Importing scientific instruments—ranging from laboratory analyzers, microscopes, and spectrometers to advanced precision sensors—from Germany to the United Kingdom remains a cornerstone of scientific collaboration and technological innovation. Germany’s expertise in high-precision engineering and the UK’s strong research ecosystem make this trade route essential.

Following Brexit, however, what was once a simple intra-EU transaction now involves formal customs declarations, VAT compliance, and product conformity requirements. This guide provides a structured, step-by-step overview for UK businesses, universities, and research organizations importing scientific instruments from Germany, ensuring full compliance and cost efficiency.

Step 1: Establishing Import Readiness

Before any shipment, UK importers must have the proper regulatory and administrative setup.

Obtain a GB EORI Number

A GB-prefixed Economic Operators Registration and Identification (EORI) number is mandatory for all imports. It links your business to HMRC’s customs systems. Apply for one via the GOV.UK EORI portal.

Decide Roles Using Incoterms®

Agree with your German supplier who will handle export and import responsibilities.

- Under EXW or FCA, you manage the export and import process.

- Under DAP or DDP, the supplier handles more—but DDP can complicate UK VAT claims, so confirm details carefully.

Step 2: Customs Classification and Origin

Classify Your Instruments Correctly

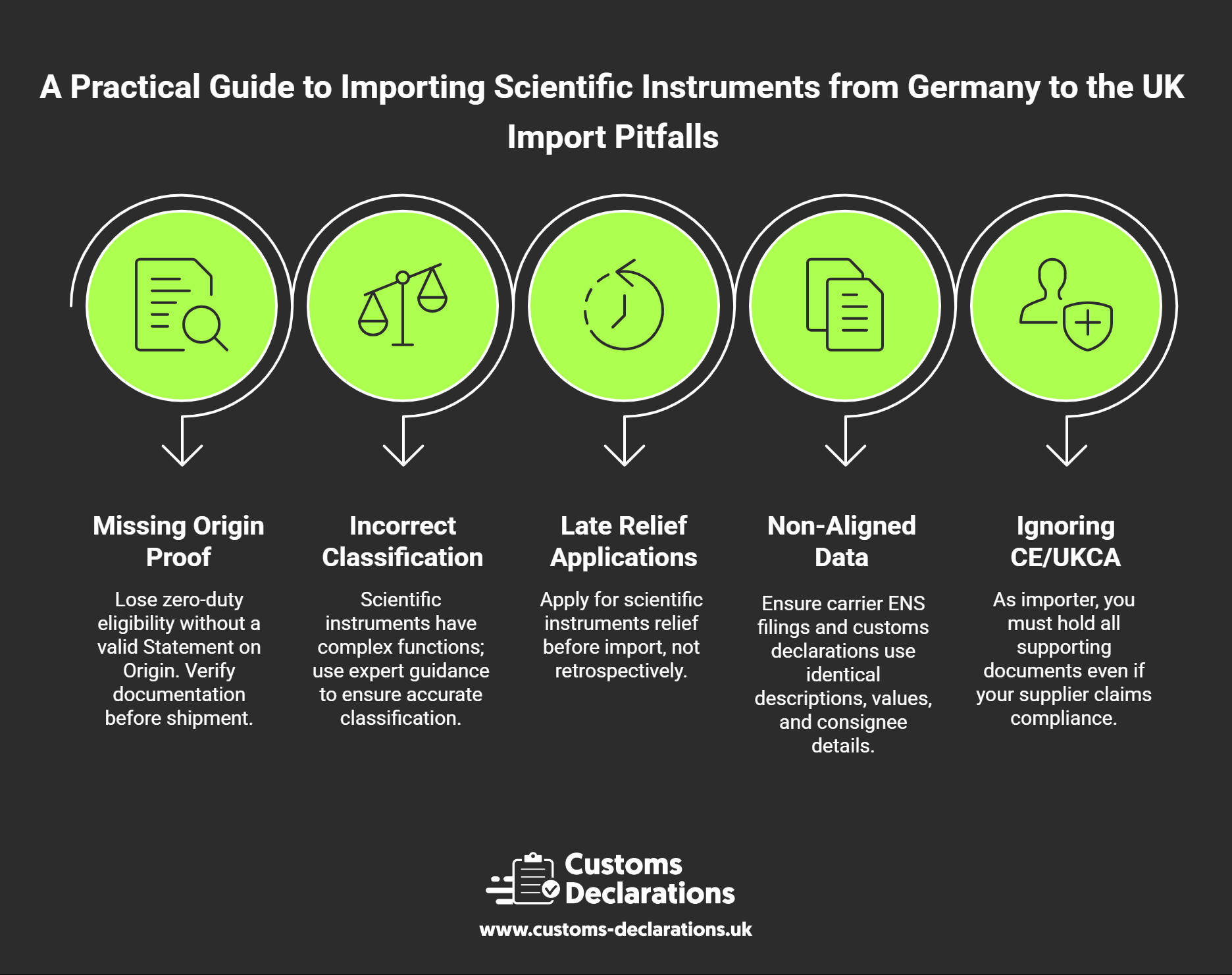

Scientific instruments typically fall under Chapter 90 of the UK Integrated Tariff. Accurate classification determines your duty rate, import controls, and licensing needs. Misclassification can cause costly delays and HMRC queries. Use the UK Integrated Tariff Tool or request a Binding Tariff Information (BTI) ruling from HMRC.

Prove EU Origin to Claim Duty-Free Entry

Under the UK-EU Trade and Cooperation Agreement (TCA), goods originating in the EU are eligible for zero customs duty. “Origin” refers to where the instrument was manufactured, not merely shipped.

To qualify:

- Your German supplier must provide a Statement on Origin on the invoice or as a separate document.

- Keep this statement for at least four years as evidence in case of HMRC verification.

If the product includes major non-EU components that do not meet the “sufficient processing” rule, standard UK Global Tariff rates will apply.

Step 3: VAT and Tax Considerations

Import VAT and Postponed VAT Accounting (PVA)

Most scientific instruments attract the standard UK VAT rate (20%). Instead of paying VAT upfront, use Postponed VAT Accounting, allowing you to declare and reclaim it on your VAT return—significantly improving cash flow.

Ensure your customs declaration correctly selects PVA. You can later download your Monthly Postponed Import VAT Statement (MPIVS) from the Customs Declaration Service for records.

Scientific Instruments Relief for Non-Commercial Use

Educational institutions, universities, and non-profit research organizations may qualify for complete exemption from both duty and VAT under HMRC’s Scientific Instruments Relief scheme.

To apply:

- Contact the National Imports Reliefs Unit (NIRU) before import.

- Provide documentation proving the equipment will be used exclusively for non-commercial research or teaching.

- On approval, NIRU issues a reference for use in your customs declaration.

(See: Pay no Customs Duty and VAT on scientific instruments – GOV.UK)

Step 4: Product Compliance and Conformity

CE and UKCA Marking

The UK government has confirmed that CE-marked products will continue to be accepted indefinitely for most goods, including scientific instruments. However, manufacturers may also use the UKCA mark to demonstrate conformity with UK-specific regulations.

Ensure that:

- The instrument carries valid CE or UKCA marking.

- You have a Declaration of Conformity and the technical file from the manufacturer.

- All user manuals and safety documentation are provided in English.

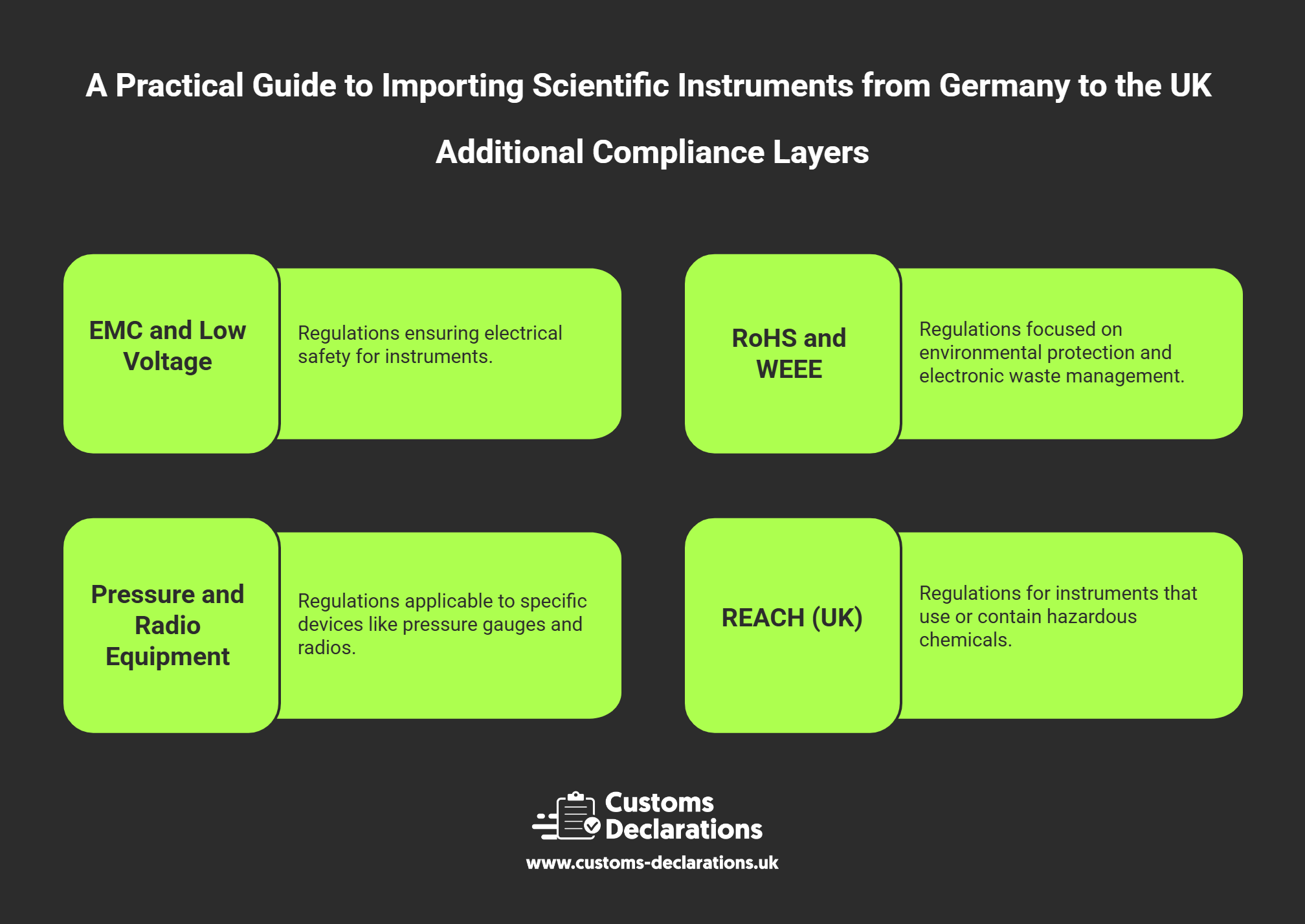

Additional Compliance Layers

Depending on the instrument, extra regulations may apply:

- EMC and Low Voltage Regulations for electrical safety.

- RoHS and WEEE for environmental protection and electronic waste.

- Pressure Equipment and Radio Equipment Regulations for certain devices.

- REACH (UK) for instruments using or containing hazardous chemicals.

As the importer, you bear ultimate responsibility for ensuring all compliance obligations are met before the product enters the UK market.

Step 5: Logistics and Shipping Considerations

Scientific instruments are delicate and valuable, requiring specialized handling.

- Air Freight: Fastest but costliest, ideal for high-value or temperature-sensitive instruments.

- Road Freight: Common for Germany–UK shipments, offering quick 1–3 day transit times.

- Sea Freight: Suitable for bulk or heavy shipments, though slower.

Insurance and Packaging

Use specialized packaging (shock and tilt sensors, humidity control) and comprehensive insurance. Document the shipment with a commercial invoice, packing list, air waybill or CMR, and the certificate of origin.

Safety & Security Declarations (ENS)

Since January 2025, all EU-to-UK shipments require Entry Summary Declarations (ENS)—pre-arrival notifications providing data about the cargo. Your carrier or forwarder usually files these, but ensure information matches your customs data.

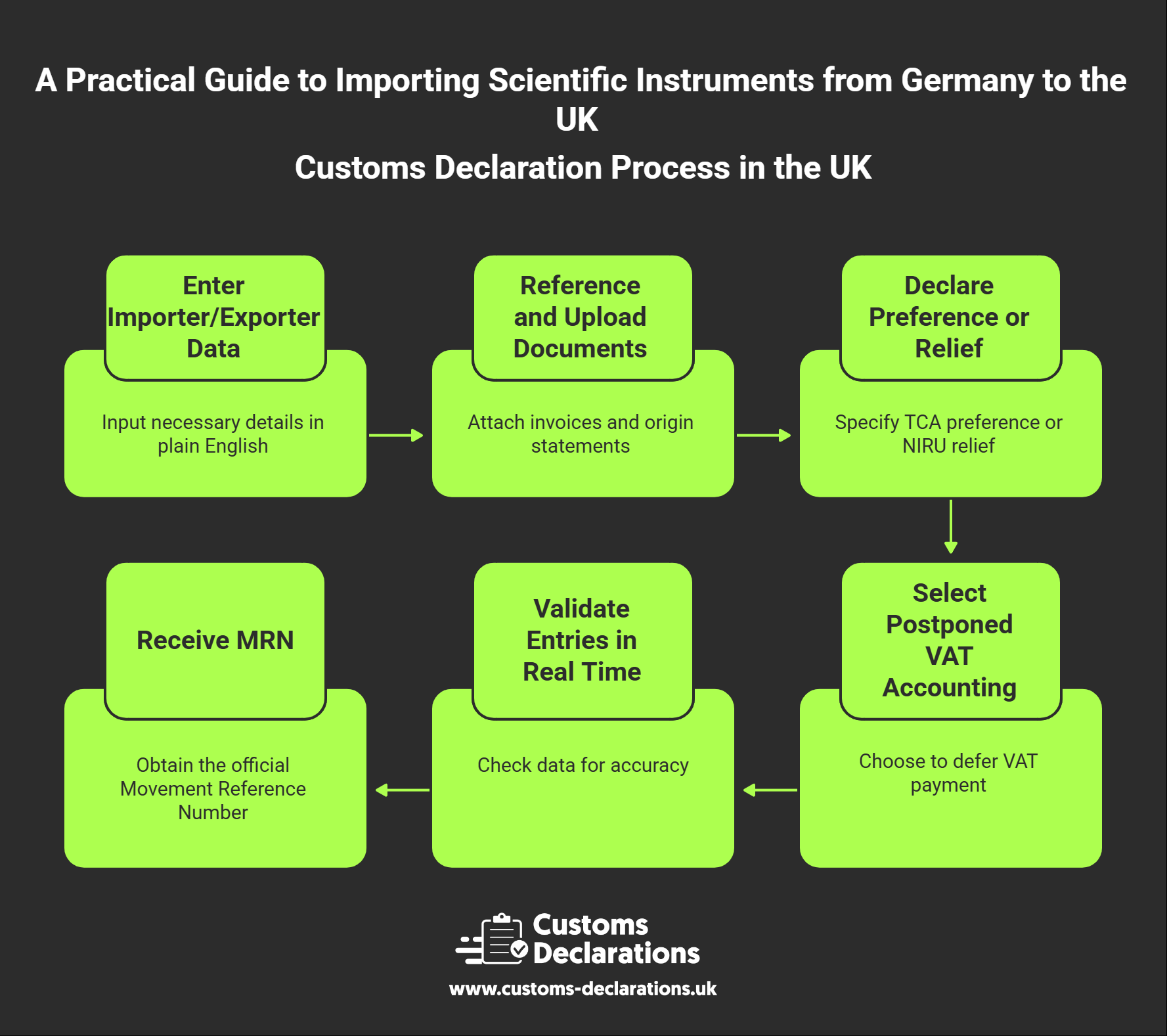

Step 6: Filing Customs Declarations via Customs Declarations UK

Streamlined Filing for Precision Imports

The Customs Declarations UK (CDUK) platform simplifies filing with HMRC’s Customs Declaration Service (CDS)—ideal for importers of scientific instruments.

Using CDUK, you can:

- Enter importer/exporter data, commercial values, and Incoterms in plain English.

- Reference and Upload supporting documentation such as invoices and origin statements.

- Declare preference under the TCA or input your NIRU relief reference.

- Select Postponed VAT Accounting and validate entries in real time.

- Receive an official Movement Reference Number (MRN) instantly upon HMRC acceptance.

All declarations and supporting files are stored securely in your CDUK account for audit readiness. Aligning your data with carrier ENS declarations helps avoid discrepancies and border delays.

Learn more: Customs Declarations UK – Import Declarations

Step 7: Record-Keeping and Post-Import Obligations

Maintain a comprehensive record set for each import, including:

- Commercial invoices and packing lists.

- Origin statements and conformity documentation.

- CDS declaration copies and MRN numbers.

- Insurance, transport, and inspection reports.

- PVA statements or NIRU approval letters.

Retention is required for at least six years under HMRC rules. For research institutions, maintaining linked compliance records (e.g., usage logs for instruments imported under relief) ensures transparency.

Conclusion

Importing scientific instruments from Germany to the United Kingdom is a structured but manageable process when compliance, documentation, and customs procedures are handled proactively.

By ensuring origin evidence, correct classification, CE or UKCA conformity, and accurate customs filing—particularly through the Customs Declarations UK platform—importers can achieve predictable costs, fast clearance, and full audit traceability.

For qualifying research and educational institutions, leveraging HMRC’s scientific-instruments relief adds further savings, making the process both efficient and financially sustainable.

With clear planning, proper documentation, and the right digital tools, UK importers can maintain seamless access to Germany’s world-class scientific equipment—empowering research, innovation, and progress.