Introduction

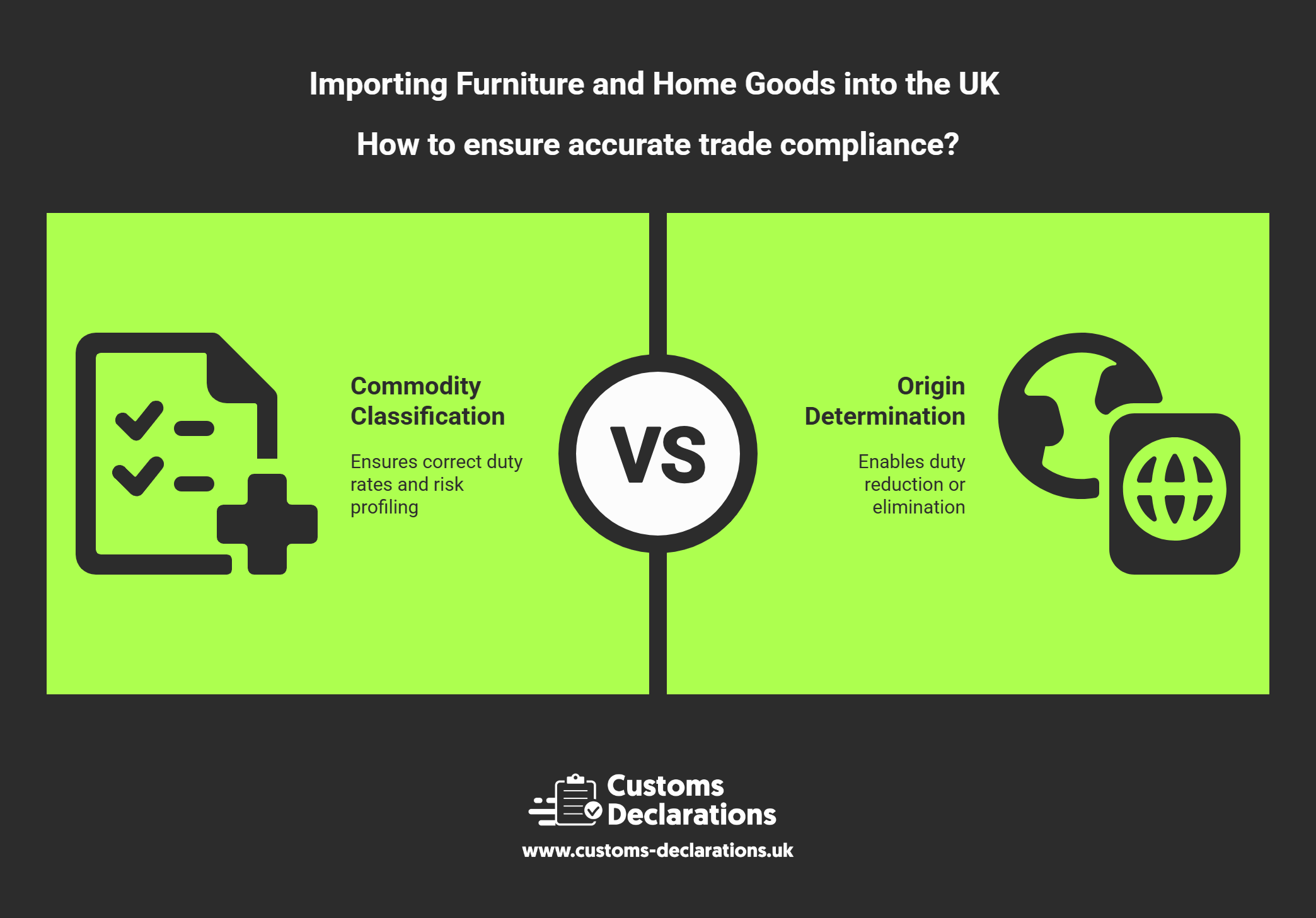

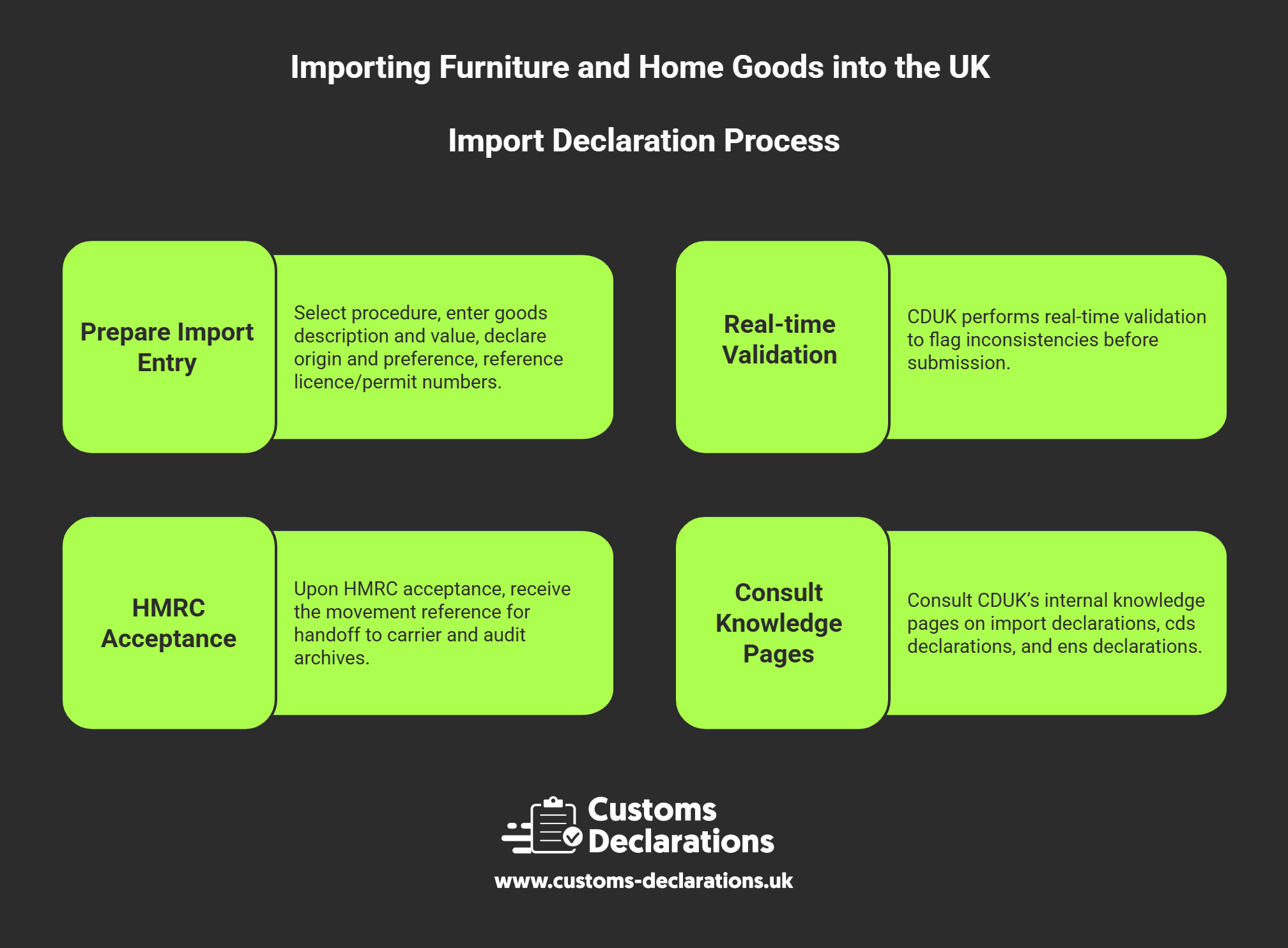

From designer sofas and handcrafted tables to lighting, textiles, glassware and ceramics, furniture and home goods arrive in the United Kingdom under close fiscal and regulatory scrutiny. To move consignments efficiently you must build a coherent pathway that starts with accurate classification and origin, continues through duty and VAT calculations, and culminates in an error-free customs declaration. This article consolidates the most relevant requirements and practical steps for importers, and explains where the Customs Declarations UK (CDUK) platform can streamline filing on HMRC’s Customs Declaration Service (CDS) and strengthen audit readiness. The guidance below reflects established practice and the core steps most shipments must follow.