Filing Customs Declarations with Customs Declarations UK

The Customs Declarations UK (CDUK) platform provides a streamlined, user-friendly pathway for UK importers to prepare and submit import declarations to HMRC’s Customs Declaration Service (CDS). Unlike generic customs software or intermediary services that may require technical expertise or incur brokerage fees, CDUK is designed for direct use by importers, freight forwarders, and logistics operators who prefer to manage their customs compliance in-house. The platform offers guided wizards that walk users through each stage of declaration preparation, prompting for essential data elements such as importer and exporter details, commodity codes, quantities, customs values, origin information, and supporting document references.

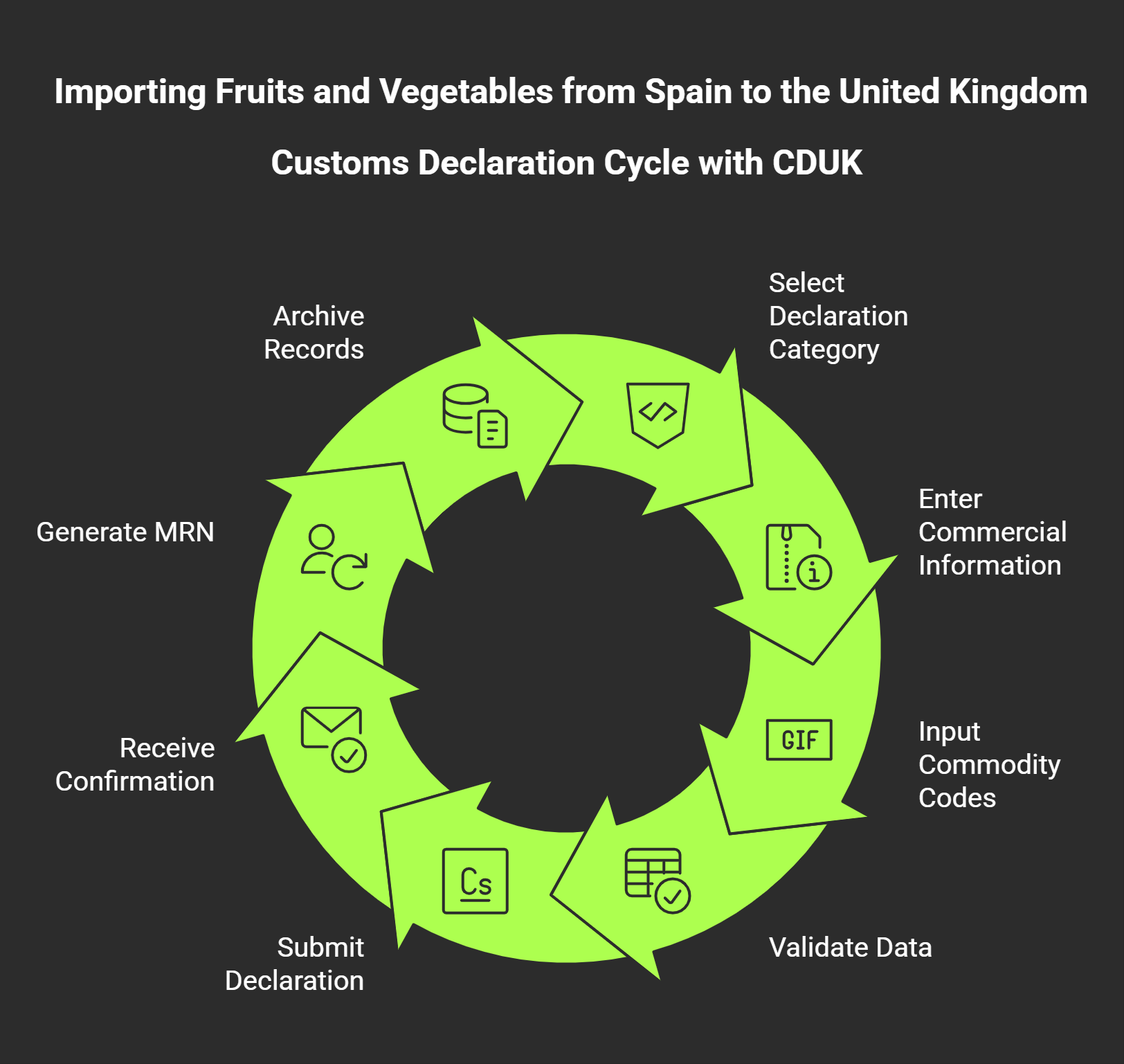

For Spanish fruit and vegetable imports, the declaration process begins by selecting the appropriate declaration category—typically a standard H1 import declaration for release to free circulation—and entering core commercial information including the Spanish supplier’s details, the UK importer’s EORI number, and a description of the goods. Users then input the commodity classification codes, ensuring that each line item corresponds to the correct ten-digit tariff heading and that all product-specific measures are addressed. CDUK performs real-time validation checks as data is entered, flagging missing fields, inconsistent values, or logical errors before submission, which significantly reduces the risk of rejection by CDS and avoids the delays and rework associated with incomplete or incorrect declarations.

Once the declaration data is complete and validated, CDUK submits the entry electronically to CDS and receives immediate confirmation of acceptance or rejection. Upon acceptance, the system generates and displays the Movement Reference Number (MRN), which serves as the unique identifier for the import transaction and is used by border authorities, carriers, and warehouse operators to track the consignment’s clearance status. CDUK automatically archives the full declaration record, including all supporting documents and status messages, for the statutory retention period of six years, ensuring that importers can respond promptly to HMRC audits, respond to post-clearance queries, and maintain compliance with record-keeping obligations. For businesses importing multiple consignments of Spanish produce on a regular basis, CDUK’s template and cloning features enable rapid declaration creation by reusing standard data fields and adjusting only variable elements such as shipment dates, quantities, and invoice values.

In addition to import declarations, CDUK supports the filing of Entry Summary Declarations (ENS) for safety and security purposes. ENS filings provide advance cargo information to UK authorities before goods physically arrive at the border, enabling risk assessment and security screening. For maritime and air shipments of fresh produce, carriers typically lodge ENS declarations on behalf of importers, but in cases where the importer holds the transport contract or where the carrier does not have a direct ENS filing arrangement, CDUK allows importers to submit their own ENS entries, ensuring that safety and security data aligns seamlessly with the subsequent customs declaration and avoiding discrepancies that could trigger holds or inspections.