Importing footwear from China to the United Kingdom presents significant commercial opportunities for retailers, wholesalers, and e-commerce businesses seeking cost-effective sourcing and product variety. However, the post-Brexit regulatory environment demands precise attention to customs classifications, product safety compliance, anti-dumping measures, and VAT obligations. This comprehensive guide explains the end-to-end process for importing shoes, boots, sandals, and other footwear categories from China, helping UK businesses navigate HMRC requirements, manage landed costs, and maintain compliance with both customs and product safety regulations.

Customs Classification: The Foundation of Accurate Declarations

Accurate tariff classification is the cornerstone of compliant footwear imports. Footwear falls primarily under Chapter 64 of the UK Integrated Tariff, with classification determined by several objective criteria including the upper material (leather, textile, rubber, plastics), sole material, construction method (welted, moulded, cemented), and intended use (sports, protective, casual wear). The classification directly determines the applicable duty rate, any trade defence measures such as anti-dumping duties, and statistical reporting requirements. Misclassification can lead to duty underpayment or overpayment, post-clearance demand notices, and potential penalties. Importers should maintain detailed product specifications including material composition percentages, manufacturing processes, and intended end-use documentation to support their classification decisions.

Anti-Dumping Duties on Chinese Footwear

One of the most significant cost factors for UK importers of Chinese footwear is the presence of anti-dumping duties. The UK has maintained certain trade defence measures inherited from the EU regime and continues to apply anti-dumping duties on specific categories of footwear with uppers of leather or certain textile materials originating in China. These duties are additional to the standard MFN rates and can substantially increase the landed cost of goods. The anti-dumping duty rates vary by product category and can range from zero percent for certain exempted manufacturers to significant percentages for others. Importantly, some Chinese manufacturers have been granted individual exemptions based on market economy status or cooperation during anti-dumping investigations, allowing them to benefit from lower or zero anti-dumping duty rates. Importers should verify whether their supplier holds an exemption and obtain the necessary documentation, typically in the form of a TARIC additional code or exemption certificate, to declare the goods correctly and avoid overpaying duties. Maintaining robust supplier due diligence and documentation is critical to claiming any available exemptions lawfully.

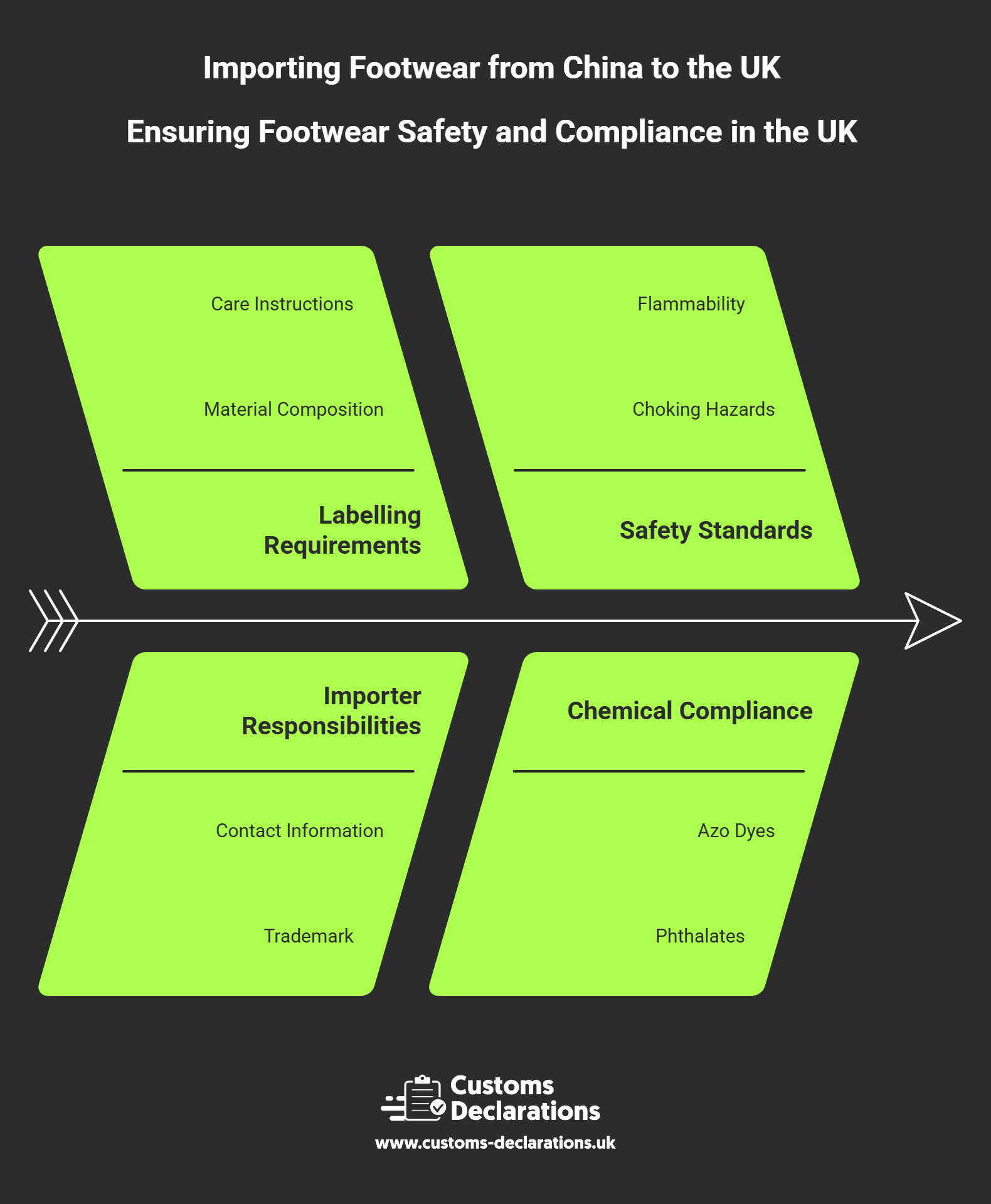

Product Safety and Compliance Requirements

Beyond customs procedures, footwear imported into the UK must comply with UK product safety regulations. The Product Safety Act and the General Product Safety Regulations require that all consumer goods placed on the UK market are safe for their intended use. For footwear, this encompasses several specific considerations. All footwear must carry appropriate labelling indicating material composition, care instructions, and size information in English. The importer assumes responsibility as the UK economic operator and must ensure that products bear the importer’s name, registered trade name or trademark, and contact address on the product or packaging. Additionally, children’s footwear and certain specialized footwear categories may be subject to additional safety standards concerning choking hazards, flammability, and chemical content. The UK recognizes CE marking indefinitely for many product categories, but importers should verify that their footwear complies with UK-specific requirements and maintain technical documentation including test reports, material safety data sheets, and risk assessments. For footwear containing certain chemicals or materials, compliance with the UK REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations is mandatory. Restricted substances such as certain azo dyes, chrome VI in leather, and phthalates in plastics must remain below specified thresholds.

Customs Valuation and Calculating Landed Costs

Accurate customs valuation is essential for determining the correct duty and VAT liability. HMRC uses the transaction value method as the primary basis for customs valuation, which represents the price actually paid or payable for goods when sold for export to the UK. This value must include all costs up to the UK border including the FOB (Free on Board) price, international freight, insurance, packing costs, and any assists or royalties that form part of the sale condition. Costs incurred after importation such as UK inland transport, customs clearance fees, or installation costs should be excluded from the customs value. For footwear imports, importers must be particularly careful to include any design fees, mould costs, or brand licensing fees if these are conditions of the sale and paid to the supplier or a related party. Import duty is calculated on the customs value at the rate applicable to the declared commodity code and origin. Import VAT is then calculated on a base that includes the customs value plus any duty and other chargeable costs, typically at the standard UK VAT rate of twenty percent. VAT-registered businesses can use Postponed VAT Accounting (PVA) to account for import VAT on their VAT return rather than paying at the border, significantly improving cash flow. For high-volume importers, establishing a Duty Deferment Account allows monthly settlement of duties and import VAT rather than payment per shipment.

Shipping Methods and Incoterms

Chinese footwear can be shipped to the UK via sea freight, air freight, or increasingly via rail freight through the Eurasian land bridge. Sea freight remains the most cost-effective option for bulk shipments, with transit times typically ranging from 25 to 40 days depending on the departure port and UK destination. Air freight offers faster transit of 5 to 10 days but at significantly higher cost per kilogram, making it suitable for high-value or urgent orders such as seasonal fashion collections. The choice of Incoterms defines the point at which risk and responsibility transfer from seller to buyer and determines which party arranges freight, insurance, and customs clearance. Common Incoterms for footwear imports include FOB (Free on Board), where the supplier delivers goods to the departure port and the importer arranges international shipping and insurance; CIF (Cost, Insurance and Freight), where the supplier arranges shipping and insurance to the UK port but customs clearance remains the importer’s responsibility; and DDP (Delivered Duty Paid), where the supplier assumes all costs and risks including UK customs clearance and delivery. While DDP may appear convenient, it can complicate VAT recovery and limit the importer’s control over customs procedures, making FOB or CIF generally preferable for experienced importers seeking to optimize costs and maintain compliance control.

Essential Documentation for Footwear Imports

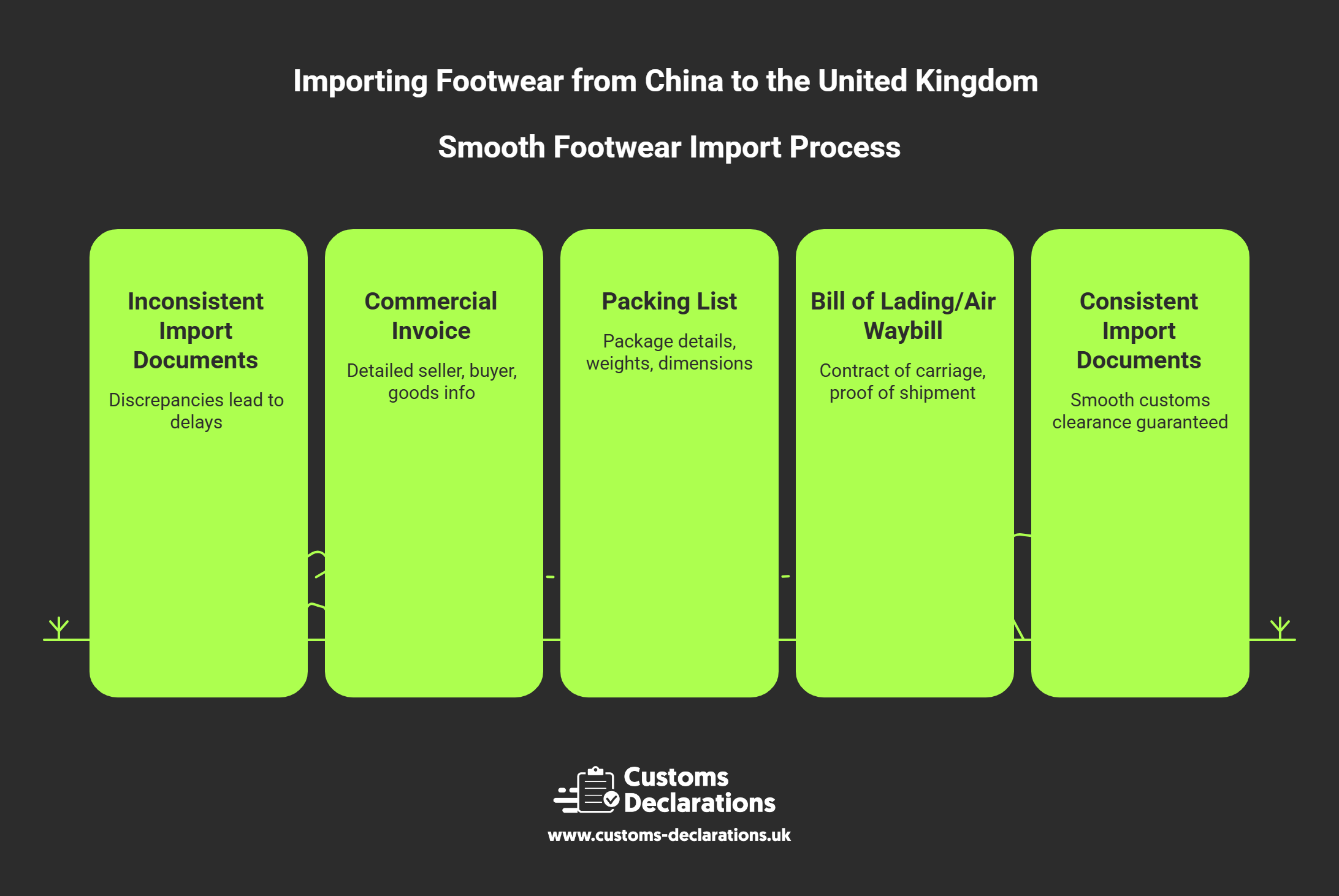

Consistent and accurate documentation is fundamental to smooth customs clearance. The commercial invoice is the primary document and must contain detailed information including the seller and buyer details with full addresses and contact information, a complete description of the goods specifying material composition and use, the agreed Incoterm, the total value broken down by line item, and the country of origin. The packing list should detail the number and type of packages, gross and net weights, dimensions, and carton markings. The bill of lading for sea freight or air waybill for air freight serves as the contract of carriage and proof of shipment. A certificate of origin, while not always mandatory for non-preferential trade, provides official confirmation of the country of manufacture and may be required to determine anti-dumping duty application. For footwear subject to anti-dumping measures, any exemption certificates or TARIC codes must be provided. Importers should also maintain material composition declarations from suppliers, test reports confirming chemical compliance, and labelling samples demonstrating conformity with UK regulations. All documentation should be consistent across sources to prevent HMRC discrepancies or inspection delays.

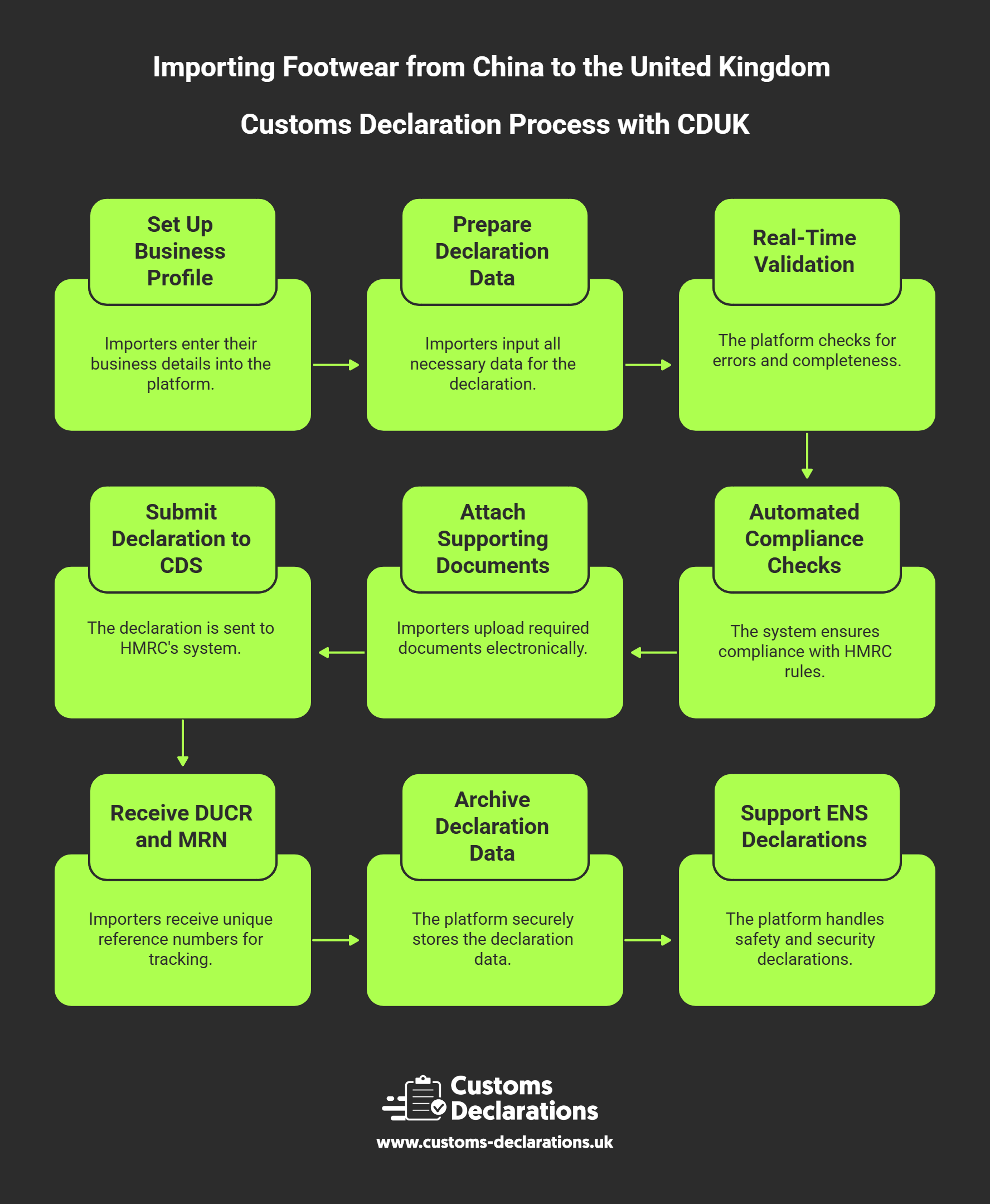

Filing Customs Declarations with Customs Declarations UK

The Customs Declarations UK (CDUK) platform provides a comprehensive, user-friendly solution for preparing and submitting import declarations directly to HMRC’s Customs Declaration Service. The platform guides importers through the complete customs filing process using plain-English workflows that eliminate the complexity traditionally associated with customs procedures. Within CDUK, importers can set up their business profile once including their GB EORI number, VAT registration details, and consignee information, then reuse this data across multiple declarations. The platform’s wizard-based interface walks users through each required data element including the commodity code with full ten-digit classification, commercial description specifying upper and sole materials, customs value broken down into FOB price, freight, and insurance, country of origin confirmation, and any applicable anti-dumping duty exemption codes or additional measures. Real-time validation checks ensure that all mandatory fields are completed and that data relationships are logical before submission, significantly reducing rejection rates and the need for manual corrections.

Once the declaration data is complete, CDUK performs automated compliance checks against HMRC’s business rules and highlights any potential issues such as missing documentation references, incorrect procedure codes, or valuation anomalies. Users can attach supporting documents electronically including invoices, packing lists, and certificates within the platform for easy retrieval during audits. Upon submission to CDS, the platform generates a unique Declaration Unique Consignment Reference (DUCR) and, once accepted by HMRC, returns the official Movement Reference Number (MRN) which serves as proof of customs clearance. CDUK automatically archives all declaration data securely for the statutory six-year retention period required by HMRC, providing immediate access to historical records for audit responses, dispute resolution, or trend analysis. The platform also supports ENS declarations (Entry Summary Declarations) for safety and security requirements, ensuring alignment between pre-arrival cargo information and customs declarations to prevent holds at ports.

For importers managing regular footwear shipments, CDUK’s template and cloning features allow rapid declaration preparation by reusing product profiles, supplier details, and routing information from previous successful submissions. This dramatically reduces data entry time while maintaining consistency and accuracy. The platform’s dashboard provides real-time visibility of declaration status, HMRC response messages, and any queries or document requests, enabling proactive case management and faster resolution of clearance issues. By centralizing the entire customs process from preparation through submission to record retention, Customs Declarations UK transforms what has traditionally been a complex, error-prone procedure into a streamlined, audit-ready workflow accessible to businesses of all sizes.

Post-Import Compliance and Record Keeping

After customs clearance, importers retain ongoing obligations that extend well beyond the point of entry. All import records including commercial invoices, transport documents, customs declarations, certificates, test reports, and correspondence must be retained for a minimum of six years as required by HMRC. These records may be requested during post-clearance audits, compliance checks, or investigations into suspected duty underpayment or misclassification. Importers should implement systematic filing systems, whether physical or digital, that allow rapid retrieval of complete documentation sets linked to specific shipments or declaration reference numbers. For footwear importers, maintaining comprehensive product files that combine customs documentation with safety compliance evidence creates a defensible audit trail demonstrating due diligence across both customs and product law dimensions. Businesses that plan to resell or distribute imported footwear within the UK should also ensure compliance with Extended Producer Responsibility schemes for packaging waste, registering with an approved compliance scheme and reporting annual packaging data to environmental regulators.

Common Pitfalls and How to Avoid Them

Several recurring mistakes cause delays, cost overruns, and compliance issues for footwear importers. Incorrect classification remains the most common error, often resulting from generic product descriptions that fail to capture the specific material composition and construction characteristics that determine the proper commodity code. Importers should invest time in understanding the classification logic for footwear and maintain detailed product specifications from suppliers to support their decisions. Undervaluation or incomplete valuation is another frequent issue, particularly when importers exclude freight costs, insurance, or assists that should be included in the customs value, leading to duty underpayment and subsequent HMRC assessments with interest and penalties. Using clear, transparent valuation worksheets that document all includable costs prevents these issues. Failure to identify and declare anti-dumping duties correctly can result in significant financial exposure, as retrospective collection of unpaid anti-dumping duties with interest can multiply costs substantially. Importers must verify the anti-dumping status of their products and suppliers before shipment and maintain robust exemption documentation where applicable.

Product compliance failures represent another major risk area. Importing footwear that lacks proper material labelling, contains restricted chemicals above permitted thresholds, or fails to include importer identification in English can trigger market surveillance enforcement action, product seizures, or requirements to recall goods already sold. Preventive controls include requesting compliance documentation from suppliers before placing orders, conducting pre-shipment testing through accredited laboratories, and implementing quality control checks upon arrival. Finally, poor coordination between shipping documentation and customs declarations creates unnecessary friction. When the bill of lading, commercial invoice, packing list, and customs declaration contain inconsistent descriptions, quantities, or values, HMRC systems flag discrepancies that delay clearance and trigger manual interventions. Establishing standard operating procedures that ensure all documentation flows from a single source of truth eliminates these avoidable delays.

Practical Checklist for First-Time Footwear Importers

For businesses new to importing footwear from China, following a structured approach reduces risk and accelerates the learning curve. Begin by obtaining a GB EORI number through the GOV.UK portal, ensuring it is validated and active before attempting to file any customs entries. If VAT-registered, configure Postponed VAT Accounting with HMRC to enable deferral of import VAT. Conduct thorough supplier due diligence by verifying business credentials, visiting factories if feasible, and requesting references from other UK customers. Obtain detailed product specifications including material breakdowns by percentage, construction methods, and intended use to support classification decisions. Request and verify all required compliance documentation including material safety declarations, test reports for restricted substances, and labelling samples demonstrating conformity with UK regulations. Confirm the anti-dumping duty status of your products by checking the UK Trade Tariff for applicable measures and determine whether your supplier qualifies for any exemptions.

Define clear Incoterms in purchase contracts that align with your logistics capabilities and cost management objectives, typically FOB or CIF for most footwear imports. Arrange freight forwarding through reputable carriers with experience in UK customs procedures, ensuring they understand your declaration requirements and can provide timely shipping documents. Prepare complete and consistent documentation including detailed commercial invoices, accurate packing lists, and certificates of origin. Use the Customs Declarations UK platform to prepare and validate your import declarations, ensuring all data elements are complete and accurate before submission. Maintain comprehensive records linking each shipment to its customs clearance documentation, compliance certificates, and financial records. Finally, establish a post-import review process that monitors for HMRC correspondence, tracks declaration amendments if needed, and archives all evidence systematically for the six-year retention period.

Conclusion: Building a Compliant and Scalable Import Operation

Importing footwear from China to the United Kingdom offers compelling commercial opportunities when executed with precision and structured compliance. Success requires mastering the interplay between accurate customs classification, comprehensive product safety due diligence, correct application of anti-dumping measures, transparent customs valuation, and systematic documentation management. By understanding the post-Brexit regulatory landscape, investing in supplier relationships built on quality and compliance, and leveraging modern digital tools such as the Customs Declarations UK platform for validated, audit-ready filings, importers transform complex cross-border trade into a repeatable, low-friction business process. The combination of supplier diligence, accurate declarations filed through CDUK, proactive compliance monitoring, and strong record-keeping creates a foundation for sustainable growth, whether importing single container loads or managing high-volume footwear distribution operations. Maintaining these controls ensures that future shipments clear efficiently, costs remain predictable, and compliance obligations are met consistently across customs, product safety, and environmental dimensions.