Introduction – Why HMRC’s Transformation Roadmap Matters Now

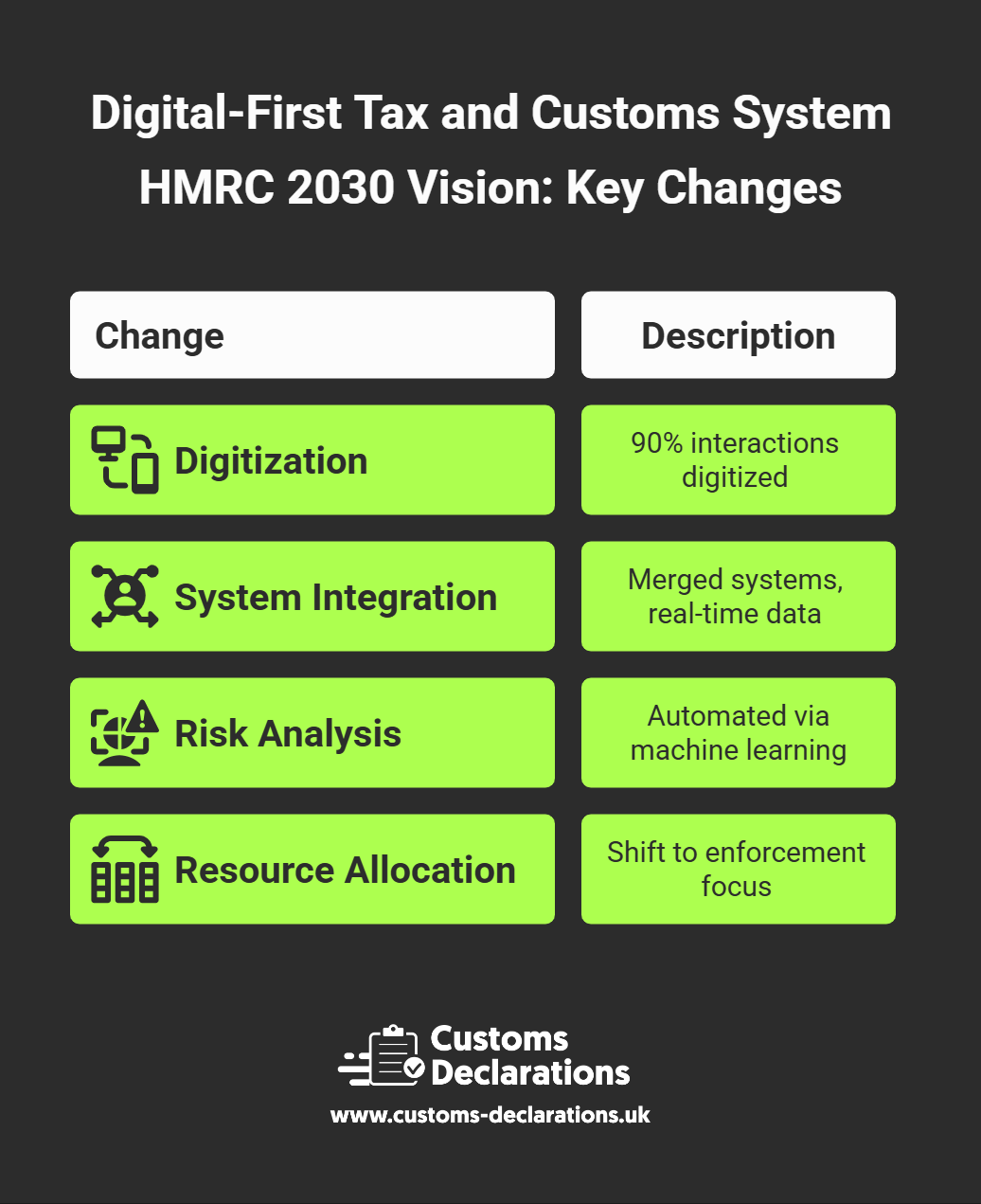

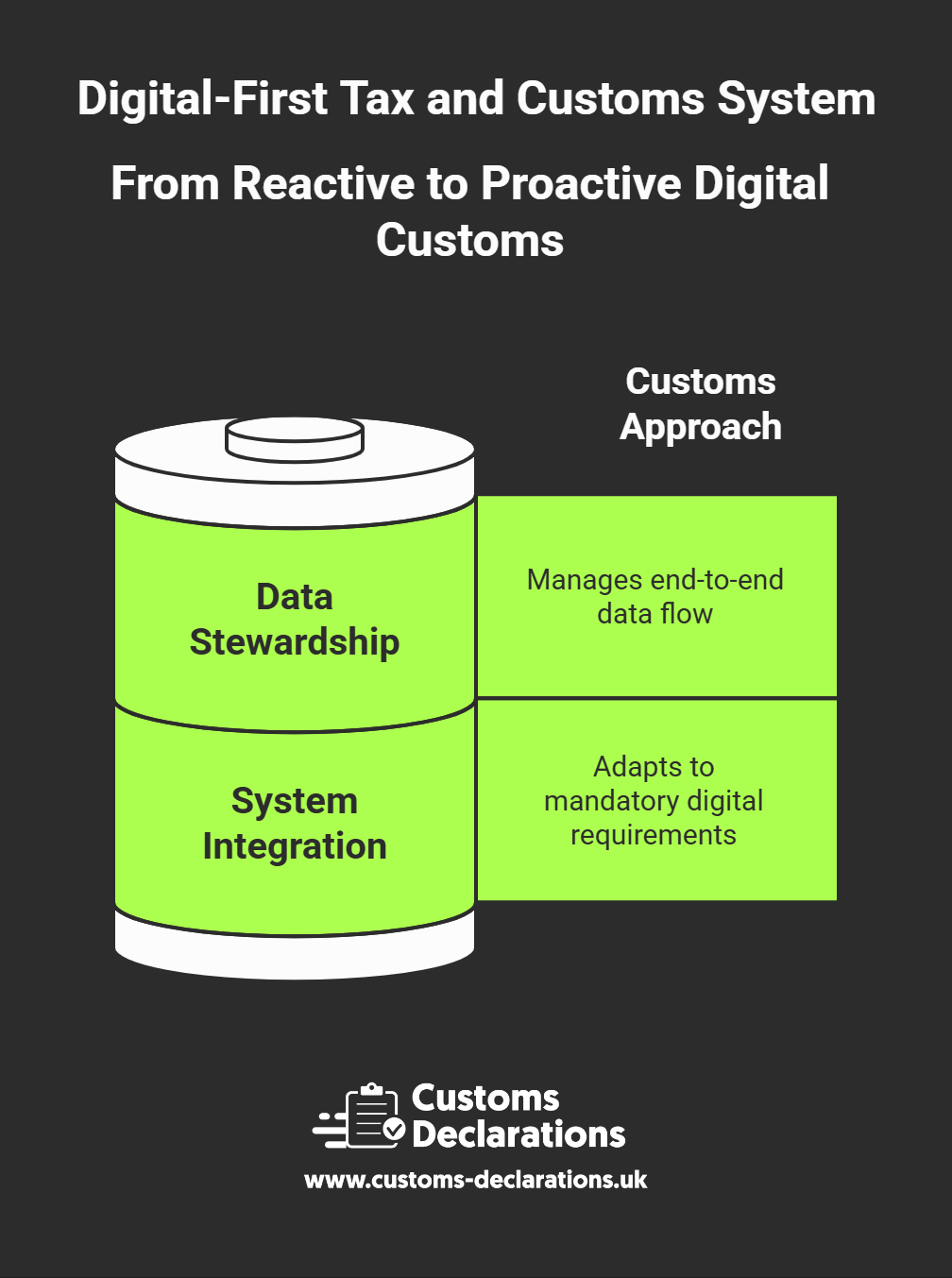

On 21 July 2025 His Majesty’s Revenue & Customs published its Transformation Roadmap—a definitive blueprint for becoming a fully digital-first authority by 2030. The document is more than an IT upgrade: it lays out a structural overhaul of every interaction that businesses, intermediaries and individuals have with HMRC. Ninety per cent of customer touch-points are expected to move online; paper fallback processes will vanish; and data-driven enforcement will tighten the screws on error-prone supply chains.

For customs brokers, freight forwarders and UK traders the message is explicit: digital competence and data accuracy will determine who clears the border smoothly and who faces delays, penalties or exclusion from streamlined regimes. This article explores the Roadmap in depth, answers the questions companies are already asking on search engines, and offers a practical action plan for thriving in HMRC’s new compliance landscape.