The relationship between the United Kingdom and the European Union has seldom stood still since the 2016 referendum, yet few moments have been as consequential as the announcement at Lancaster House on 19 May 2025. Branded the UK–EU Partnership Deal, this accord seeks to move both sides beyond years of reactive fixes and into a more constructive, rules-based cooperation that addresses trade bottlenecks, security gaps and mobility irritants all at once. According to official projections, the package could add about £9 billion a year to UK GDP by 2040 while safeguarding critical EU interests in market stability and regional security.

1 From Trade and Co-operation to Partnership: How We Got Here

The 2020 Trade and Co-operation Agreement (TCA) kept goods moving but left thorny practical issues unresolved—most notably food-safety paperwork, divergent carbon-pricing regimes and ad-hoc security coordination. A change of government in Westminster in 2024 and mounting business pressure on both sides created the political headroom for a broader reset. Fifteen months of technical talks produced a compact that builds on, rather than replaces, the TCA but introduces bespoke mechanisms where friction remained highest.

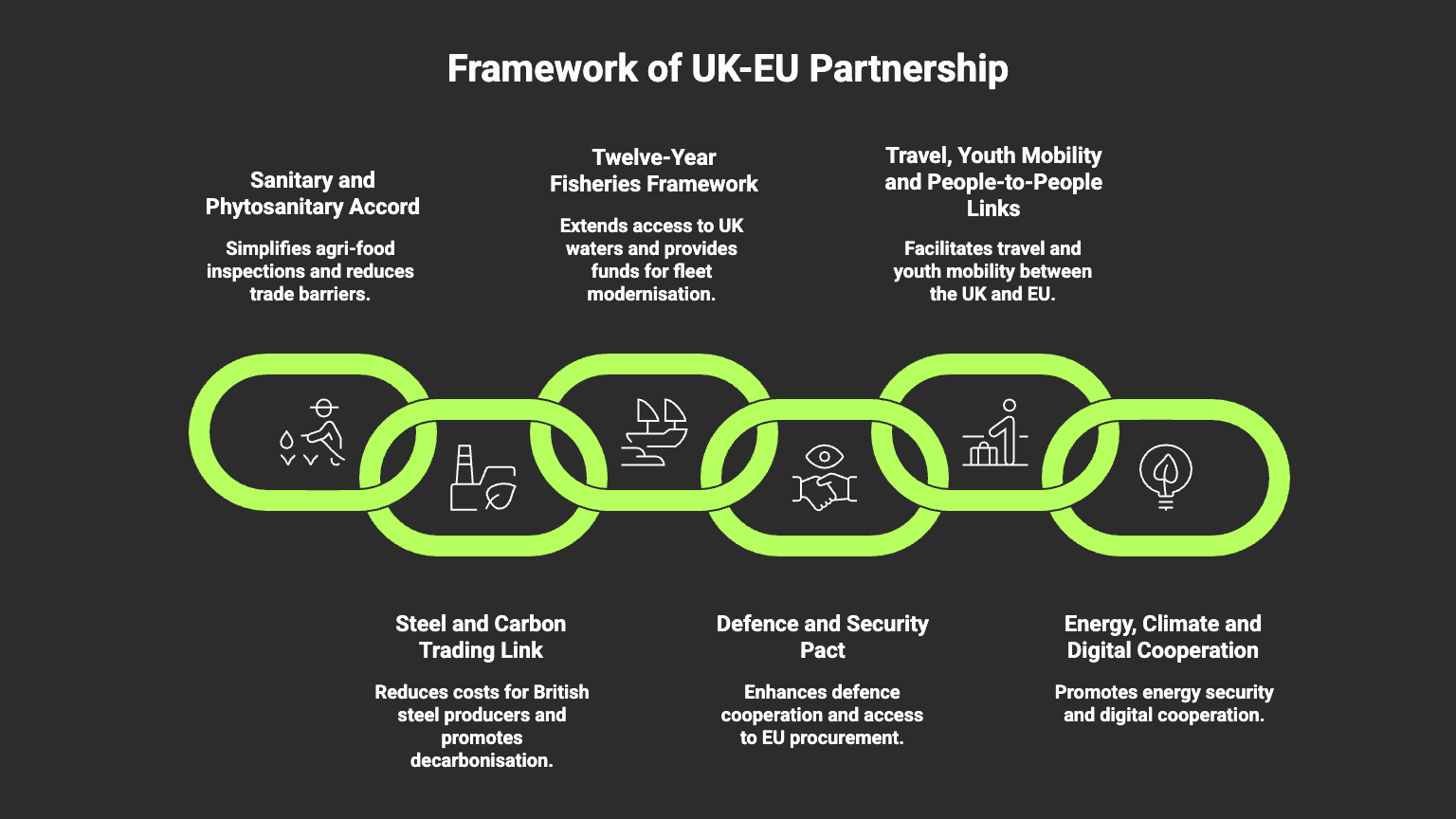

2 What the Partnership Deal Covers

2.1 Sanitary and Phytosanitary (SPS) Accord

At the heart of the agreement lies a breakthrough SPS accord. Routine inspections on agri-food consignments will now be limited to risk-based spot checks. Documentary requirements are simplified, allowing exporters to reuse health certificates for wider product categories. Government modelling suggests this could reverse a 21 percent slump in UK agrifood exports that followed Brexit and bring prices down for consumers on both sides.

2.2 Steel and Carbon Trading Link

British steel producers feared the EU’s incoming Carbon Border Adjustment Mechanism would add up to £800 million a year to costs. The new deal links the UK Emissions Trading Scheme to the EU ETS, recognising UK allowances and saving the industry around £25 million annually in direct tariffs while preserving incentives to decarbonise.

2.3 Twelve-Year Fisheries Framework

Fisheries dominated headlines again. Brussels secured a 12-year extension of access to UK waters until 2038, essentially freezing the current distribution of quota shares. In return, London obtained a £360 million “fishing and coastal growth fund” for fleet modernisation and coastal community revival.

2.4 Defence and Security Pact

A formal UK-EU defence dialogue will now sit alongside NATO cooperation. Britain will join the EU’s €170 billion SAFE defence-investment platform and the Military Mobility project under PESCO, gaining privileged access to EU procurement and research funds while committing to semi-annual ministerial meetings on sanctions, cyber-resilience and space security.

2.5 Travel, Youth Mobility and People-to-People Links

Beginning in late 2025, UK passport holders will be able to use EU e-gates at most major airports, cutting queue times significantly. Negotiations are under way for a Youth Experience Scheme granting 18–35-year-olds the right to live and work across the Channel for up to three years, modelled on UK agreements with Australia and New Zealand. Talks to re-enter Erasmus+ are also progressing.

2.6 Energy, Climate and Digital Cooperation

The accord mandates exploratory work on UK reintegration into the EU’s shared electricity market, a move expected to stabilise prices and strengthen energy security. It also opens discussions on mutual recognition of digital signatures and explores UK participation in EU crime-fighting databases beyond the DNA, fingerprint and vehicle-number records already shared.

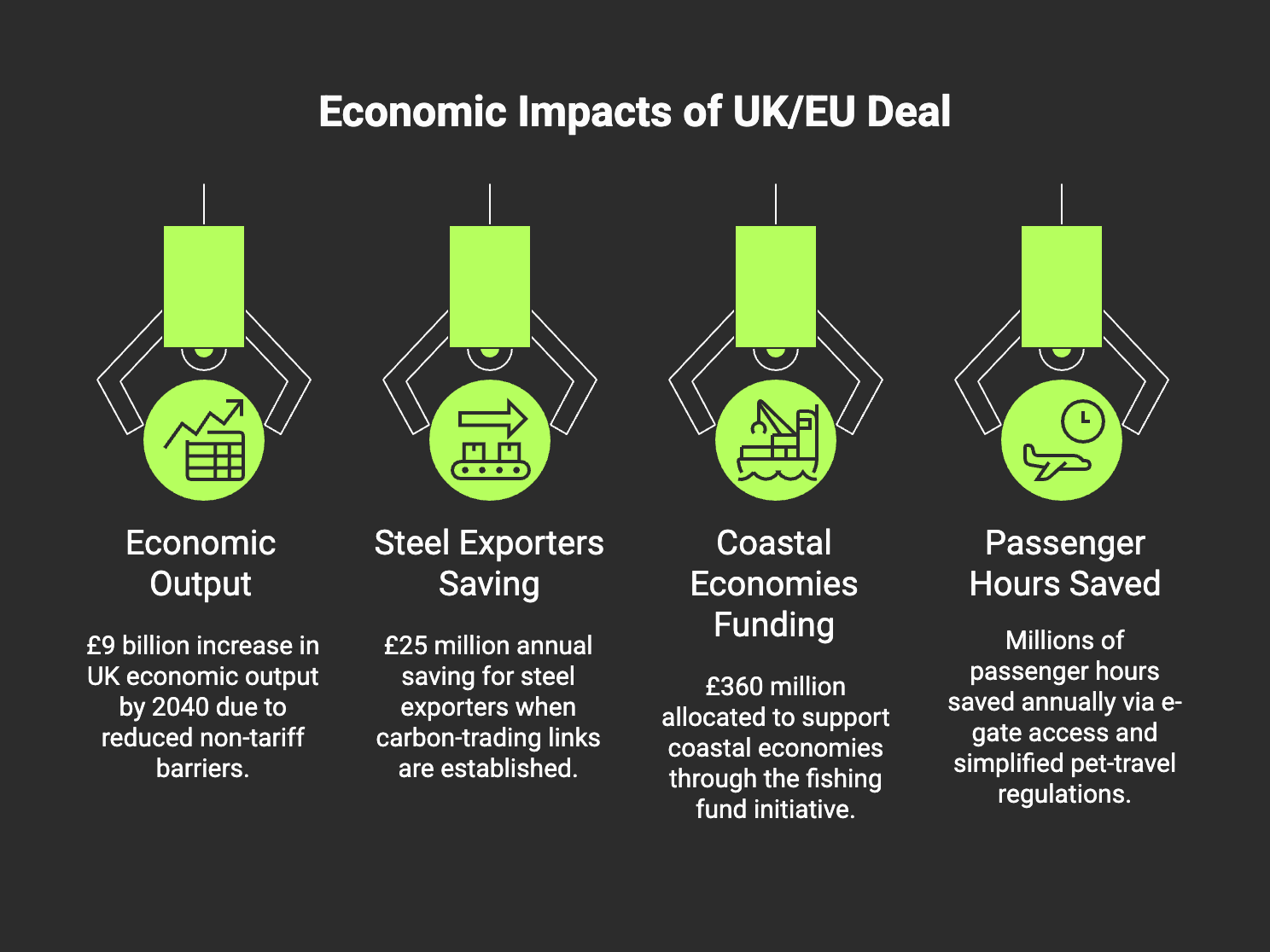

3 Economic Impact at a Glance

Independent and government assessments converge on sizeable long-term gains:

- £9 billion in extra UK economic output by 2040 as non-tariff barriers fall.

- £25 million annual saving for steel exporters once carbon-trading links take effect.

- £360 million earmarked for coastal economies through the fishing fund.

- Millions of passenger hours saved each year through e-gate access and reduced pet-travel red tape.

4 Who Wins and Who Worries?

Beneficiaries in the UK include meat processors, dairy exporters and chilled-food hauliers freed from costly veterinary certificates; specialty-steel mills in Yorkshire and Wales that keep EU market share; cyber-security firms poised to bid into EU defence calls; and young professionals eager for low-bureaucracy work visas.

EU stakeholders gain continuity in fish supply, a cooperative UK partner on sanctions and hybrid threats, and a more predictable carbon-price interface that shields continental producers from unfair competition.

Sceptics span hard-line Brexit figures objecting to “rule-taking” in carbon trading and sovereignty campaigners dismayed by the fisheries compromise. On the continent, protectionist farming lobbies question whether reduced SPS checks could dilute bio-security standards.

5 Implementation Timeline

- Q3 2025 – SPS accord enters into force after domestic legislation and EU comitology sign-off.

- October 2025 – EU digital border system goes live; UK travellers begin using e-gates.

- Early 2026 – Carbon-trading linkage operational, pending IT system integration.

- Annual from 2026 – Joint fisheries committee sets quotas under the new 12-year framework.

A joint Partnership Council will meet each spring to monitor rollout and adjust technical annexes without reopening the main treaty.

6 Frequently Asked Questions

8 The Wider Strategic Context

Geopolitical turbulence—from Russia’s war in Ukraine to global supply-chain shocks—has elevated the value of predictable alliances. By embedding crisis-response clauses and synchronising sanction regimes, the UK and EU aim to project stability in an unsettled neighbourhood. The deal also signals that pragmatic, sector-specific integration remains possible outside full EU membership, offering a potential template for other third-country partnerships.

Conclusion

The May 2025 UK–EU Partnership Deal is less a dramatic reunion than a carefully calibrated détente. It eliminates neither borders nor politics, but it promises lighter paperwork at Dover, competitive breathing space for Welsh blast furnaces, and faster security data flows at a time when threats ignore frontiers. Successful implementation will depend on regulatory diplomacy and domestic goodwill, yet the accord’s design—living, reviewable, and heavily data-driven—provides the tools to adapt. For businesses, travellers and policymakers alike, the message is clear: post-Brexit relations are no longer defined solely by what was lost, but increasingly by what pragmatic cooperation can regain.