Detailed Analysis of Inflation Trends

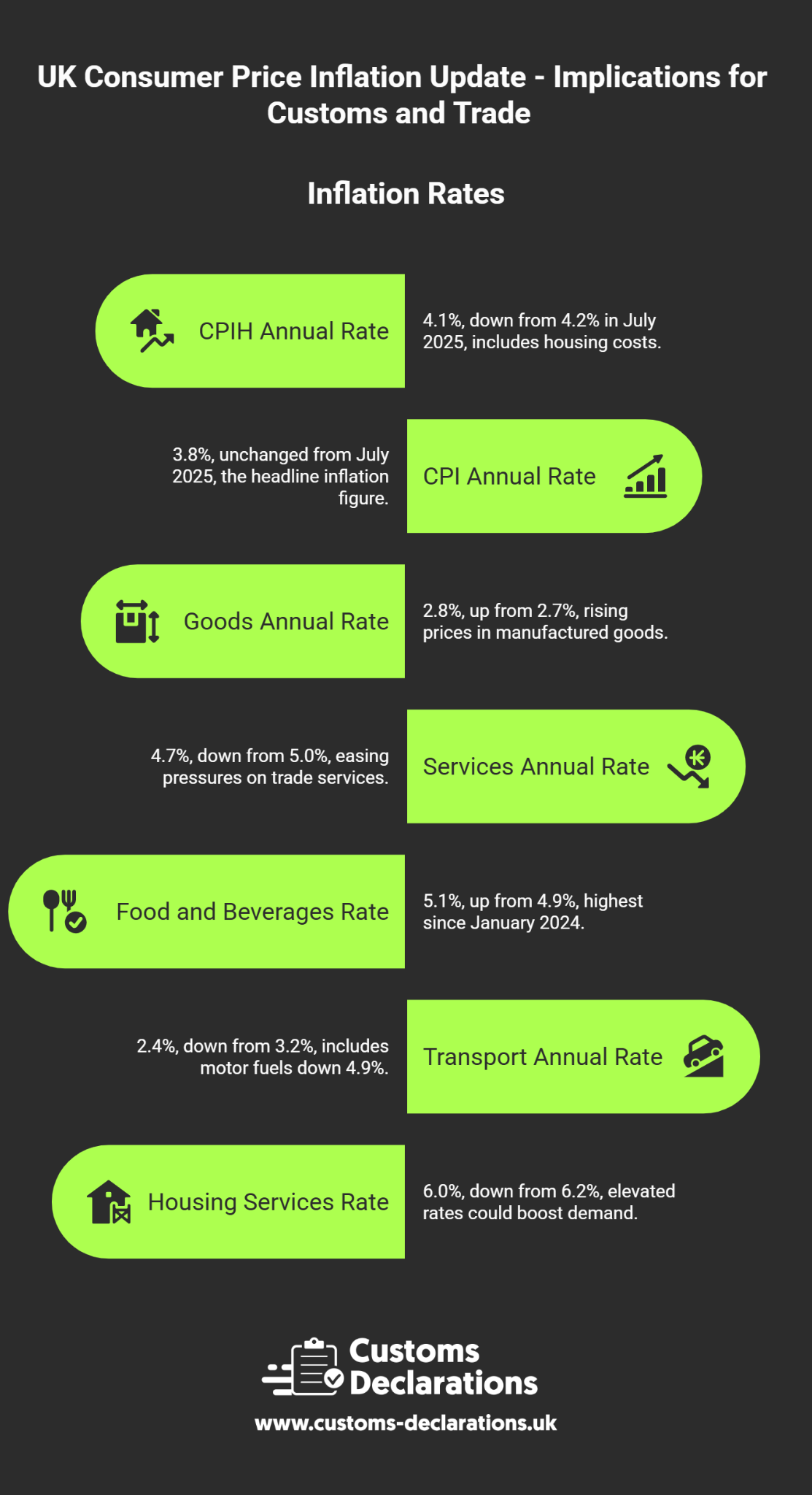

Diving deeper, the ONS report paints a nuanced view of inflation drivers, many of which tie back to global supply chains and trade dependencies. Here’s how key sectors are performing and what it means for the UK economy:

Housing and Household Services: Steady but Elevated

With an annual inflation rate of 6.0%, this sector remains a hotspot, driven by owner occupiers’ housing costs at 5.3% – the lowest since late 2023. Monthly prices rose by 0.3%, slightly less than last year. For trade businesses, this could mean increased demand for imported household goods like appliances or furnishings, as higher housing costs squeeze consumer budgets toward affordable overseas options. In customs terms, expect more declarations for EU-sourced items, where accurate valuation is key to avoiding overpaid duties.

Transport: Easing Pressures with Trade Nuances

The transport sector’s 2.4% annual rate reflects downward pulls from air fares (up only 2.1% monthly vs. 22.2% last year, due to holiday timing) and motor fuels (annual fall of 4.9%). Petrol and diesel prices ticked up slightly month-on-month but remain lower year-over-year. This is good news for trade logistics: lower fuel costs reduce shipping expenses, potentially boosting UK export competitiveness in Europe. However, volatility in air fares highlights seasonal risks for time-sensitive imports, emphasizing the need for robust customs planning to mitigate delays at borders.

Food and Non-Alcoholic Beverages: Rising Costs Amid Import Dependencies

At 5.1% annually, food inflation is climbing, fueled by vegetables, dairy, and fish, offset somewhat by cereals and oils. Monthly prices rose 0.4%, higher than last year. The UK’s heavy reliance on imported food (especially from Europe) means these increases could stem from global supply issues, currency fluctuations, or trade barriers. For customs declarants, this translates to heightened scrutiny on agricultural tariffs and origin rules, ensuring compliance with post-Brexit protocols to avoid costly penalties.

Restaurants and Hotels: Uptick in Service Inflation

Rising to 3.8% annually, this sector saw prices fall 0.2% monthly, less than last year’s drop, mainly from accommodation. While not directly trade-focused, it indirectly affects business travel and tourism-related imports, such as hospitality supplies. Trade firms dealing in perishable goods might see knock-on effects from higher operational costs.

Overall, core inflation’s slowdown (excluding volatiles) suggests the Bank of England’s policies are taking hold, but goods inflation’s slight uptick points to persistent pressures from imported commodities. The ONS also notes a dataset on CPI contributions by import intensity, which is vital for understanding how global trade flows inflate domestic prices – a must-monitor for customs strategies.