Introduction

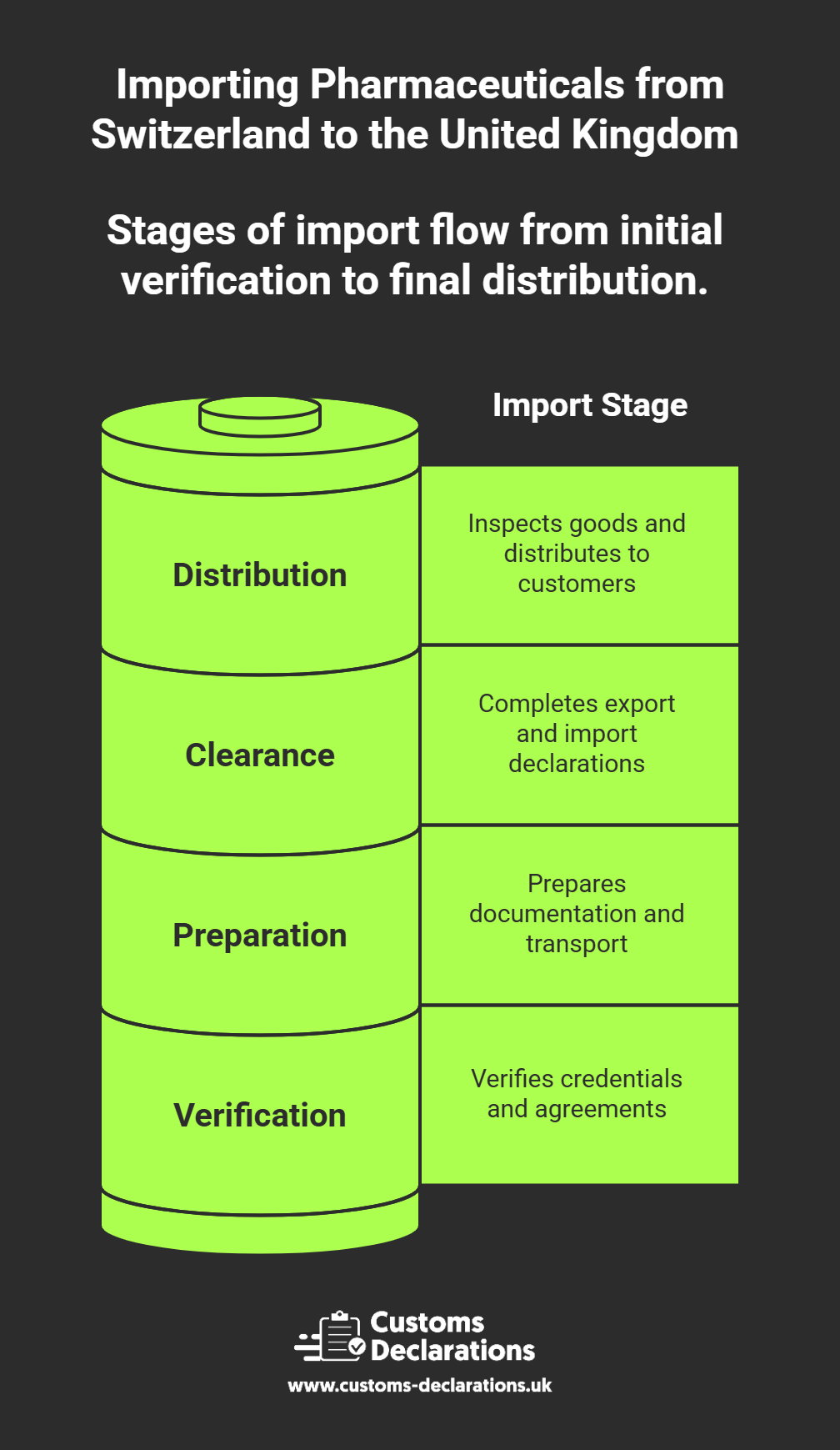

Importing pharmaceuticals from Switzerland to the United Kingdom combines regulatory rigour with logistical precision. Switzerland remains a global leader in pharmaceutical innovation, housing some of the world’s most advanced manufacturing facilities regulated by Swissmedic, while the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) upholds stringent oversight of all medicines entering the British market.

Since Brexit, the UK and Switzerland have reinforced their trading relationship through a Mutual Recognition Agreement (MRA) and a bilateral trade agreement, ensuring continued access to high-quality Swiss medicines. These agreements preserve preferential customs treatment, zero tariffs for eligible products, and mutual recognition of Good Manufacturing Practice (GMP) inspections and batch certificates. This alignment makes Switzerland one of the UK’s “approved countries,” simplifying pharmaceutical imports while maintaining full regulatory safeguards.

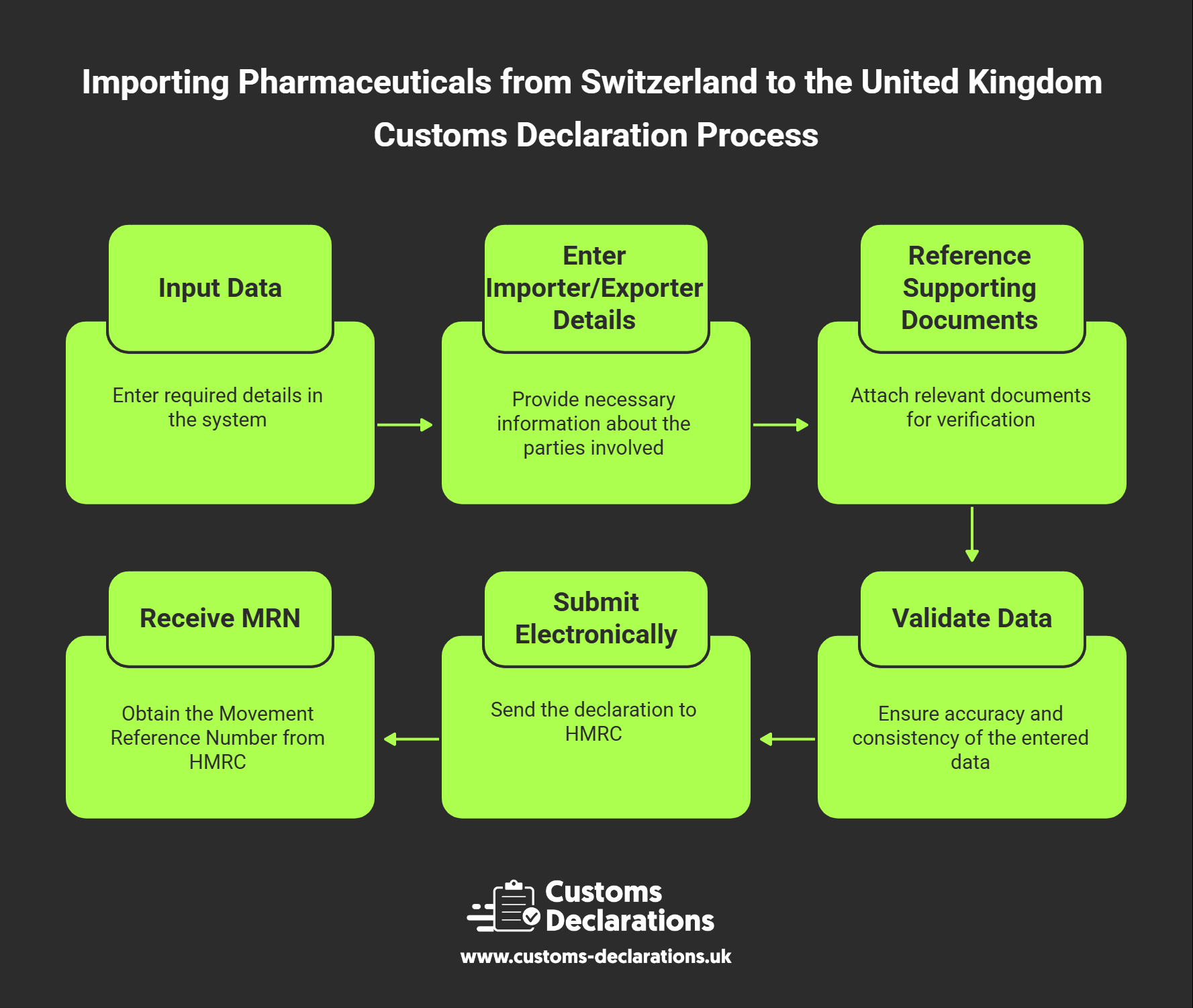

This guide explains the process, licences, documentation, and customs procedures required for importing pharmaceuticals from Switzerland into the UK — with a particular focus on how to file customs declarations efficiently using the Customs Declarations UK (CDUK) platform.