Filing Customs Declarations Using the Customs Declarations UK Platform

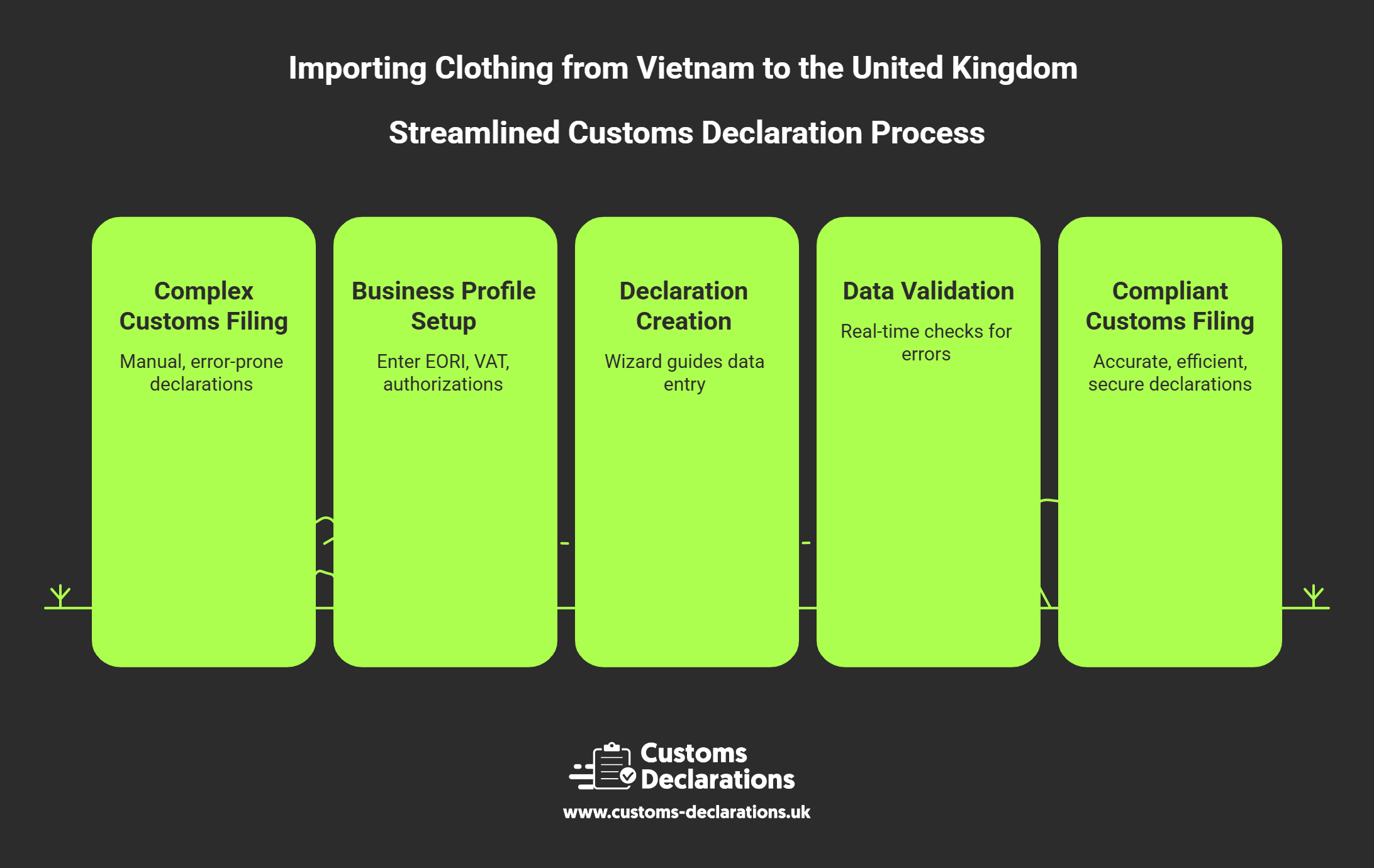

The Customs Declarations UK (CDUK) platform provides UK importers with a structured, user-friendly pathway to prepare and submit import declarations to HMRC’s Customs Declaration Service (CDS). Filing accurate, complete declarations is essential for lawful importation, timely clearance, and compliance with all customs and fiscal obligations. CDUK simplifies this process by offering guided workflows, real-time validation, and secure record-keeping that aligns with HMRC requirements.

Within the CDUK platform, importers begin by setting up their business profile, including the GB EORI number, VAT registration details, and any relevant customs authorizations or approvals. Once the profile is established, users can create new customs declarations for each shipment of Vietnamese clothing. The platform presents a wizard-based interface that walks users through each required data element in plain English, reducing the complexity of navigating CDS codes and technical jargon. Importers enter key information including the consignor and consignee details, the commodity classification code determined during the product research phase, the customs value and its components, the country of origin, and the preferential tariff treatment being claimed under UKVFTA.

For clothing imports claiming preferential duty, the declaration must include the correct procedure code indicating free circulation with preference, reference to the UKVFTA agreement, and the origin criterion code that corresponds to the type of origin evidence held. CDUK’s built-in validation engine checks data consistency and completeness before submission, flagging missing fields, illogical entries, or discrepancies that could result in declaration rejection or clearance delays. This real-time feedback allows importers to correct errors immediately, avoiding costly rework and reducing the risk of penalties for incorrect declarations.

Once all data is entered and validated, the declaration is submitted electronically to CDS. Upon acceptance by HMRC, the platform retrieves the Movement Reference Number (MRN), which serves as the unique identifier for the customs entry and is required for release of the goods by the port or carrier. CDUK securely archives the complete declaration dataset, including all supporting documents, invoices, packing lists, and origin statements, for the statutory six-year retention period mandated by HMRC. This comprehensive digital record provides importers with instant access to historical data for compliance audits, VAT reporting, and financial reconciliation.

The platform also supports the preparation and submission of ENS declarations (Entry Summary Declarations) for safety and security purposes. While ENS filings are typically submitted by carriers, importers can use CDUK to align their customs declaration data with the safety and security information provided to customs authorities, ensuring consistency across all datasets and reducing the risk of holds or inspections triggered by data mismatches. For businesses managing multiple shipments or complex supply chains, CDUK offers features such as bulk data upload via CSV files, reusable templates for common product lines, and integration capabilities with internal ERP or logistics systems, streamlining the declaration process and enabling scalable, efficient customs operations.