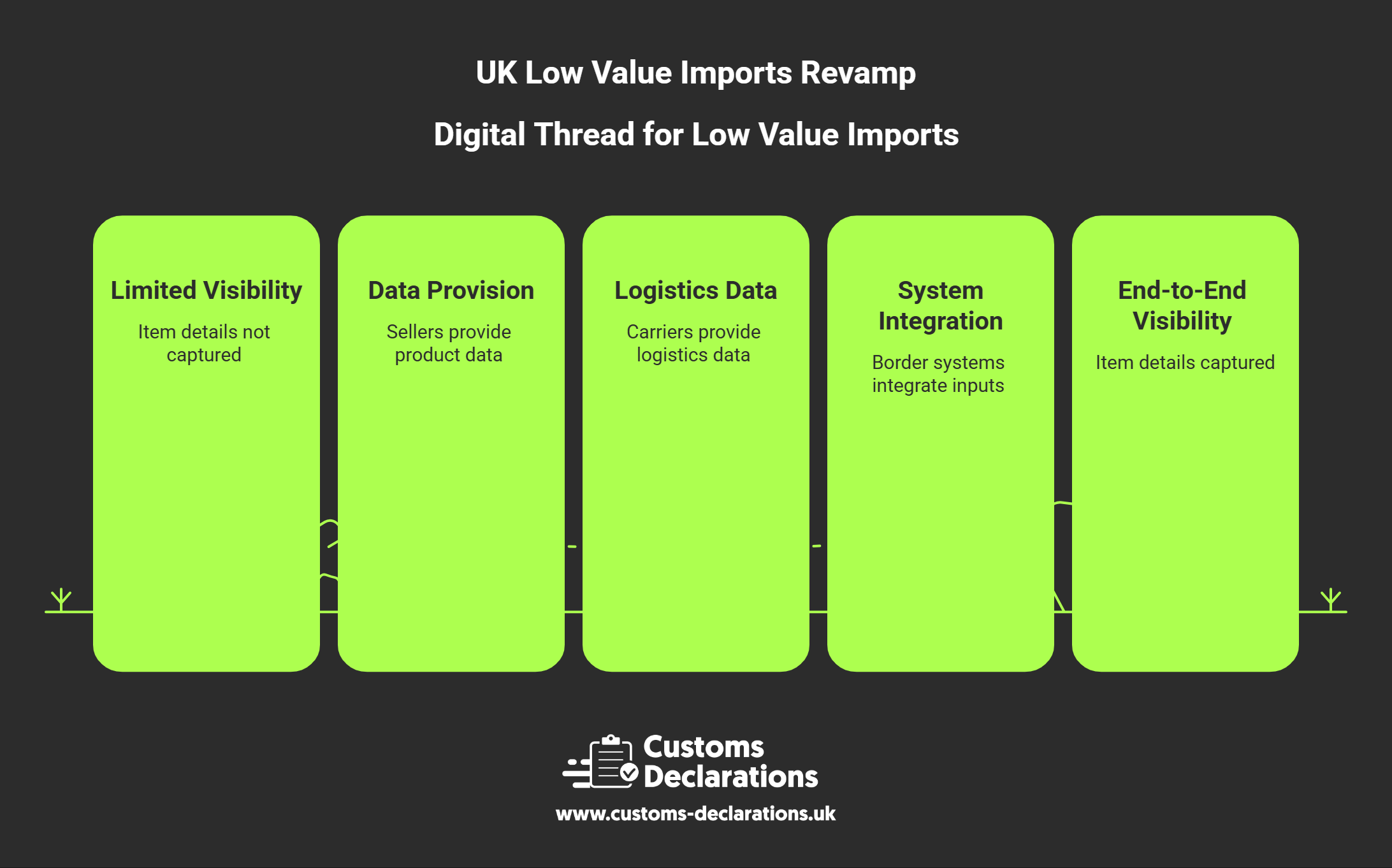

The proposals outlined in the consultation are ambitious and far-reaching: shifting duty liability to sellers and marketplace operators, mandating item-level data submission, potentially requiring fiscal representatives for overseas businesses, introducing optional simplified tariff schedules, considering additional fees for cost recovery, and integrating VAT collection more closely with customs processes. Each of these elements involves significant technical, operational, and commercial complexities that will require careful refinement through co-design with industry.

What is abundantly clear is that the government is approaching this reform with genuine openness to stakeholder input and a recognition of the need for sufficient implementation time. The four-year runway to March 2029 is intended to provide businesses of all sizes—from small independent sellers to major marketplace platforms and global logistics operators—with the opportunity to prepare, invest, and adapt. For those currently utilising BIRDS declarations for low value trade, the message is unambiguous: the era of duty relief and minimal data requirements is coming to an end, and the future will demand greater compliance rigour, more sophisticated systems, and closer integration with HMRC’s data and risk frameworks.

At the same time, the government’s commitment to developing streamlined, proportionate compliance pathways—such as the simplified tariff bucket option and quarterly payment cycles—demonstrates a pragmatic understanding that the new system must remain accessible and workable for the diverse ecosystem of sellers, platforms, and service providers that collectively drive low value trade. Success will ultimately be measured not only by revenue collection and data quality, but by whether the reformed arrangements support a thriving, competitive, and secure cross-border marketplace that benefits UK consumers and businesses alike.

For those seeking to navigate this transition effectively, early engagement with the consultation, investment in understanding the proposed requirements, and proactive planning for system changes and process adaptation will be essential. Platforms like Customs Declarations UK, which already support BIRDS declarations, import declarations, CDS declarations, and ENS declarations, will play a critical enabling role in helping businesses maintain compliance continuity as the LVI landscape transforms. The next four years will require collaboration, innovation, and resilience from all participants in the UK customs ecosystem—but the destination, if achieved, will be a fairer, more transparent, and more secure framework for low value imports into the United Kingdom.