Introduction – From Free Trade to “Geoeconomic Alignment”

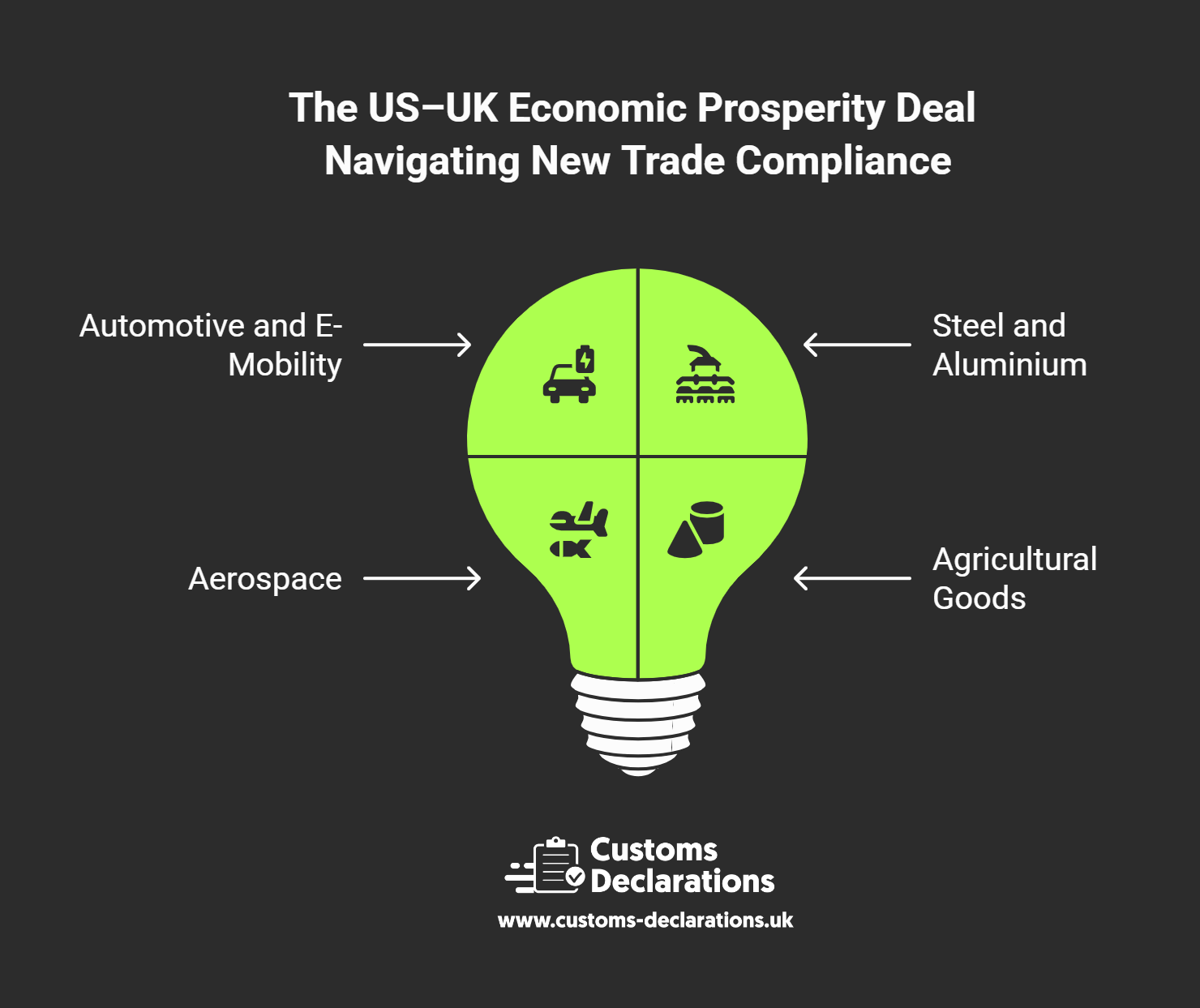

When the United States and the United Kingdom unveiled their Economic Prosperity Deal on 8 May 2025, the headlines focused on headline-grabbing tariff cuts for cars, aerospace parts, and agricultural goods. But the real significance of the EPD lies elsewhere. Unlike a traditional free-trade agreement that sweeps away duties and quotas across the board, the EPD is a carefully segmented framework that grants market access only when businesses can prove that their supply chains meet stringent security and resilience criteria defined largely in Washington. It blends tariff relief, sector-specific quotas, and a sweeping “supply-chain security” doctrine to create what officials call an alliance of trusted production and what critics label managed trade with a geopolitical filter.

For UK importers and exporters the message is clear: customs declarations are no longer a purely fiscal ritual. They have become the front line of geopolitical risk management. Origin data, supplier ownership structures, and end-use statements can now determine whether a shipment enjoys a 10 percent tariff on arrival in Baltimore—or faces a sudden 25 percent duty because the steel in its chassis cannot be traced beyond a high-risk jurisdiction. This article unpacks the EPD in a way that import managers, logistics directors, compliance officers, and CEOs can act on. It explains how the deal works, why supply-chain security sits at its core, and what practical steps British businesses must take to stay competitive in an era when customs compliance doubles as foreign-policy alignment.