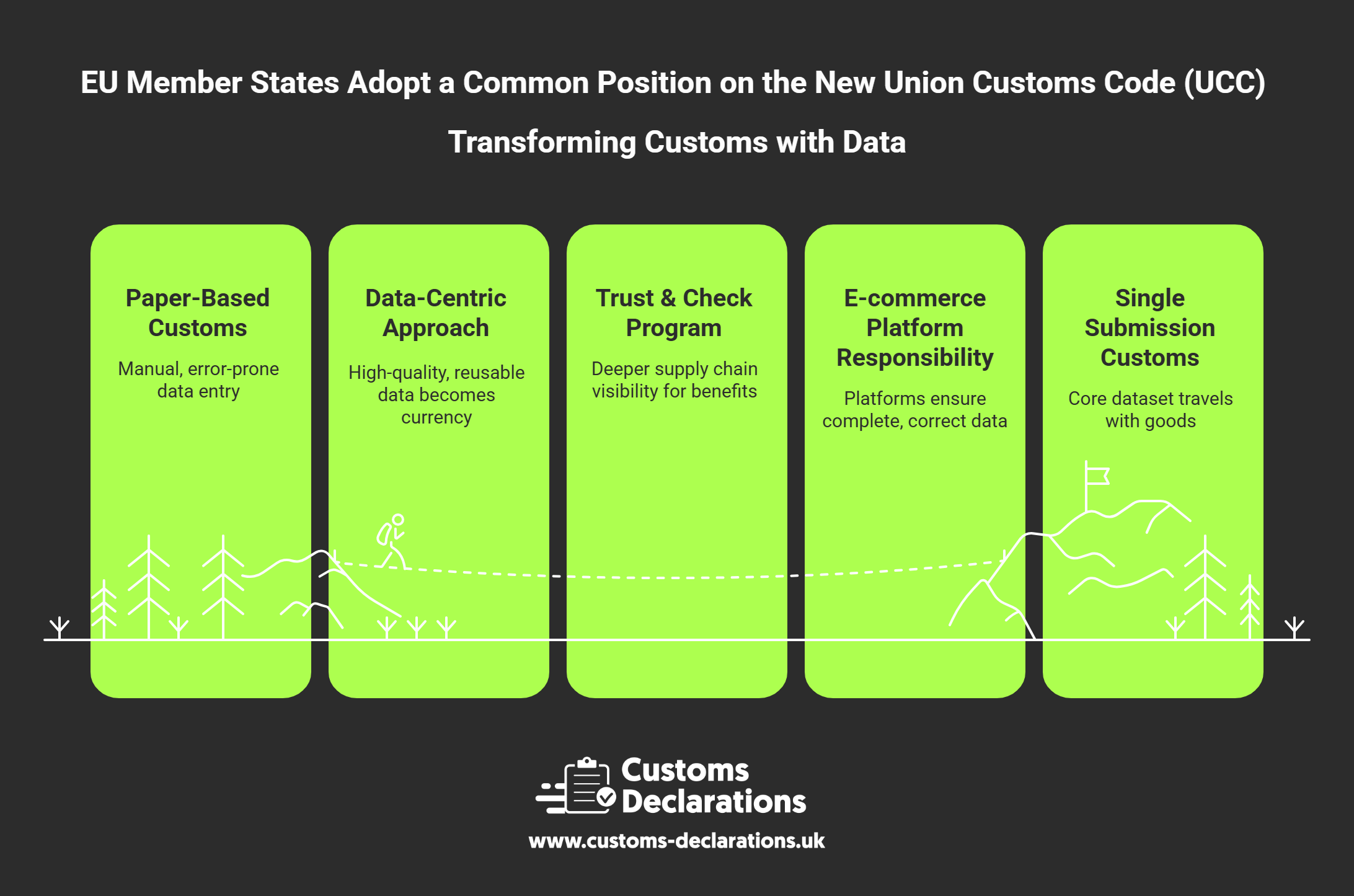

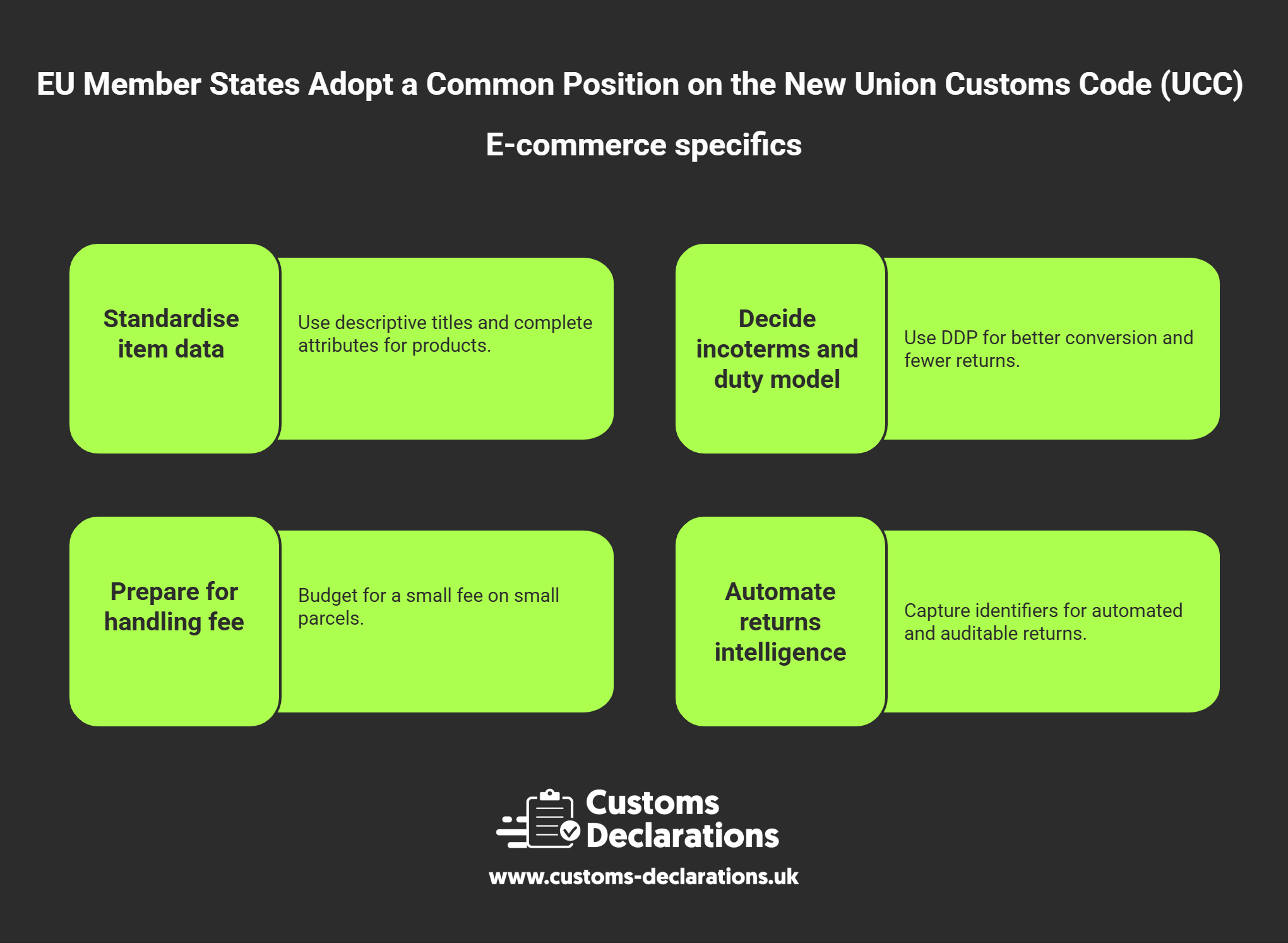

On 27 June 2025, EU finance ministers agreed a common position on the most ambitious overhaul of the Union Customs Code (UCC) in a generation. For traders, platforms, logistics companies and customs brokers, this is not just another legislative waypoint: it is the blueprint for how goods data will be collected, assessed, and cleared across the EU for the next decade. The reform pivots the customs union toward a digital-first, risk-led model built on a central EU Customs Data Hub, overseen by a new European Customs Authority (EUCA) and paired with an upgraded “Trust & Check” regime for highly compliant traders. Alongside that structural shift, the package rethinks how the EU handles the tidal wave of e-commerce parcels, proposes platform accountability, and signals a phased move away from fragmented national IT toward one shared data spine.

This article translates that reform into the practical impacts your business will feel. We explain what is changing, what the Council’s position actually says in business terms, how the timeline is likely to unfold, and—most importantly—what to do next so your customs declaration processes, systems, contracts and customer communications are ready.