The United Kingdom’s market for wines and specialty beverages—ranging from estate-bottled Bordeaux and premium sparkling wines to craft beers, ciders, meads, sakes, and small-batch spirits—remains resilient and discerning. Turning that demand into sustainable margin requires clear mastery of three pillars: accurate commodity classification and origin treatment; precise computation of customs duty, alcohol duty, and import VAT; and a disciplined declaration workflow that integrates excise controls and food-law labelling. This article presents a practical, step-by-step framework for importers. It emphasises how to structure your documentary evidence, how to decide between paying duty at the frontier or using duty-suspension regimes, and how to file a clean customs declaration through the Customs Declarations UK (CDUK) platform.

Laying the groundwork: registrations, approvals, and roles

Before you contract for supply, ensure your business holds a valid GB EORI number and is set up to interact with HMRC’s Customs Declaration Service (CDS), either directly or through a broker. An active EORI and a clear routing decision (self-filing or agent-led) are foundational, because the customs declaration must be submitted electronically with consistent identity data on all paperwork.

Alcoholic drinks also engage excise law. If you will trade wholesale volumes, register under the Alcohol Wholesaler Registration Scheme (AWRS) and understand how movements under duty suspension are controlled in EMCS (Excise Movement and Control System). Where you plan to store or move products in bond, approvals and adherence to warehouse and movement rules are mandatory.

Classification and origin: the bedrock of cost and eligibility

Classification determines much more than a line on your declaration. Wines, beers, other fermented products, and spirits sit in Chapter 22 of UK Trade Tariff. The correct 10-digit commodity code hinges on objective product features such as alcohol content, still or sparkling state, container size, and (for spirits) product type. Getting this right triggers the correct measures, including duty method and any additional controls, and it prevents post-clearance assessment. The UK Trade Tariff should be consulted for the precise code applicable to your SKU and packaging.

Origin can reduce duty where a trade agreement applies, but only if your documentary trail substantiates a claim. For most lanes this takes the form of a statement on origin on the commercial invoice supported by supplier/manufacturing records; if you cannot demonstrate compliance, the buyer will default to the MFN rate. In short, never issue a preference claim you cannot defend.

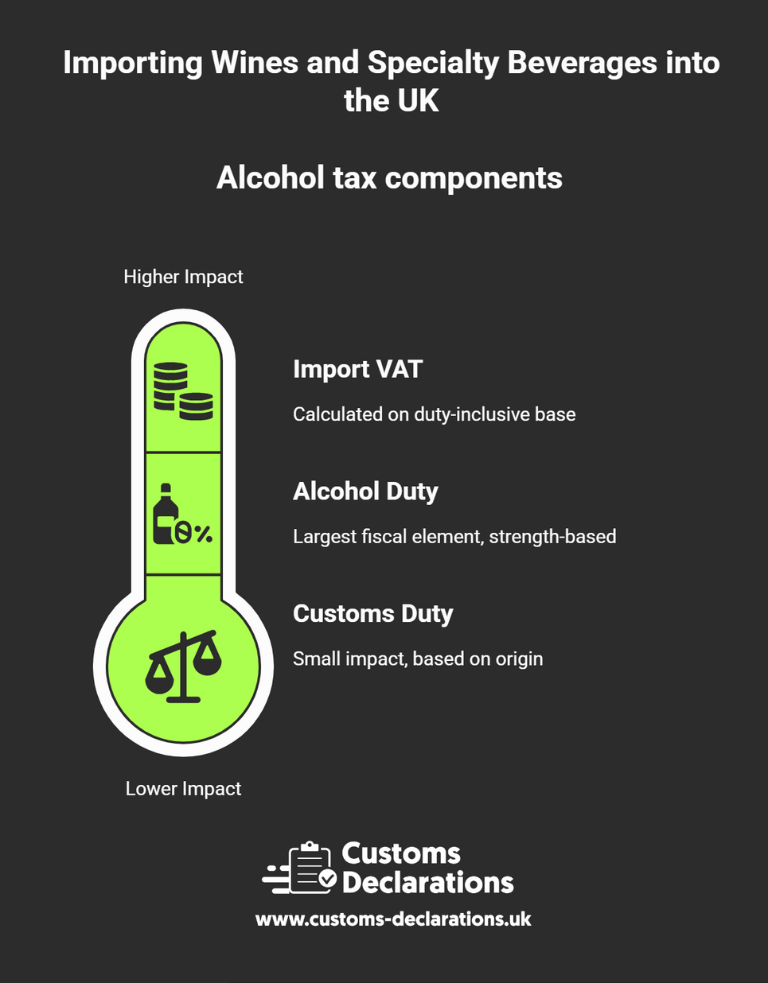

Duties and taxes: customs duty, alcohol duty, and VAT—how they interact

For many finished wines, beers, and spirits, customs duty is often low or zero under the UK Global Tariff, subject to code and origin; however, you must check the live tariff and any lane-specific measures that may apply. Treat customs duty as one component of a larger tax base rather than the headline cost.

Alcohol (excise) duty is typically the largest fiscal element. The UK’s reformed system is strength-based: rates are expressed per litre of pure alcohol (LPA), with bands and category rules that capture still and sparkling wines, other fermented products, and spirits. Stronger products generally attract higher duty, and the historical gap between still and sparkling has been rationalised within the banded structure. Always price against the current HMRC table rather than last season’s figures.

Import VAT at the standard rate is calculated on a base that includes the customs value plus any customs duty and alcohol duty. Because VAT rides on a duty-inclusive base, even small mis-valuations or duty errors can cascade into larger VAT discrepancies. This is why excise precision and good valuation documentation matter before you commit retail price points.

To illustrate the mechanics rather than fix numbers: compute the CIF value of the goods, apply any customs duty due, calculate excise by converting litres into litres of pure alcohol via the ABV, and then apply VAT to the sum. The system is transparent, but it rewards disciplined pre-calculation by SKU and pack size.

Duty-suspension options: EMCS and excise warehousing

Many importers improve cash flow by placing consignments straight into an authorised excise warehouse on arrival, suspending alcohol duty (and the VAT linked to it) until release to home use. This route is attractive for seasonal allocations, staged releases, or wholesale models with longer holding periods. Movements under suspension must be recorded on EMCS, backed by valid movement guarantees, and supervised by an authorised warehousekeeper.

Northern Ireland continues to move duty-suspended alcohol with the EU under EMCS rules. If your flows involve NI retail under the Windsor Framework, track any separate labelling nuances as policy evolves.

Labelling and food-law compliance: what must appear—and when

Labelling is not a mere marketing exercise; it is a compliance gateway. From 1 January 2024, wine labels for the GB market must show a UK-based Food Business Operator (FBO) or the importer’s name and address alongside standard particulars such as product name, ABV, net quantity, allergens (for wine, typically sulphites), lot code, origin, and any category statements. Spirits, beers, and other fermented products have their own specific labelling rules; ensure your artwork is aligned well before shipment to avoid re-labelling costs and border delays.

At a practical level, mislabelled goods can be detained until corrected. Remediation is expensive and disruptive; it is usually cheaper to align labels early than to retrofit in a UK depot under the pressure of pending release dates.

The export-side dossier from your supplier—and your import file

Treat your document set as a single, coherent story. Your commercial invoice should state an accurate technical description, unit and total values, currency, country of origin, and agreed Incoterms. The packing list must mirror the invoice with package counts, gross and net weights, and dimensions. Where applicable, include origin evidence to support any preference claim and ensure any excise-related paperwork required for movements under suspension is prepared. Keep a complete digital archive tied to each import entry; this is invaluable for audits and for proving VAT zero-rating on subsequent exports.

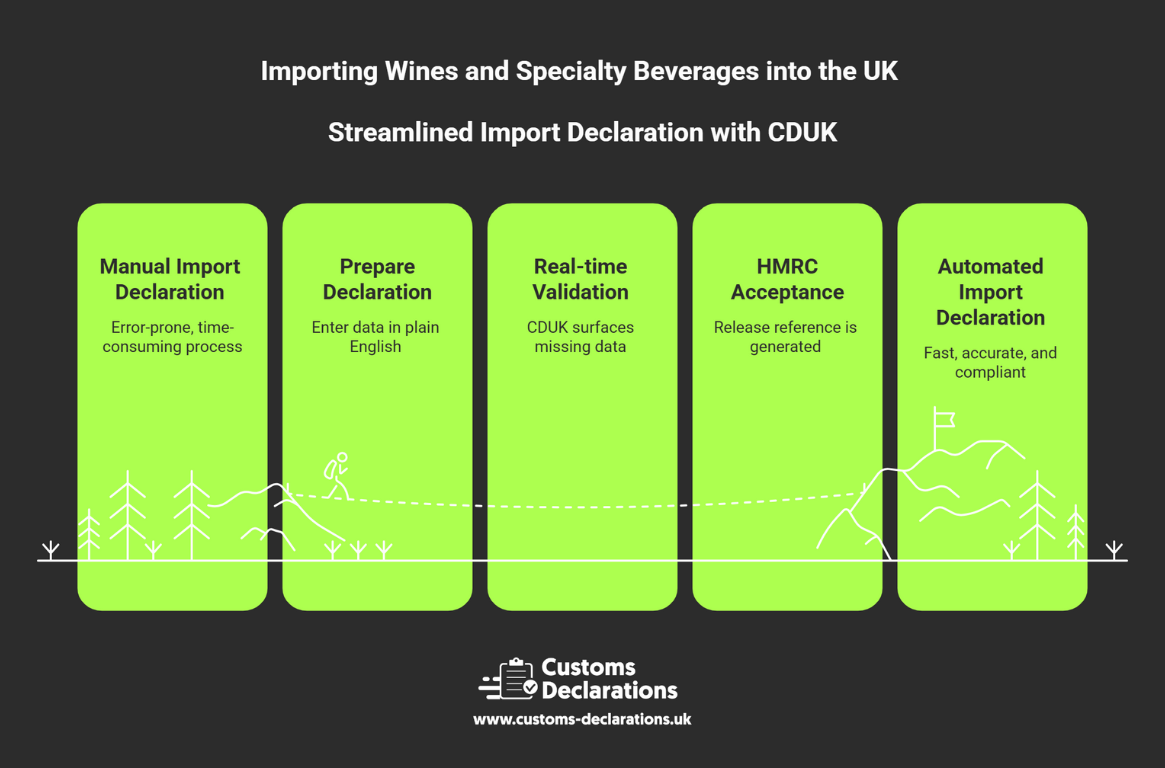

Filing the import declaration through Customs Declarations UK (CDUK)

Every commercial import must be declared electronically to HMRC’s CDS. In Customs Declarations UK platform, you prepare the import declaration in plain English through a guided flow designed for alcoholic beverages. Select the correct customs procedure, enter the importer/consignee details, declare the commodity code and customs value, specify origin and any preference claim, and reference any licences or approvals that apply to the consignment (for example, warehousing or movement references where goods will enter duty suspension). CDUK runs real-time validations to surface missing or inconsistent data before submission. When HMRC accepts the entry, a release or movement reference appears on the notifications section; share it with your carrier and retain it with the invoice and transport document as part of your audit trail. Using clone functionality for repeat SKUs and saving draft profiles for lanes reduce error rates and speed throughput during peak season.

For a detailed walkthrough of the data elements and submission flow, consult our internal guides on import declarations and cds declarations. Where a carrier must lodge safety and security data, align your descriptions and weights so those filings are consistent with your customs declaration; our primer on ens declarations explains how this dataset interacts with risk analysis.

Frontier timing, safety & security data, and carrier coordination

Airlines, shipping lines, and road operators work to strict cut-offs for security filings and load-lists. Even when the carrier submits the safety-and-security dataset, the importer must supply accurate descriptions, weights, and consignee details so that carrier data and customs declarations reconcile. Inconsistencies can trigger inspections or roll-overs at hubs and ports; prevent them by sharing finalised descriptions and weights from your declaration file with your forwarder and confirming how duty-suspended routing will be handled in EMCS after release.

Choosing your import flow: pay now or suspend

If you release to home use at the frontier, be ready to settle alcohol duty and the VAT computed on the duty-inclusive base. If you route to an excise warehouse, ensure the EMCS e-AD is in place and that movement guarantees and warehousekeeper approvals are valid. The decision is commercial as much as compliance-driven: slower-moving allocations, on-trade kegs, or large seasonal drops often benefit from duty suspension until closer to sale.

Governance: records, reconciliations, and internal controls

Strong governance lowers your cost of compliance. Maintain evidence of your classification determinations, tariff and rate lookups, ABV certificates, valuation workings for CIF, EMCS movement logs, warehouse releases, and final customs and VAT statements. Sampling a subset of entries each month and reconciling declarations to source documents helps catch small errors before they become systemic. Where you trade both direct retail and wholesale, maintain separate SOPs for frontier release versus duty-suspended flows.

A concise operational run-through

A UK importer with mixed wine and spirits portfolios confirms EORI and CDS access, maps classification by SKU, and decides to warehouse high-value spirits while releasing the wines at the frontier. Labels are verified to show the UK FBO/importer address and allergen statements. The supplier’s invoice and packing list are aligned; the forwarder receives finalised descriptions and weights. In Customs Declarations UK platform, the importer completes the import declaration, verifies valuation and origin fields, and submits; on acceptance, the release reference is shared with the carrier. Spirits are moved under EMCS to bond; wines are duty-paid at entry. The importer files and archives the MRN/release messages, transport documents, and EMCS records for audit. The result is predictable release, accurate landed costs, and fewer operational surprises.

Conclusion

Importing wines and specialty beverages at scale becomes straightforward when treated as one integrated discipline. Precise classification and origin shape eligibility and control costs; the strength-based alcohol duty model demands current-rate calculations by SKU; and the VAT base makes accuracy doubly important. Combine that with compliant labels, a coherent document set, and a validated electronic submission through the Customs Declarations UK platform, and your consignments will reach shelves and cellars with minimal friction and a robust audit trail. For policy specifics on the UK’s strength-based alcohol duty structure and recent uprating, consult HMRC’s current Alcohol Duty rates page to underpin your pricing model.