Introduction: Why this agreement could be the most consequential UK trade pact since Brexit

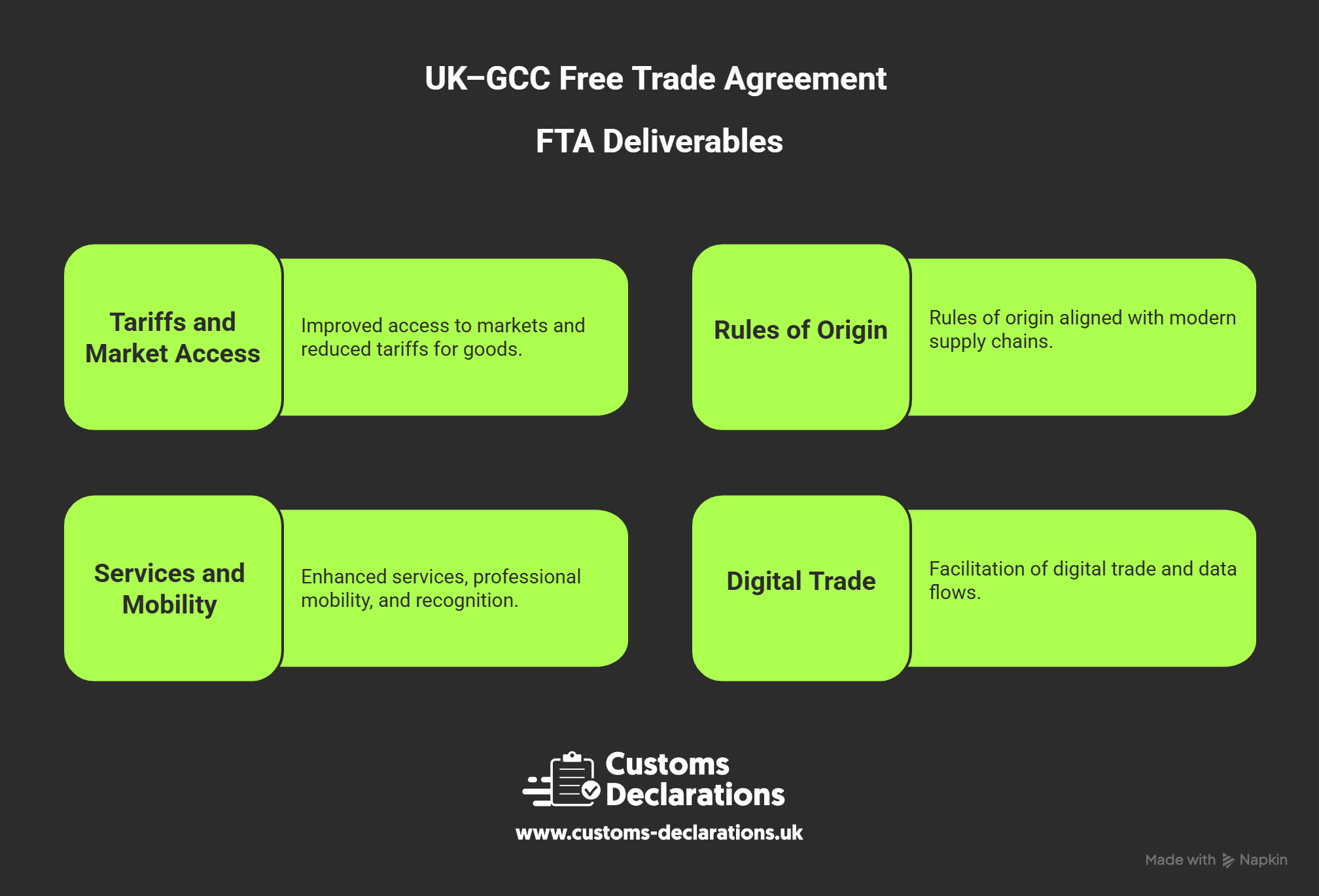

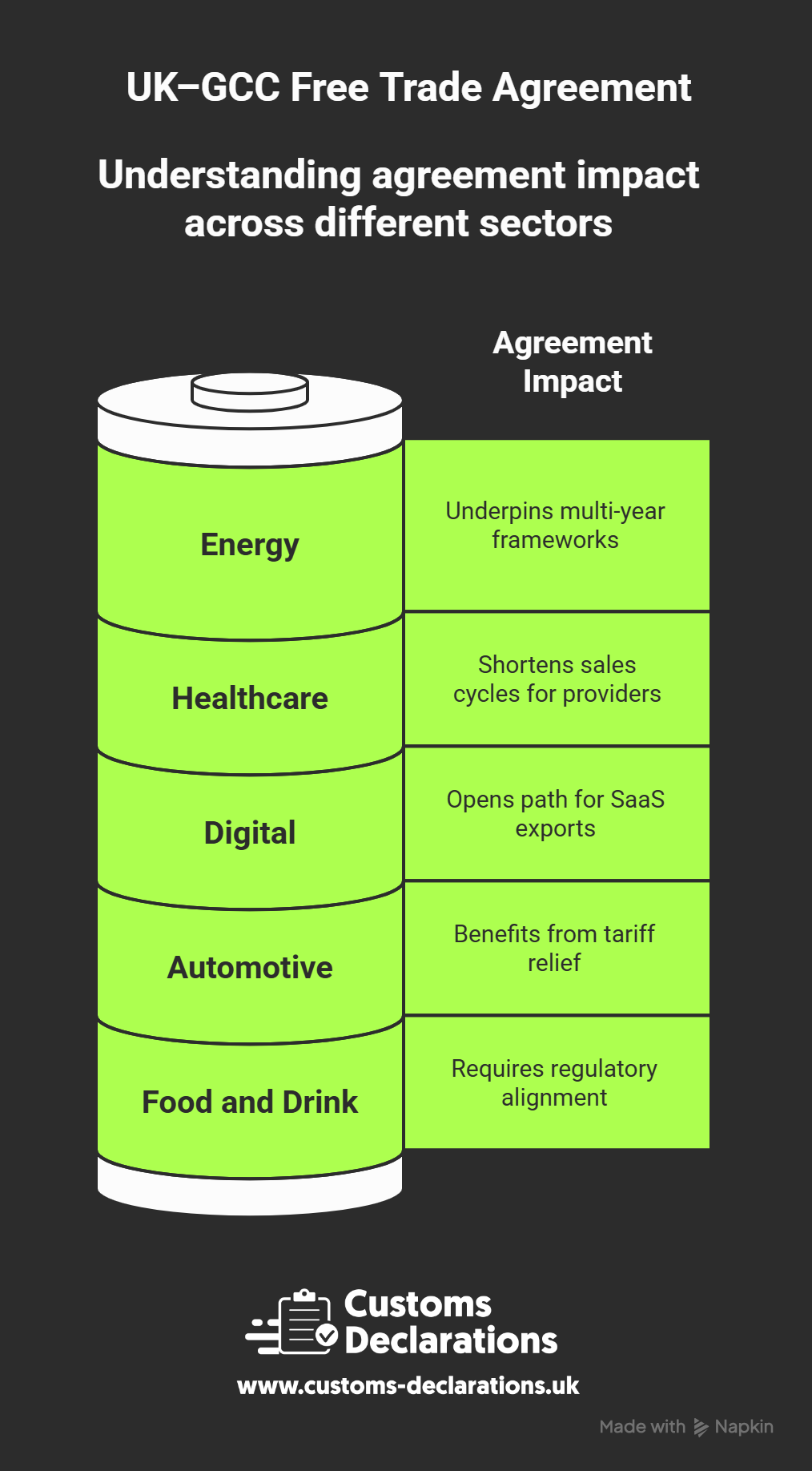

The United Kingdom and the Gulf Cooperation Council (GCC)—Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates—are close to concluding a far-reaching free trade agreement (FTA). The corridor already moves tens of billions of pounds in goods and services annually, spanning everything from aerospace components and premium cars to legal services, fintech and higher education. What the FTA promises is not just tariff relief. It is a structural reset that could standardise rules of origin, lock in market access for world-class UK services, simplify customs procedures for traders on both sides, and catalyse new investment—especially in clean energy, advanced manufacturing and digital trade.

This deep dive unpacks the agreement from a business operator’s perspective. It explains what the FTA likely covers, how it intersects with practical compliance (from customs declaration data to origin proofs), who stands to gain, what the sticking points are, and how UK exporters and importers can prepare now—before legal text is finalised. Where useful, we include practical links for import declarations, export declarations, CDS declarations and ENS declarations so policy translates directly into day-to-day execution.