Introduction

Importing a passenger car from Germany to the United Kingdom can offer real value—access to wider specifications, better pricing, and rare models—provided the import is managed with the same precision you would apply to a regulated financial transaction. Since the UK’s exit from the EU, Germany-to-GB movements are now international imports governed by customs law, vehicle approval rules, and registration procedures. In practical terms, every successful import follows a predictable arc: confirm eligibility for preferential duty under the UK-EU Trade and Cooperation Agreement (TCA), establish a defensible customs value, make a complete customs declaration, notify HMRC through NOVA, secure GB vehicle approval (or pass an IVA), and then register with the DVLA. Treating those steps as a single, joined-up process yields predictable costs and faster time to registration.

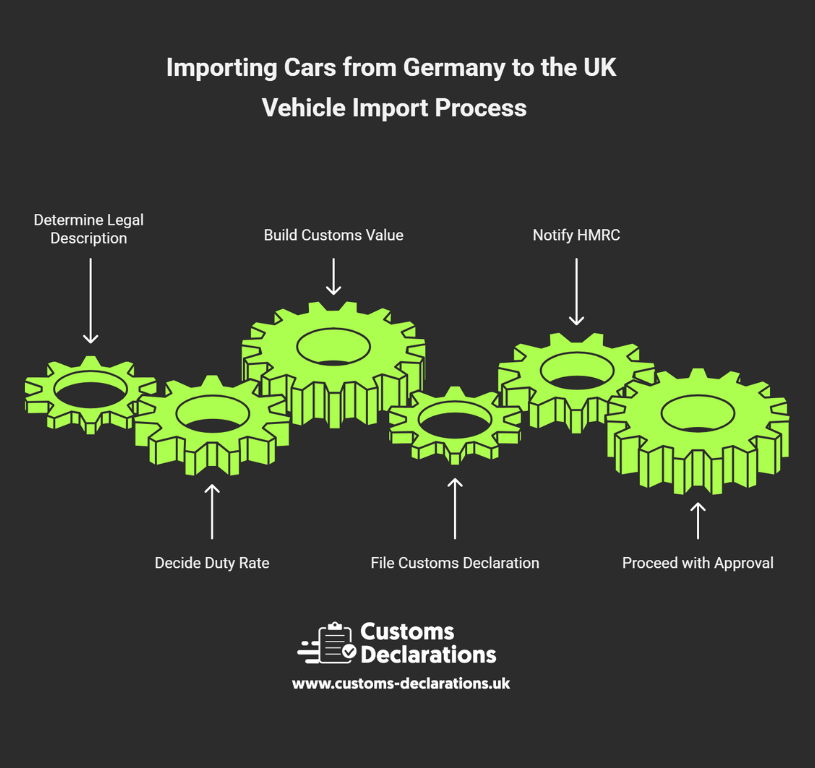

The end-to-end roadmap at a glance

The import sequence is logical. First, determine the correct legal description of the vehicle so you understand the measures that apply and the baseline duty position. Second, decide whether you can legally claim 0% duty using preferential origin under the TCA; if not, plan for the most-favoured-nation rate commonly applied to passenger vehicles. Third, build a compliant customs value using the transaction value (Method 1) with the required additions to the border and the correct exclusions after import. Fourth, file the customs declaration and arrange payment of any duty and import VAT, and within fourteen days notify HMRC via NOVA. That foundation enables the remaining steps—vehicle approval and DVLA registration—to proceed without friction.

Preferential origin: when a German car qualifies for 0% duty

A car “bought in Germany” is not automatically of EU preferential origin. Preferential duty under the TCA applies only when the vehicle meets the product-specific rule of origin for its tariff heading. In practice, that means verifying the economic origin of the vehicle rather than relying on the shipping route or the seller’s address. You must hold valid proof of origin at the time of import—most commonly a statement on origin on the commercial invoice—or rely on importer’s knowledge only if you genuinely have sufficient manufacturing evidence on file. Where the rule is met, 0% customs duty applies; otherwise, the most-favoured-nation rate will be charged. Capture this test and the supporting evidence in your import file so that a future audit can reach the same conclusion.

When planning electric-vehicle purchases, note that the UK and EU extended the more flexible EV/battery origin thresholds until 31 December 2026, reducing the risk of tariffs during the transitional period. Still, do not assume qualification: preference remains evidence-driven, and you should retain supplier declarations and, where applicable, bills of materials that demonstrate compliance with the rule.

For retail buyers and dealers alike, the safest practice is to obtain the seller’s statement on origin before shipment. If the claim is unavailable or cannot be supported, plan the landed cost using the non-preferential rate and do not claim preference at the border.

Customs valuation: building the duty and VAT base correctly

HMRC’s default valuation method is the transaction value—the price actually paid or payable for the exported vehicle—plus specific additions to the point of import. At minimum, you should include international freight, insurance, and any origin-side handling or loading costs up to the UK frontier. If payable as a condition of sale, certain royalties or licence fees and the value of any assists must also be included. By contrast, exclude UK inland transport after import and post-import taxes or fees, such as the DVLA first registration fee. Keep documents that show which costs were included in the invoice price and which were added separately so an auditor can see how you reached the declared figure.

This same logic applies to options and software. Factory-fitted options that form part of the sale belong in the transaction value, and HMRC may require you to add amounts billed separately if they were a condition of the sale. Clear paperwork separating UK-fitted accessories or post-sale add-ons—items that are not part of the customs value—will help you avoid overvaluation. If you omit dutiable amounts or include non-dutiable items, you can misstate both customs duty and import VAT, creating exposure to assessments and penalties.

To illustrate the mechanics, imagine a used German-market car with an ex-works invoice price and separate charges for overseas transport and origin handling. The customs value adds the costs to the UK border to the invoice price and excludes UK inland delivery. HMRC’s monthly exchange rate should be applied on the entry date for conversion. This base then drives any duty (0% with valid preference, otherwise the non-preferential rate appropriate to the precise legal description) and forms part of the import VAT calculation.

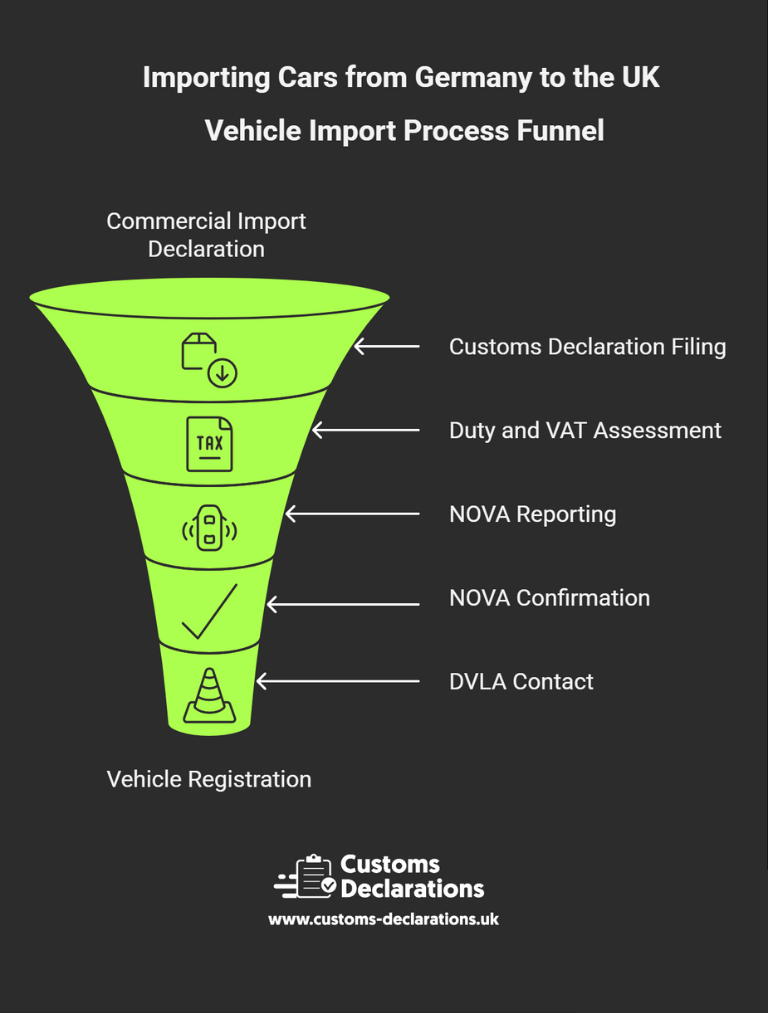

Making the border filings: customs declaration and NOVA

Every commercial import must be declared into CDS (Customs Declaration Service). You can use Customs Declarations UK Platform for filing your customs declarations efficiently. When HMRC accepts the entry, duty (if any) and import VAT are assessed against the customs value and origin position you have evidenced.

In parallel, the vehicle must be reported to HMRC’s NOVA system within 14 days of arrival so the tax authority can confirm the VAT position and release the vehicle for registration. Once NOVA is confirmed, wait 48 hours before contacting DVLA to allow the electronic records to sync; starting early is a common source of delay. Retain the NOVA confirmation with your declaration evidence and commercial documents.

Type approval and IVA: proving the car is road-legal in GB

Before DVLA registration, a vehicle must demonstrate compliance with GB safety and environmental standards. There are two principal routes. Where available, GB/UK(NI) type approval documentation provides the smoothest path for series-produced vehicles. In many other cases, importers use Individual Vehicle Approval (IVA), particularly for used vehicles or niche models not covered by a current GB type approval. The IVA process confirms that the vehicle broadly meets modern requirements and will often involve minor modifications—such as lighting adjustments, miles-per-hour speedometer conversion, or emissions documentation—to secure a pass. Planning those modifications early in the timeline avoids storage charges and missed appointments.

If you cannot present a certificate of conformity and your vehicle is under ten years old, IVA is commonly the appropriate route; older vehicles can be handled differently but should not be assumed exempt from all checks. Costs and scheme choice vary, so engage with the VCA/DVSA guidance as early as possible and bring the correct evidence to the test centre.

DVLA registration: putting the car on the road

After your NOVA confirmation and approval evidence are in place, apply to register the vehicle with DVLA, paying the first registration fee and vehicle excise duty as appropriate and presenting any required identity, insurance and inspection documentation. Complete, legible paperwork shortens timelines and reduces the chance of DVLA queries or inspection requests. Keep copies of everything as part of your import archive.

Filing through Customs Declarations UK (CDUK)

For many importers—especially those importing multiple vehicles or managing imports alongside exports—Customs Declarations UK (CDUK) provides a structured, guided pathway to prepare and lodge the customs declaration in plain English and transmit it to CDS.

Within CDUK, begin by setting up the importer and consignee identities and reusing saved profiles for repeat lanes. Select the appropriate procedure for the import, then capture the commercial description, declared value and its components, and the origin position. Where you will claim preferential duty, the platform ensures the necessary origin fields are present and consistent with the invoice and your evidential file. If licences or approvals are required for the consignment, these can be referenced directly in the declaration. Real-time validation checks for missing or illogical data—such as mismatched units or inconsistent weights—before submission to CDS, reducing rejections and manual rework. On acceptance by HMRC, CDUK displays the movement reference number, and your full submission artefacts are archived centrally for the statutory retention period. This archive should be paired with your NOVA confirmation and any later DVLA or approval documents so that customs, tax, and vehicle-compliance evidence can be retrieved together.

Because safety and security filings (ENS) are often handled by carriers on your behalf, you should still align the narrative. Share final descriptions, weights, and consignee details from your CDUK declaration with your forwarder so the carrier dataset matches what you submit to HMRC. Mismatches can generate holds, scans, and storage charges that are easily avoided with a simple pre-alert. For step-by-step guidance, see our internal resources on import declarations, cds declarations, and ens declarations.

The documents that prove your story

A complete, consistent document set remains your best defence against queries. At minimum, retain the commercial invoice showing the vehicle and any factory options, the freight and insurance evidence to the UK border, any proof used to support your preferential origin claim, the type-approval certificate or IVA pass, the customs entry printouts, the NOVA confirmation, and the DVLA registration paperwork. Tie these to the declaration via the Movement or reference numbers so an auditor can reconcile quantities, values, and narratives across all records.

Common pitfalls and practical ways to avoid them

Two origin traps are particularly common. First, assuming that purchasing from a German dealer means the car is of EU origin. Always verify origin rules and keep proofs; a vehicle substantially made elsewhere may not qualify for preference even if sold in Germany. Second, neglecting to obtain the statement on origin before shipment; without it, border teams will apply the non-preferential rate even where the vehicle would otherwise have qualified.

Valuation missteps are equally avoidable. Leaving out delivery and insurance to the UK border, or—conversely—adding UK inland delivery, will skew the customs value. Treat options consistently, and document how you treated software or licensing fees if they were a sale condition.

Process timing can also trip importers. IVA capacity and modification work can take weeks; plan early with the test centre and your service partner. And resist contacting DVLA immediately after NOVA; the system needs time to update.

For EVs, stay alert to the transitional origin rules through the end of 2026. For used-vehicle valuation, Method 1 still applies where there is a bona fide sale; if the price is unusually low, maintain market evidence to defend the declared value.

Special cases and nuances worth planning for

If your import route uses Northern Ireland or you intend to store vehicles before release, be aware that NI operates under specific arrangements and you should confirm the exact VAT and import rules before proceeding. For highly customised vehicles or niche models, expect to rely on IVA and allow for modification time. Where valuation seems unusually low for age and condition, keep market comparables and service history as part of your file. Each of these variations is manageable, but only when evidence is assembled before Customs or DVLA asks for it.

Governance and record-keeping: treat evidence as part of the product

Strong governance is the hallmark of low-friction imports. Establish a repeatable template for your Germany-UK lane that captures classification logic, origin proofs, valuation workings, and the declaration/NOVA/DVLA trail in one place. Sample a portion of entries each month to check that declared data still matches the underlying documents, and update your templates when rules or business practices evolve. Good governance is not bureaucracy; it is the cheapest insurance against delays, penalties, and rework.

Conclusion

Bringing a car from Germany to the UK is entirely straightforward when you anchor your approach in evidence. Verify origin and secure the statement on origin if you plan to claim 0% under the TCA; build a compliant customs value that includes the right costs to the frontier and excludes post-import expenses; declare accurately into CDS; notify NOVA within fourteen days; and complete the vehicle approval and DVLA steps with orderly documentation. When you orchestrate these elements through Customs Declarations UK, your import becomes a repeatable, auditable process rather than a one-off project. The result is predictable clearance, accurate landed costs, and swift, friction-free registration.