The United Kingdom government has issued its inaugural strategic direction to the Trade Remedies Authority (TRA), marking a decisive shift toward a more responsive, efficient, and business-friendly trade defence framework. This intervention comes at a critical juncture when UK producers and manufacturers face intensifying global competition, supply chain volatility, and pricing pressures from subsidised or dumped imports. By mandating simplification, acceleration, and greater accessibility across the TRA’s investigative processes, the government aims to ensure that legitimate UK businesses can secure timely protection without navigating prohibitively complex or protracted procedures. For importers, exporters, and customs practitioners who manage import declarations and export declarations on a daily basis, this policy shift has immediate operational relevance—particularly where anti-dumping or countervailing measures alter duty rates, procedural codes, or documentation requirements on affected commodity codes.

Understanding Trade Remedies: The Role and Mandate of the TRA

The Trade Remedies Authority was established under the Taxation (Cross-border Trade) Act 2018 to serve as the UK’s independent investigative body for trade defence cases following Brexit. Prior to EU exit, the United Kingdom participated in the European Union’s unified trade defence system, with cases investigated by the European Commission and measures applied EU-wide. Post-Brexit, the UK needed its own domestic framework capable of investigating allegations of dumping (selling goods below normal value), subsidisation, and sudden import surges that cause or threaten serious injury to UK industries. The TRA evaluates applications from UK producers, conducts detailed economic and legal analysis, and recommends whether protective measures—such as anti-dumping duties, countervailing duties, or safeguards—should be imposed, maintained, varied, or revoked. Final decisions rest with the Secretary of State for Business and Trade, but the TRA’s recommendations form the evidential and analytical foundation for those decisions.

Trade remedies are not protectionist barriers designed to insulate inefficient industries indefinitely; rather, they function as targeted, time-bound interventions that restore fair competitive conditions when foreign producers gain market access through practices deemed injurious under World Trade Organization (WTO) rules. A properly functioning trade defence system balances the interests of domestic producers seeking protection, downstream users and consumers concerned about price increases, and the broader principle of maintaining an open trading environment. The government’s strategic direction to the TRA reflects an acknowledgment that the system must be both credible—capable of deterring unfair trade practices—and pragmatic, enabling businesses to secure relief without excessive administrative burden or delay.

Key Elements of the Government’s Strategic Direction

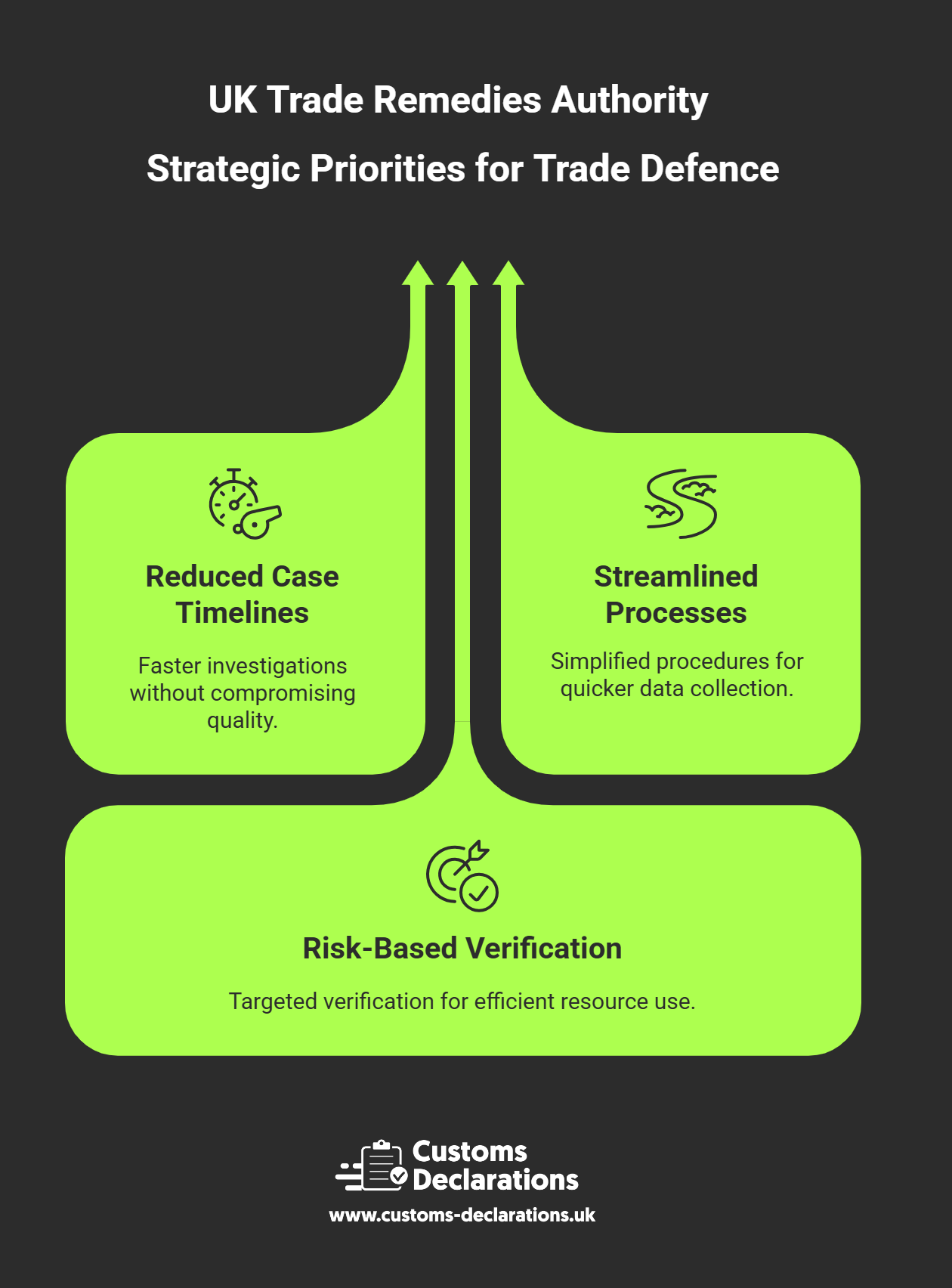

The strategic direction issued to the TRA contains several interrelated priorities designed to make the trade defence system faster, simpler, and more attuned to the operational realities faced by UK businesses. Central to the directive is an emphasis on reducing case timelines without compromising investigative rigour or legal defensibility. Trade remedy investigations are inherently complex, requiring detailed data collection, verification visits, economic modelling, injury analysis, causation assessments, and public interest considerations. Historically, these processes have extended over many months, during which affected UK producers continue to suffer injury from unfairly traded imports. The government has directed the TRA to identify procedural efficiencies, streamline information requests, and adopt risk-based verification approaches where appropriate, all with the goal of delivering timely outcomes that allow businesses to plan with greater certainty.

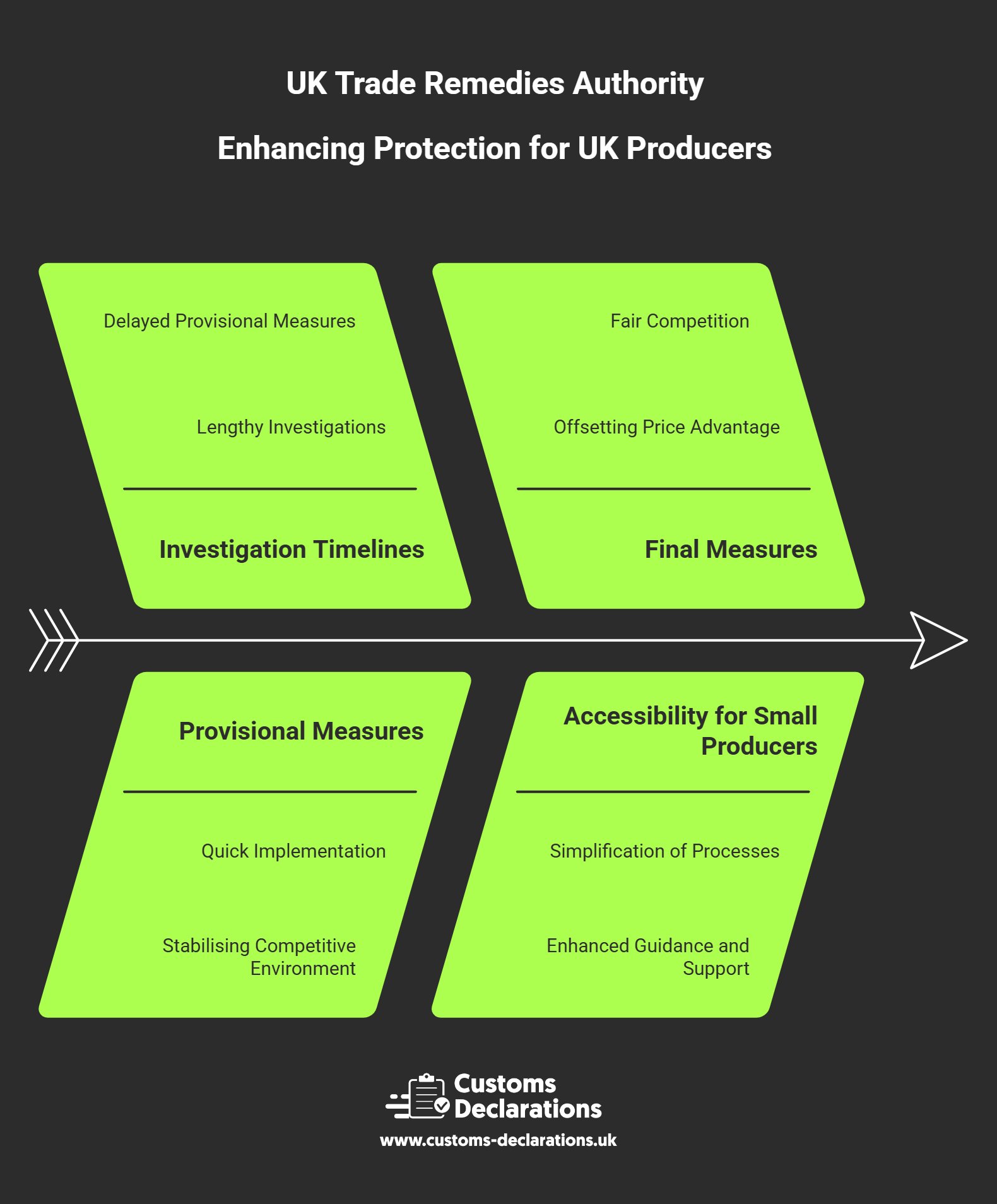

Simplification is equally critical. Many small and medium-sized enterprises (SMEs) that might benefit from trade remedies lack the in-house expertise or resources to navigate the technical requirements of filing a complaint, responding to questionnaires, or participating in hearings. The TRA has been instructed to enhance accessibility by providing clearer guidance, more user-friendly templates, and targeted outreach to ensure that legitimate applicants—regardless of size—can engage effectively with the system. This includes simplifying the language used in procedural documents, offering pre-filing consultations to help applicants understand eligibility and evidence requirements, and reducing the volume of redundant or overly granular data requests that impose disproportionate compliance costs.

The directive also underscores the importance of transparency and stakeholder engagement. Trade remedy cases affect not only applicant producers but also importers, exporters, downstream manufacturers, retailers, and consumers. Early and meaningful consultation with all interested parties improves the quality of the TRA’s analysis and ensures that recommendations reflect a balanced assessment of the economic interest. The government has encouraged the TRA to publish clear timelines, intermediate findings, and reasoning in a manner that allows stakeholders to understand how evidence is being weighed and what additional information might strengthen or challenge a case. For customs professionals managing CDS declarations and customs declaration workflows, this transparency is invaluable because it provides advance notice of potential duty rate changes, new measure codes, or documentation requirements that will need to be integrated into declaration templates and compliance processes.

Implications for UK Producers: Faster Access to Protection

For UK manufacturers and producers facing injury from dumped or subsidised imports, the strategic direction offers the prospect of more responsive protection. Lengthy investigations can erode a domestic industry’s market position, financial stability, and capacity to invest in innovation or employment. By accelerating case timelines, the TRA can deliver provisional measures—temporary duties imposed while the investigation continues—more quickly, providing interim relief that stabilises the competitive environment. Final measures, once imposed, create a more level playing field by offsetting the price advantage enjoyed by foreign exporters engaging in unfair practices. The government’s emphasis on simplification also lowers the barrier to entry for smaller producers who might previously have been deterred by the perceived complexity or cost of pursuing a case. Enhanced guidance and pre-filing support can help these businesses assess the strength of their evidence and structure their applications in a way that maximises the likelihood of a successful outcome.

It is important to recognise that trade remedies are not guaranteed; applicants must demonstrate injury, causation, and that measures would be in the public interest. However, a more efficient and accessible system increases the probability that meritorious cases will be filed and resolved promptly, discouraging foreign producers from engaging in dumping or subsidisation in the first place. The deterrent effect of a credible trade defence system should not be underestimated—exporters are less likely to pursue aggressive pricing strategies if they know that affected UK industries can secure timely relief through a transparent and predictable process.

Practical Steps for Businesses: Monitoring, Engagement, and Compliance

UK producers considering whether to file a trade remedy complaint should begin by assessing whether they meet the standing requirements—typically, applicants must represent a significant proportion of the domestic industry producing the like good. Early engagement with the TRA through pre-filing consultations can clarify these thresholds and help structure the application in a way that addresses the key legal and economic tests. Evidence of injury—such as declining market share, price depression, reduced profitability, or employment losses—must be clearly documented and directly linked to the unfairly traded imports. The government’s simplification agenda means that the TRA is now better positioned to guide applicants through this process, but robust internal data collection and financial records remain the foundation of a successful case.

For importers and customs professionals, the priority is vigilance and adaptability. Monitoring the TRA’s public register of active cases, initiation notices, and provisional or final determinations allows businesses to anticipate changes in duty rates and scope definitions. Where a business’s imports may fall within the scope of an ongoing investigation, participating in the TRA’s consultation process—by submitting questionnaire responses, providing market data, or attending hearings—can influence the final recommendation and ensure that the economic impact on importers and downstream users is properly considered. This is particularly relevant where measures might increase input costs for UK manufacturers who rely on the imported product, potentially creating unintended competitive disadvantages.

Filing accurate customs declarations when trade remedy measures are in force requires close attention to commodity classification, origin determination, and the correct application of additional duty codes. Declarants must ensure that the declared customs value, combined with any anti-dumping or countervailing duties, is correctly calculated and that the appropriate procedure codes are used. For goods subject to trade remedy measures, HMRC may apply enhanced scrutiny or post-clearance audit focus, making it essential to maintain comprehensive supporting documentation—including purchase contracts, origin certificates, technical specifications, and correspondence with suppliers—that can substantiate the declared characteristics and origin of the goods.

The Role of Digital Customs Platforms in Managing Trade Remedy Complexity

Modern customs declaration platforms play a vital role in helping businesses navigate the added complexity introduced by trade remedy measures. Systems such as Customs Declarations UK offer several features that are particularly valuable in this context. First, integrated tariff lookup tools automatically flag when a commodity code is subject to trade remedies, alerting declarants to the existence of additional duties or special documentation requirements. Second, template and cloning functionality allows businesses to store pre-configured declaration profiles for commonly imported goods, which can be rapidly updated when tariff changes occur, ensuring consistency and reducing manual entry errors. Third, real-time validation checks confirm that measure codes, origin declarations, and duty calculations are correctly applied before submission to HMRC’s Customs Declaration Service, minimising the risk of rejections or post-clearance assessments.

Public Interest Considerations and Economic Impact Assessments

One of the distinctive features of the UK’s trade remedy framework is the explicit consideration of public interest. The TRA is required to assess whether imposing, varying, or revoking measures would be contrary to the public interest, taking into account impacts on consumers, downstream industries, and the broader economy. This public interest test has been a subject of debate, with some arguing that it introduces uncertainty and could undermine the effectiveness of trade defences, while others view it as a necessary safeguard against measures that might cause disproportionate harm to other sectors. The government’s strategic direction does not eliminate the public interest test, but it does emphasise the need for the TRA to conduct this analysis efficiently and transparently, ensuring that all relevant economic impacts are considered without creating undue delay or unpredictability.

For businesses engaged in customs and trade compliance, understanding the public interest dimension is important because it can influence the scope, duration, or level of measures ultimately imposed. Where a proposed measure would significantly increase costs for downstream manufacturers or consumers, the TRA may recommend a lower duty rate or a shorter duration than would otherwise be justified based solely on the injury and dumping analysis. Participating in public interest consultations—by providing data on input costs, supply chain dependencies, or market alternatives—can therefore be a valuable strategic action for importers and end-users who would be negatively affected by high trade remedy duties.

Conclusion: A More Agile and Accessible Trade Defence System

The government’s first strategic direction to the Trade Remedies Authority represents a substantive commitment to ensuring that the UK’s trade defence system serves the practical needs of domestic producers while remaining consistent with international obligations and broader economic interests. By prioritising speed, simplicity, and transparency, the directive aims to empower UK manufacturers to secure timely protection against unfair trade practices without facing prohibitive procedural barriers. For customs professionals, importers, and businesses managing import declarations, export declarations, and customs compliance workflows, this shift has tangible operational implications. Trade remedy measures directly affect duty rates, classification requirements, and documentation standards, making it essential to monitor TRA cases, understand scope definitions, and maintain robust systems for adapting to tariff changes.