Introduction

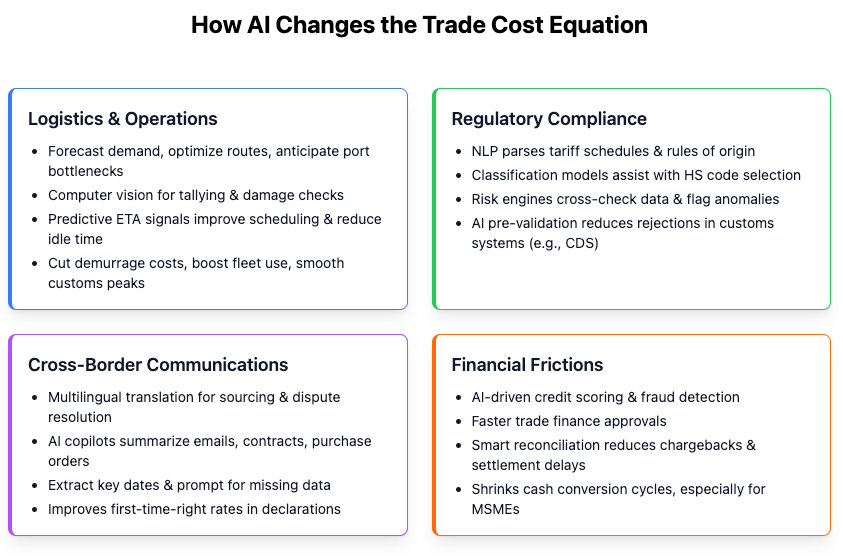

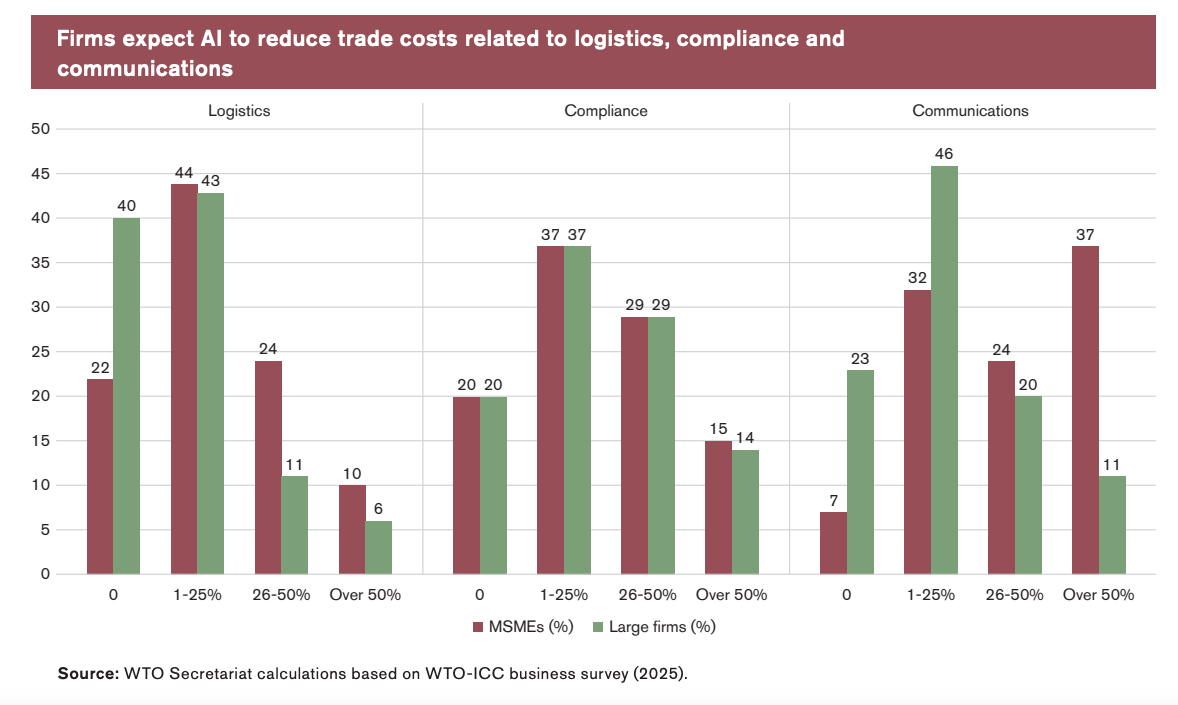

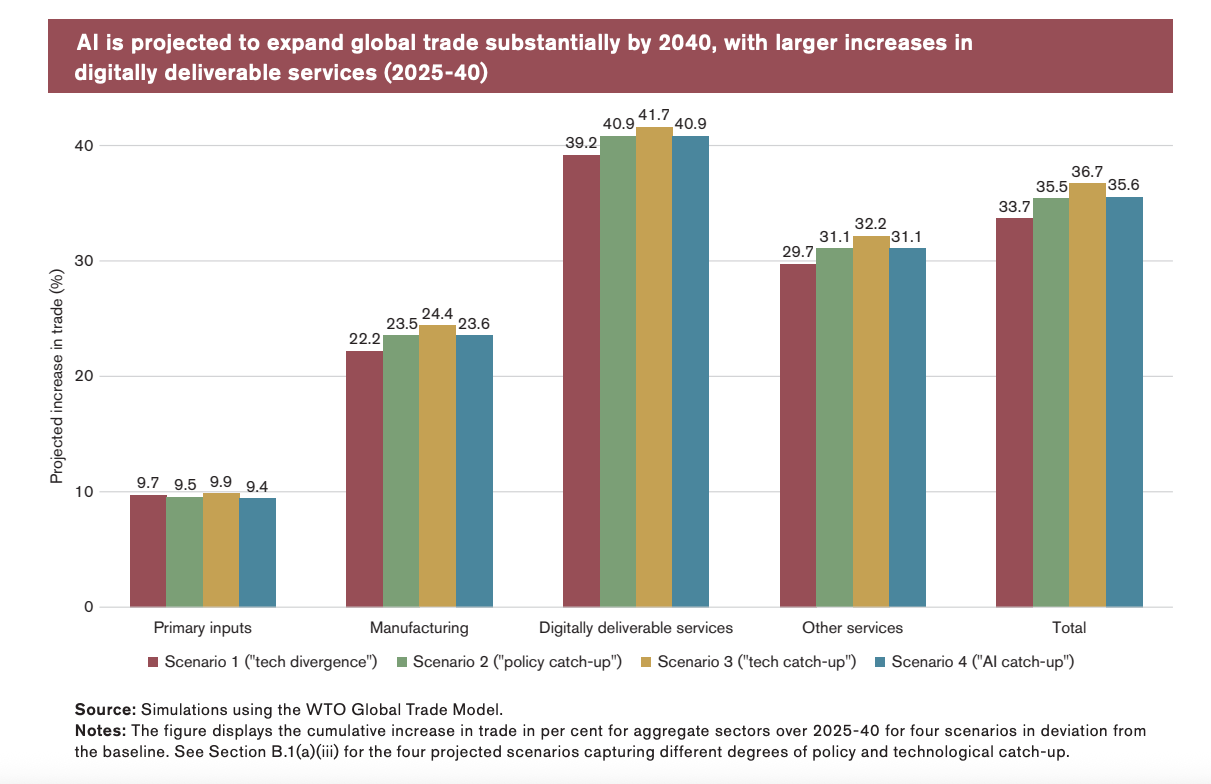

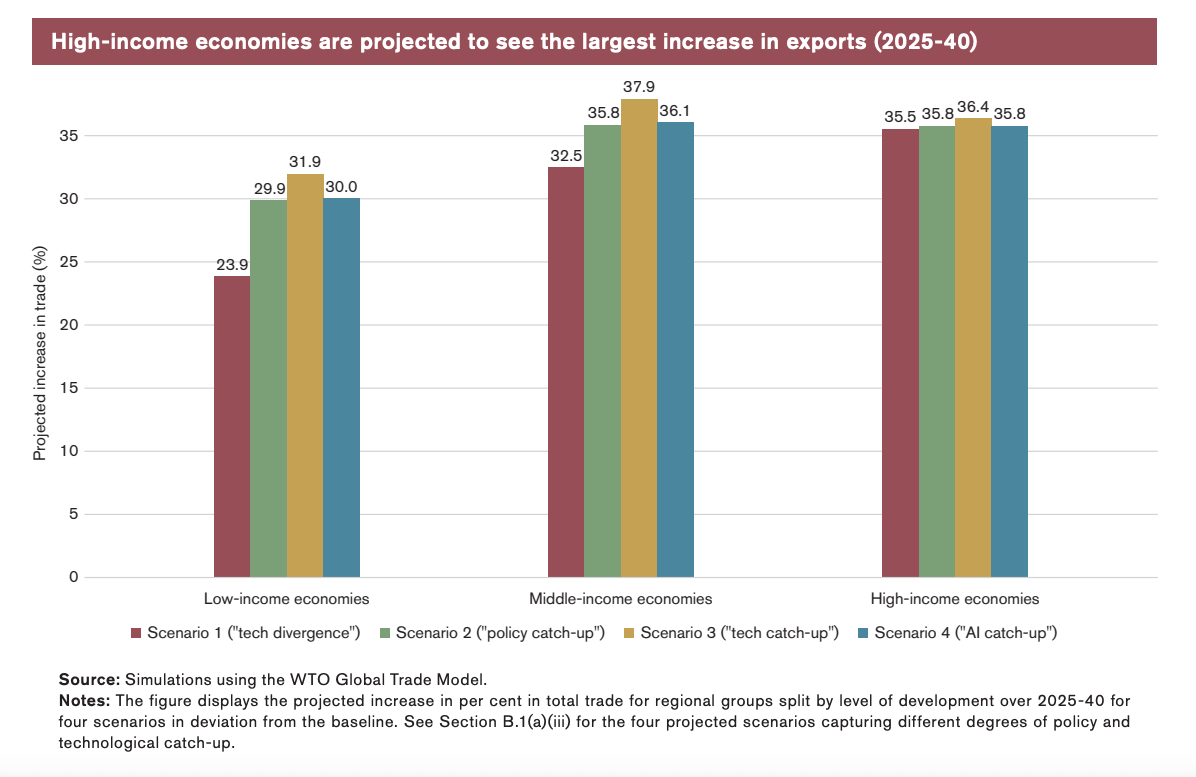

Artificial intelligence (AI) is no longer a peripheral technology in international commerce; it is becoming the connective tissue that ties together supply chains, services trade, border processes, and market access. The World Trade Report 2025 positions AI as a general-purpose technology with economy-wide spillovers that can amplify trade-led growth—provided governments and firms invest in the foundations that let AI diffuse across borders. The report’s central thesis is clear: if the world keeps markets open for AI-enabling goods and services, strengthens rules for trusted cross-border data, and equips people and institutions with the right skills and infrastructure, AI can lower trade costs, expand exports (especially in digitally deliverable services), and make participation more inclusive for micro, small, and medium-sized enterprises (MSMEs). If countries retreat into fragmentation, the gains concentrate and inequalities widen.

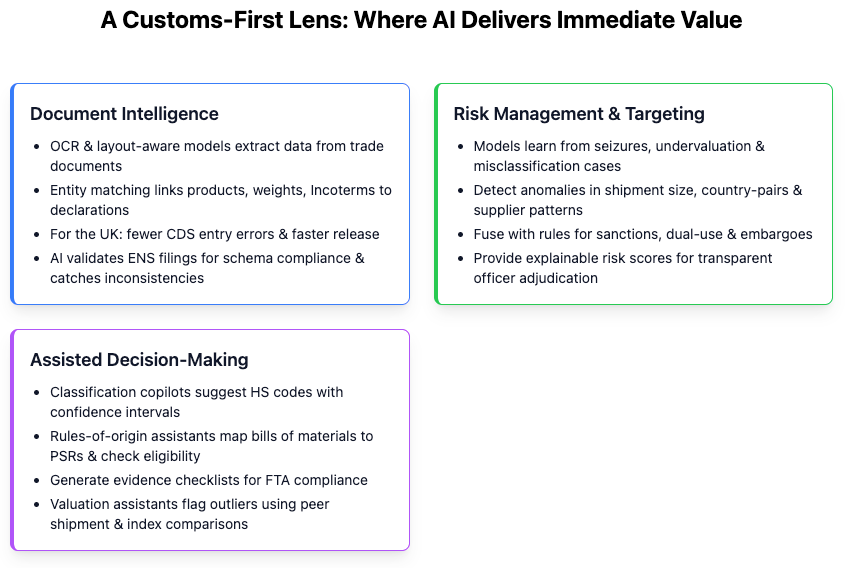

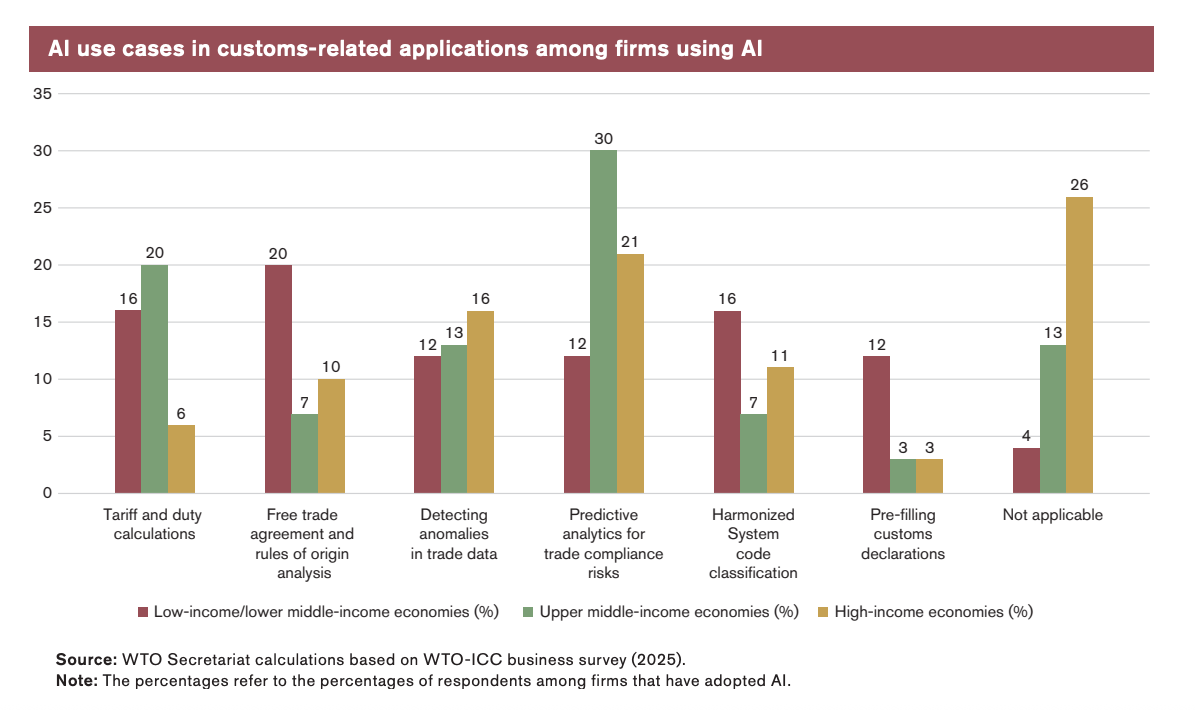

This article synthesizes the report for trade practitioners and policymakers, with a particular focus on customs and border management. It explains how AI reduces operational trade frictions, where the largest growth effects are likely to materialize, what risks must be managed, and which policy choices—domestic and multilateral—will determine whether AI becomes a catalyst for broad-based prosperity or a wedge that deepens divides. Where relevant, the article connects these insights to day-to-day compliance activities—import declarations, export declarations, CDS declarations and ENS declarations—that traders and intermediaries must complete to keep goods moving.