Introduction: Understanding the European Union’s Complex Economic Landscape

As autumn 2025 unfolds, the European Union (EU) finds itself navigating a landscape defined by contrasts—modest growth in GDP, persistent industrial weakness, and surprisingly resilient housing markets. According to the European Statistical Monitor by Eurostat, the EU economy is experiencing a delicate balance between cautious optimism and structural challenges.

For businesses involved in cross-border trade, understanding these dynamics is vital. Questions are being asked:

- Why is EU growth still sluggish despite stable employment?

- How are rising house prices coexisting with weakened industry?

- What implications do these trends hold for import declarations, export declarations, and customs operations across Europe?

This article provides a deep dive into the European economy’s latest indicators—unpacking trends in GDP, industry, trade, and inflation—and examines how businesses can adapt to a changing environment.

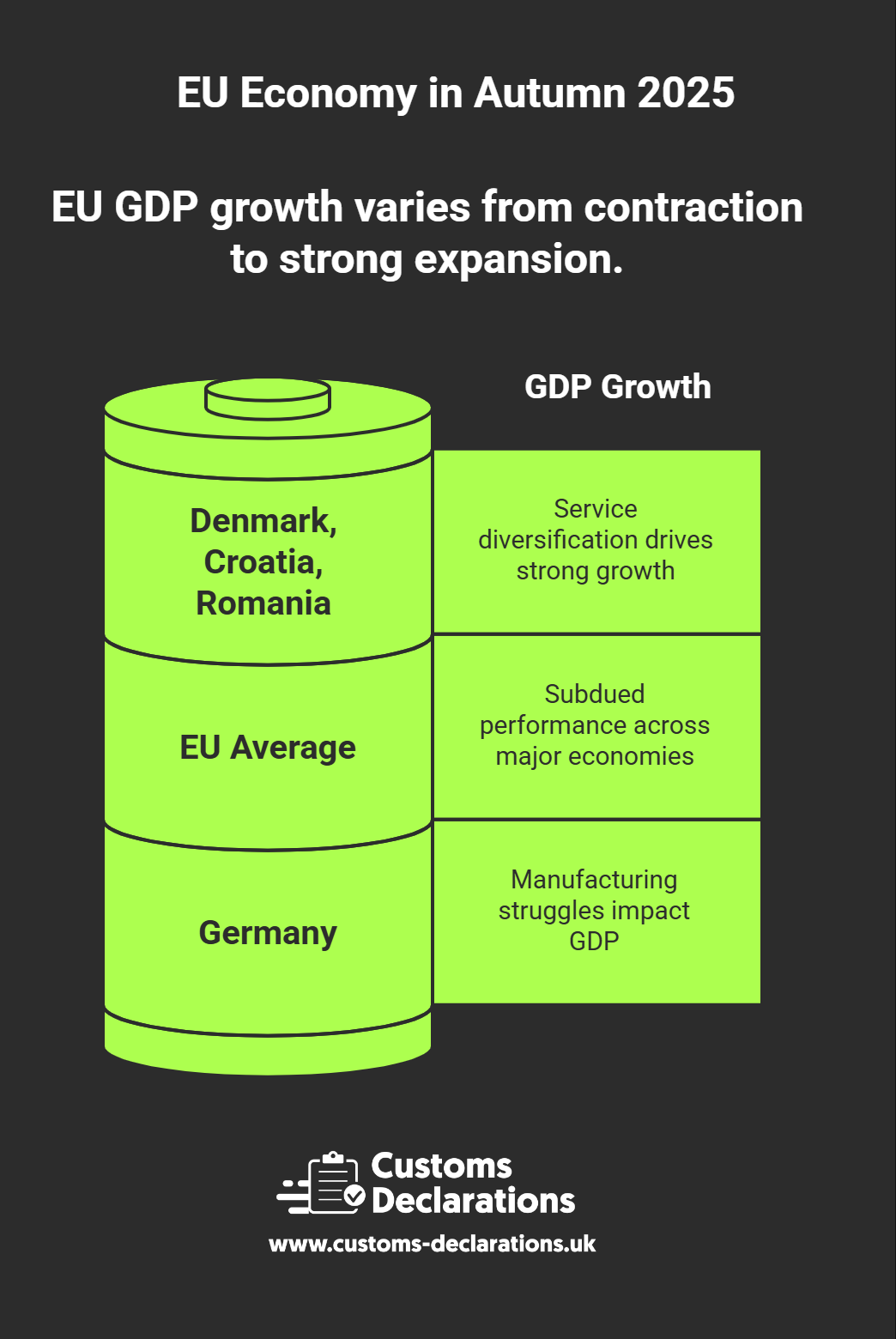

GDP Growth: Recovery, but Without Momentum

The EU’s GDP grew by 0.2% in Q3 2025, signaling a fragile recovery from earlier stagnation. For context, annual GDP growth across the bloc has hovered around 0.3%, reflecting subdued performance in Europe’s major economies.

Germany, once the engine of Europe, saw a 0.3% contraction earlier this year—symptomatic of broader struggles in manufacturing and exports. In contrast, smaller economies such as Denmark, Croatia, and Romania recorded over 1% quarterly growth, demonstrating that flexibility and service diversification can buffer against global headwinds.

The uneven performance underscores Europe’s two-speed recovery: service-led economies are faring better than industrial ones. However, with consumer confidence fragile and business investment hesitant, the EU remains far from robust expansion.

Industrial Production: A Sector Under Pressure

Industrial output remains one of the weakest points in the EU’s economy. Eurostat data shows a 1.0% drop in production in August 2025 compared with the previous month—continuing a pattern of decline since 2023.

Key sectors hit hardest include:

- Machinery and automotive manufacturing, affected by global competition and high energy costs.

- Energy-intensive industries, struggling with tighter emission policies and lingering input cost volatility.

Germany’s output plunged 5.2%, Greece’s 4.5%, and Austria’s 3.1%, while Ireland saw a 9.8% increase, driven by the pharmaceutical and tech sectors—though such spikes are often statistical anomalies due to concentrated multinationals.

This ongoing contraction isn’t merely cyclical—it’s structural. The EU’s industrial competitiveness is being reshaped by automation, decarbonization costs, and the global pivot to localized supply chains.

The implications for trade are direct: fewer manufactured exports mean fewer customs declarations being filed, as European factories scale back on cross-border shipments. Businesses operating through systems like CDS Declarations are witnessing fluctuating volumes reflecting this slowdown.

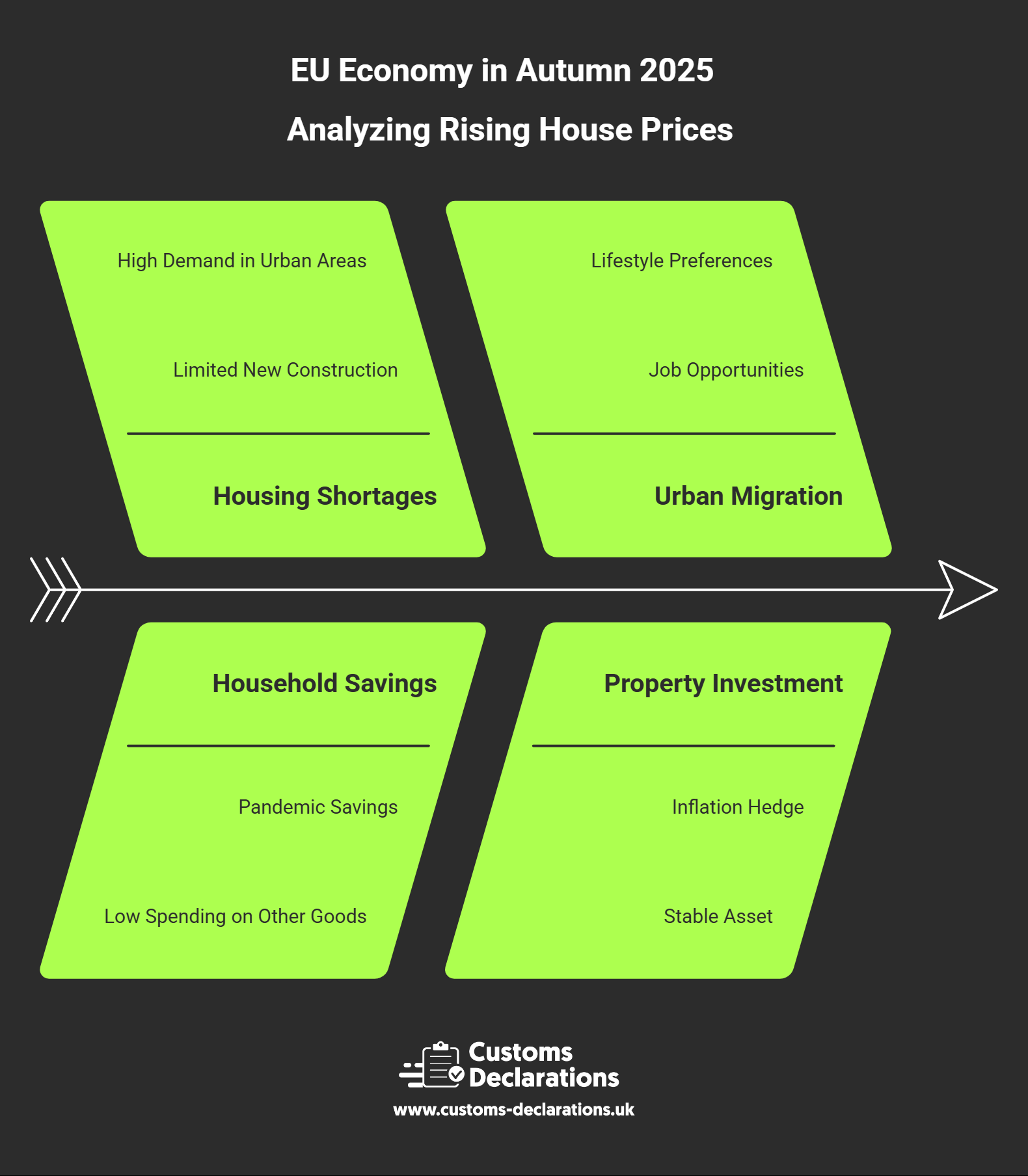

Housing Market: Defying Gravity

While factories struggle, housing markets are booming. EU-wide house prices jumped 5.4% year-on-year in Q2 2025—the seventh consecutive quarterly increase—bringing the House Price Index to 160, nearly 60% higher than a decade ago.

So, why are house prices rising despite high interest rates?

- Persistent housing shortages in cities like Berlin, Lisbon, and Amsterdam.

- Strong household savings accumulated during the pandemic.

- Urban migration and demographic pressures.

- Property investment as a hedge against inflation.

Portugal led the surge with an astonishing 17.2% rise, followed by Bulgaria (15.5%) and Hungary (15.1%). Only Finland saw prices fall, by 1.3%. Even after adjusting for inflation, real house prices still grew 2.8% across the bloc.

This resilience is a double-edged sword. While rising property values boost household wealth, they also heighten concerns about affordability, especially for younger Europeans. With interest rates remaining elevated, the housing boom could eventually strain financial stability if wage growth doesn’t keep pace.

Labor Market: Europe’s Stabilizing Force

Despite industrial weakness, the labor market remains remarkably robust. Unemployment stood at 5.9% in September 2025, near historic lows, with about 13.2 million people unemployed across the 27-member bloc.

This stability reflects labor shortages in key sectors—particularly technology, healthcare, and construction—and employers’ reluctance to shed workers after years of recruitment challenges. The employment rate has climbed to 76.2%, while the youth NEET rate (not in employment, education, or training) dropped to 11.9%, indicating gradual progress.

Still, beneath the surface lies hidden slack: 10.9% of the labor force remains underemployed or discouraged. Spain leads the unemployment rankings with 10.8%, while Malta posts a low 2.7%.

Europe’s tight labor market is both a strength and a constraint—sustaining consumption but contributing to wage-driven inflation in services.

Inflation: Calming, but Not Yet Conquered

After years of turbulence, inflation is finally easing. In September 2025, EU inflation dropped to 2.6%, down sharply from its 2022 peak. The Eurozone average stood slightly lower at 2.2%, with early October estimates hinting at 2.1%—nearly aligned with the European Central Bank’s (ECB) target.

What’s driving inflation lower?

- Stabilized energy prices, after the shocks of 2022–2023.

- Normalized supply chains, reducing input cost pressures.

- The delayed impact of tight monetary policy from the ECB.

However, core inflation—excluding food and energy—remains stubborn, particularly in services, where wage growth sustains price pressures.

Across member states, Romania (8.5%) and Estonia (6.2%) top the inflation chart, while France (0.8%) and Cyprus (0.0%) enjoy near-price stability.

For traders and logistics operators, inflation stabilization translates into more predictable trade costs and steadier customs valuations in import and export declarations.

International Trade: Weakening External Demand

Trade remains a weak link in Europe’s economic chain. In August 2025, exports fell 1.2% and imports 2.1%, revealing broad-based softening.

The reasons are multifaceted:

- Sluggish global demand from China and the U.S.

- Heightened geopolitical tensions affecting supply chains.

- Intensified competition from Asian manufacturers.

- Growing regionalization of production networks.

For logistics operators and customs brokers, this slowdown has practical implications. Fewer consignments mean fewer ENS declarations and a moderation in CDS filing volumes. However, it also creates opportunities: businesses adopting digital-first customs compliance platforms like Customs Declarations UK can streamline operations, improve accuracy, and reduce overheads in a tight-margin environment.

The EU’s export-driven model, long powered by Germany and the Netherlands, faces a turning point. Unless industrial competitiveness improves, Europe risks losing its traditional trade advantage.

Services and Retail: The Balancing Act

While industry falters, services are cushioning the economy. Service output declined by just 0.1%, and retail trade stayed flat at 0.0% in August—indicating stagnation rather than contraction.

Tourism, however, remains a bright spot. Overnight stays rose 1.1% year-on-year, with southern economies like Spain, Italy, and Greece benefiting from a record summer travel season.

This divergence between goods and services underscores a structural shift: Europe’s growth increasingly depends on services trade, digital business, and tourism, not manufacturing alone.

Fiscal Policy and Government Finances: Tight but Improving

The EU’s budget deficit improved to –3.7% of GDP, while public debt stabilized at 81.8%. Yet fiscal space remains tight, with high interest costs and social spending weighing on government budgets.

Member states face the classic EU dilemma—balancing fiscal discipline with the need for growth-oriented investment. The risk is that excessive austerity could further weaken recovery just as inflation normalizes.

Energy and Green Transition: A Quiet Success Story

Amid economic turbulence, the EU continues progressing toward its climate goals. Greenhouse gas emissions dropped to 1.99 tonnes per capita, and renewables now generate 49% of total electricity.

This marks a significant milestone in Europe’s energy transformation, though challenges persist—particularly in industrial emissions and urban air quality, which still exceed World Health Organization thresholds.

The ongoing Green Deal agenda, coupled with clean-tech investments, could serve as a new growth engine for Europe—potentially revitalizing industrial competitiveness through sustainability.

Business Confidence and Entrepreneurship: Resilient but Cautious

The Economic Sentiment Indicator slipped to 95.5, below its long-term average, signaling persistent caution. However, a 4.6% increase in new business registrations hints at underlying entrepreneurial energy.

At the same time, bankruptcies rose 1.7%, highlighting the stress facing small and medium-sized firms in retail, logistics, and construction.

This mix of resilience and strain suggests that while traditional sectors are struggling, new ventures—especially in green energy, digital trade, and AI services—continue to drive business formation.

Navigating the Trade and Customs Landscape

For companies engaged in cross-border commerce, these macroeconomic shifts are not just theoretical—they translate into operational realities.

- Declining industrial output means fewer goods movements but greater pressure on customs compliance efficiency.

- Fluctuating trade patterns heighten the need for precise, timely CDS and ENS declarations to avoid costly errors.

- The push toward digital transformation in customs is no longer optional; it’s essential for maintaining competitiveness.

Platforms like Customs Declarations UK offer self-service tools for importers and exporters to manage import, export, and safety & security filings seamlessly, reflecting the increasing need for automation in customs operations.

Looking Ahead: What Lies Beyond 2025

The European economy remains in transition. Policymakers must navigate inflation normalization, structural industrial decline, and the housing affordability crisis—while balancing green investment and fiscal responsibility.

Key questions shaping 2026 and beyond include:

- Can the EU’s manufacturing base recover competitiveness amid automation and energy transition?

- Will the housing boom stabilize, or does it risk inflating a bubble?

- How can digitalization and customs modernization support smoother trade across borders?

Europe’s next phase will hinge on how effectively it harnesses technological innovation, reforms labor markets, and invests in long-term competitiveness.

Conclusion: Europe’s Balancing Act

The EU economy in autumn 2025 tells a story of contrasts—slow growth paired with solid employment, industrial decline offset by surging property markets, and cautious optimism amid global uncertainty.

For businesses and traders, success lies in agility: understanding macroeconomic signals, optimizing customs operations, and seizing opportunities in emerging sectors. While risks remain, Europe’s structural resilience and policy adaptability continue to provide a foundation for gradual recovery.