Introduction – Why the CPTPP Matters to the United Kingdom

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership, better known as the CPTPP, is one of the world’s most advanced free-trade arrangements. With eleven founding economies across Asia, Oceania and the Americas, it already accounts for roughly 15 per cent of global GDP and represents a consumer market worth about £12 trillion. When the United Kingdom cleared its final ratification obstacle on 15 June 2025—after Canada agreed to approve the UK’s accession—the nation achieved its most significant commercial pivot since leaving the European Union. As the first European state to join the Pacific-centric bloc, the UK positions itself at the heart of a region projected to generate more than half of global economic growth by 2050.

For British exporters, investors and service providers, CPTPP membership promises new tariff-free lanes, modern rules for digital commerce, and a framework that rewards supply-chain resilience. For policymakers, it secures a strategic foothold in a fast-growing part of the world while reinforcing the Government’s “Global Britain” narrative. This article offers a deep examination of the deal: its architecture, timetable, economic potential, practical challenges and the questions businesspeople are already asking.

What Exactly Is the CPTPP?

CPTPP is a high-standard free-trade agreement covering Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. It evolved from the original Trans-Pacific Partnership after the United States withdrew in 2017. The treaty liberalises more than 99 per cent of goods tariffs among members, sets stringent disciplines on subsidies and state-owned enterprises, and contains leading-edge chapters on digital trade, intellectual property, labour and environmental standards. Crucially, it permits new members to accede, allowing the bloc to grow gradually in size and influence.

The UK’s Journey From Application to Ratification

- 1 February 2021 – London submits a formal application to accede.

- June 2021 – Negotiations begin in earnest.

- 31 March 2023 – Substantive talks conclude after twenty-one sessions.

- 16 July 2023 – Accession Protocol signed in Auckland.

- 15 December 2024 – The treaty enters into force for the UK and six members that have ratified its entry (Japan, Singapore, Vietnam, New Zealand, Chile, Peru).

- 15 June 2025 – Canada, previously hesitant over hormone-treated beef, announces its support following bilateral concessions reached at the G7 summit.

- Autumn 2025 – Canadian legislation is expected to pass, allowing the agreement to apply between Ottawa and London 60 days later.

- Mexico remains the final hold-out; once it approves, the UK will trade under CPTPP terms with the entire bloc.

The UK already maintains bilateral free-trade agreements with nine CPTPP economies, yet accession adds genuine value. It simplifies rules of origin (allowing components sourced from any member to count toward duty-free status), embeds comprehensive digital-trade norms and offers a single, predictable dispute-settlement architecture.

Headline Benefits for the United Kingdom

Tariff Elimination on Goods

Over 99 per cent of current UK exports to CPTPP countries will become tariff-free once the relevant schedules are fully phased in. Examples include:

- Scotch whisky to Malaysia: duty cut from 80 per cent to zero.

- Passenger cars to Canada: staged elimination of tariffs, accelerating reductions compared with the existing UK-Canada Trade Continuity Agreement.

- Ceramic tiles, building materials and construction machinery to Malaysia and Vietnam: full duty-free entry in short order.

- Cheese and specialist dairy products to Chile: phased removal of duties that run up to 24 per cent today.

Expanded Services and Digital Trade

Services generate more than 70% of UK GDP. The CPTPP’s digital-trade chapter bans unjustified data-localisation requirements, protects source code, and preserves free cross-border data flows—vital commitments for fintech, professional services and e-commerce platforms. For legal, accounting and architectural firms, the agreement guarantees non-discriminatory market access and promotes transparent licensing procedures.

Investment Protection and Promotion

Inward investment from CPTPP partners stood at roughly £182 billion in 2021. The bloc’s investment rules lock in fair and equitable treatment, cap performance requirements and enable covered investors to repatriate profits freely. Although the investor–state dispute settlement (ISDS) system remains controversial, modern safeguards curb frivolous claims and affirm governments’ rights to regulate for public policy objectives.

Supply-Chain Flexibility

CPTPP’s “full accumulation” rule of origin lets manufacturers source inputs from across the partnership while keeping preferential tariff status. A UK automotive firm could, for instance, import steel from Japan, electronics from Malaysia and assemble in the Midlands, yet still ship finished vehicles into Vietnam at zero duty. The rule encourages supply-chain diversification away from geographic concentrations that proved vulnerable during the pandemic era.

Opportunities for Small and Medium-Sized Enterprises

A dedicated SME annex requires each government to publish user-friendly guidance, establish contact points and run outreach events. By standardising paperwork and digital-certification formats, the treaty lowers threshold costs that often deter smaller exporters.

Economic Impact and Strategic Significance

The Treasury estimates the long-run boost to UK GDP at a modest 0.08 per cent, mainly because existing bilateral deals with nine partners already deliver significant liberalisation. Yet focusing solely on static modelling understates the strategic upside:

- Indo-Pacific Presence – Membership embeds the UK in a region forecast to account for 54 per cent of global growth by mid-century.

- Platform for Future Enlargement – Economies like Indonesia, the Philippines, South Korea and Taiwan have expressed interest in joining, potentially widening the UK’s tariff-free network automatically.

- Geopolitical Leverage – As a G7 country inside CPTPP, Britain gains influence over rule-setting in areas such as e-commerce and net-zero supply chains, reinforcing democratic standards in an era of contested global norms.

Current Ratification Status and What It Means Day-to-Day

As of July 2025, the UK trades under CPTPP terms with eight members. The benefits will not extend to Canada until its Parliament passes implementing legislation, likely late 2025. Trade with Mexico continues under a 2020 rollover agreement, with CPTPP preferences delayed until Mexico’s Senate votes.

Businesses should therefore map tariff schedules carefully: a whisky shipment to Malaysia qualifies for zero duty today, while the same consignment to Toronto still follows the older timetable until Canadian ratification enters into force. Customs brokers and finance teams must use the correct preference codes to avoid unexpected bills or compliance penalties.

Challenges and Risks to Consider

Incremental Market Gains

Because nine partners already have UK FTAs, some tariff cuts are incremental rather than revolutionary. Firms must assess whether new savings justify the administrative steps involved in claiming CPTPP origin.

Regulatory Diversity

Import rules vary widely—from halal certification in Malaysia to labelling standards in Chile. UK exporters must budget for in-market compliance consultants or partnering with local distributors that understand unique requirements.

ISDS Controversy

The investor-state mechanism enables foreign investors to challenge government measures that harm their commercial interests. Although protocols seek to balance investor protection with sovereign regulation, public scrutiny can be intense. Businesses should track any UK side letters that may curtail ISDS with specific partners.

Domestic Agriculture Pressure

Tariff elimination works both ways. Canadian beef, New Zealand lamb and Australian wine will enjoy improved access to British shelves, intensifying competition for domestic farmers. Policymakers may need to monitor adjustment programmes or extension services to help local producers upgrade and differentiate.

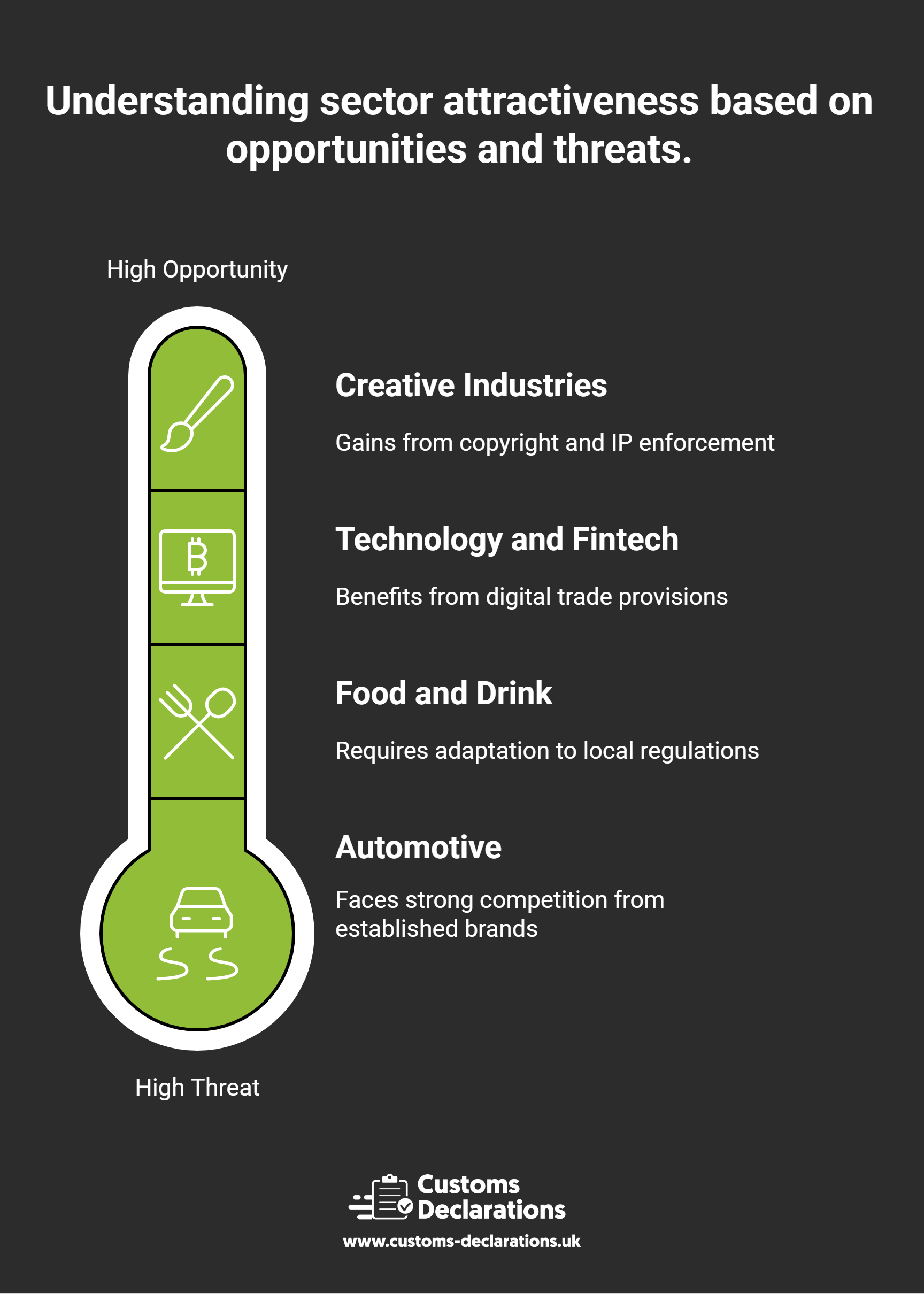

Sector-Specific Opportunities and Threats

Automotive – Tariff-free access to Vietnam and Malaysia plus flexible rules of origin make the region attractive for both finished vehicles and high-value components. However, Japanese and Korean brands remain entrenched.

Food and Drink – Scotch whisky, dairy specialities, craft gin and premium biscuits stand to gain from significant tariff cuts. Producers must, however, adapt packaging to local language and health-warning requirements.

Technology and Fintech – Digital-trade provisions support cloud-based services, payment gateways and cybersecurity firms. UK start-ups can scale in Singapore or Tokyo with fewer data-flow hurdles.

Creative Industries – Stronger copyright (life of author plus 70 years) and robust IP enforcement help publishers and gaming studios monetise content across the Pacific.

6 Frequently Asked Questions

When will the UK actually feel the benefits?

Exporters to Japan, Singapore, Vietnam, New Zealand, Chile, Peru, Malaysia and Brunei can claim CPTPP preferences now. Benefits extend to Canada approximately 60 days after its Parliament completes legislation, and to Mexico once its Senate passes the accession protocol.

Are data-protection standards compromised by free data flows?

The CPTPP balances open data movement with high-level privacy safeguards, allowing parties to uphold domestic privacy laws while preventing localisation rules that discriminate unfairly.

How can SMEs start exporting under CPTPP?

First, verify product-specific tariff lines and rules of origin via the Government’s online tariff lookup. Second, engage with the Department for Business and Trade’s Export Support Service and attend CPTPP-focused webinars. Third, consider local partnerships to navigate cultural and regulatory nuances.

Looking Ahead – CPTPP’s Future and the UK’s Place Within It

Expansion could soon add South Korea, Taiwan or Indonesia to the partnership, automatically enlarging the UK’s preference network. Meanwhile, London and Ottawa are resuming bilateral FTA talks to address non-tariff irritants such as cheese quotas and hormone-treated beef, complementing CPTPP rules. Technological cooperation taskforces on artificial intelligence, cyber-security and green finance also sit on the horizon, amplifying the strategic dividend of membership.

Domestically, the Government must balance openness with support for sectors facing heightened import competition. Transparent adjustment assistance and innovation grants will be critical in ensuring the net welfare gains promised by the treaty materialise across every UK region.

Conclusion

Accession to the CPTPP is more than another trade agreement; it is a geopolitical statement and an economic hedge. It locks the United Kingdom into a dynamic Indo-Pacific network, rewires supply-chain incentives and embeds digital-economy best practice. While the headline GDP uplift may look modest on paper, the real prize lies in long-term strategic positioning, diversified export growth and the ability to shape twenty-first-century trade rules from inside the room rather than from its periphery. For UK businesses willing to adapt, invest and comply, CPTPP offers a springboard into markets that will define the next generation of global commerce.