Update: CERTEX Implementation Delayed – What You Need to Know

In a late-June announcement, HM Revenue & Customs (HMRC) confirmed that the previously planned roll-out of CERTEX—the EU’s Certificates Exchange System—for Northern Ireland has been delayed indefinitely. Implementation will no longer take place on 28 June 2025, and no new start date has been specified—a development that significantly shifts the readiness timeline for businesses handling controlled goods.

Why Was CERTEX Delayed?

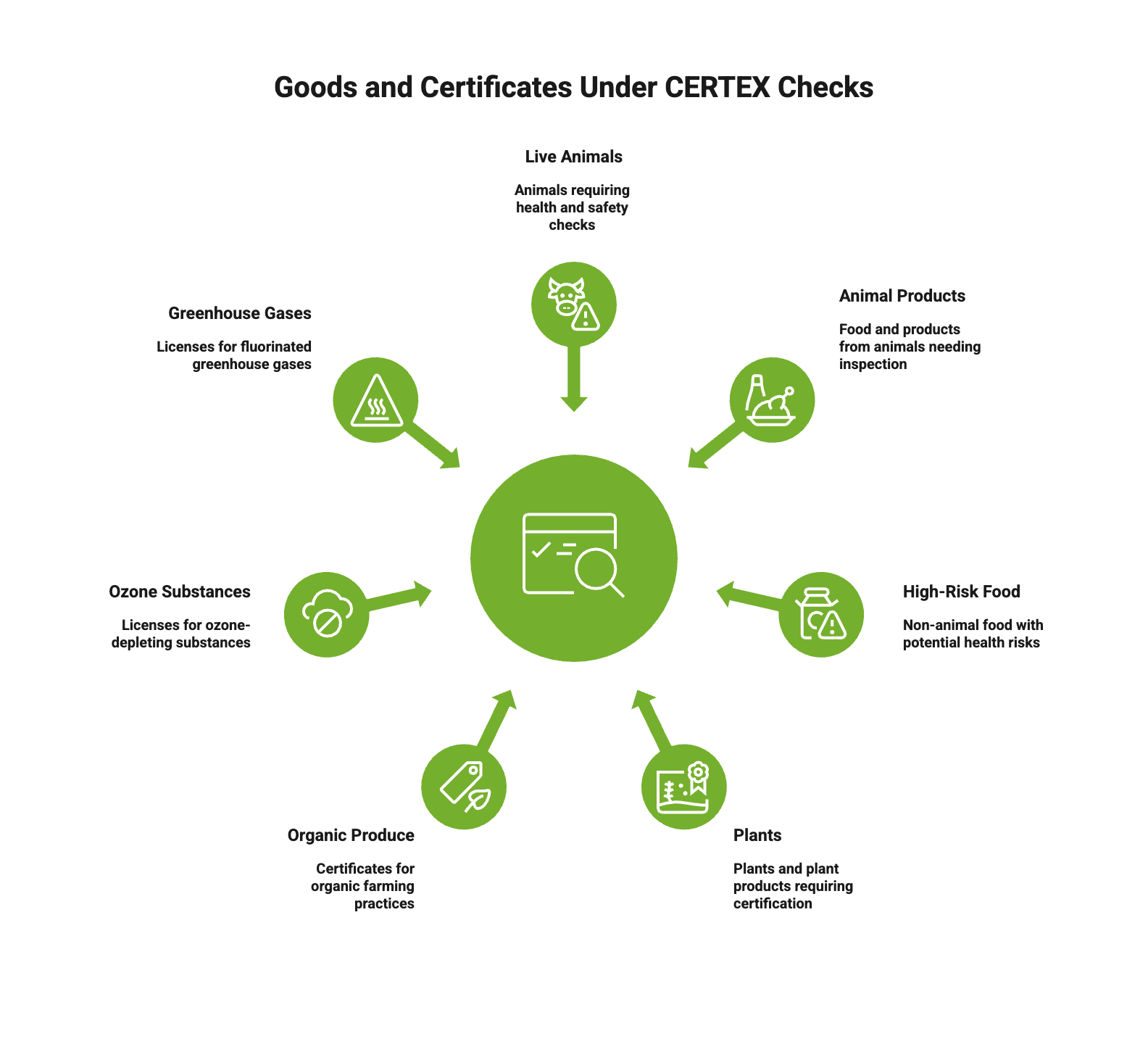

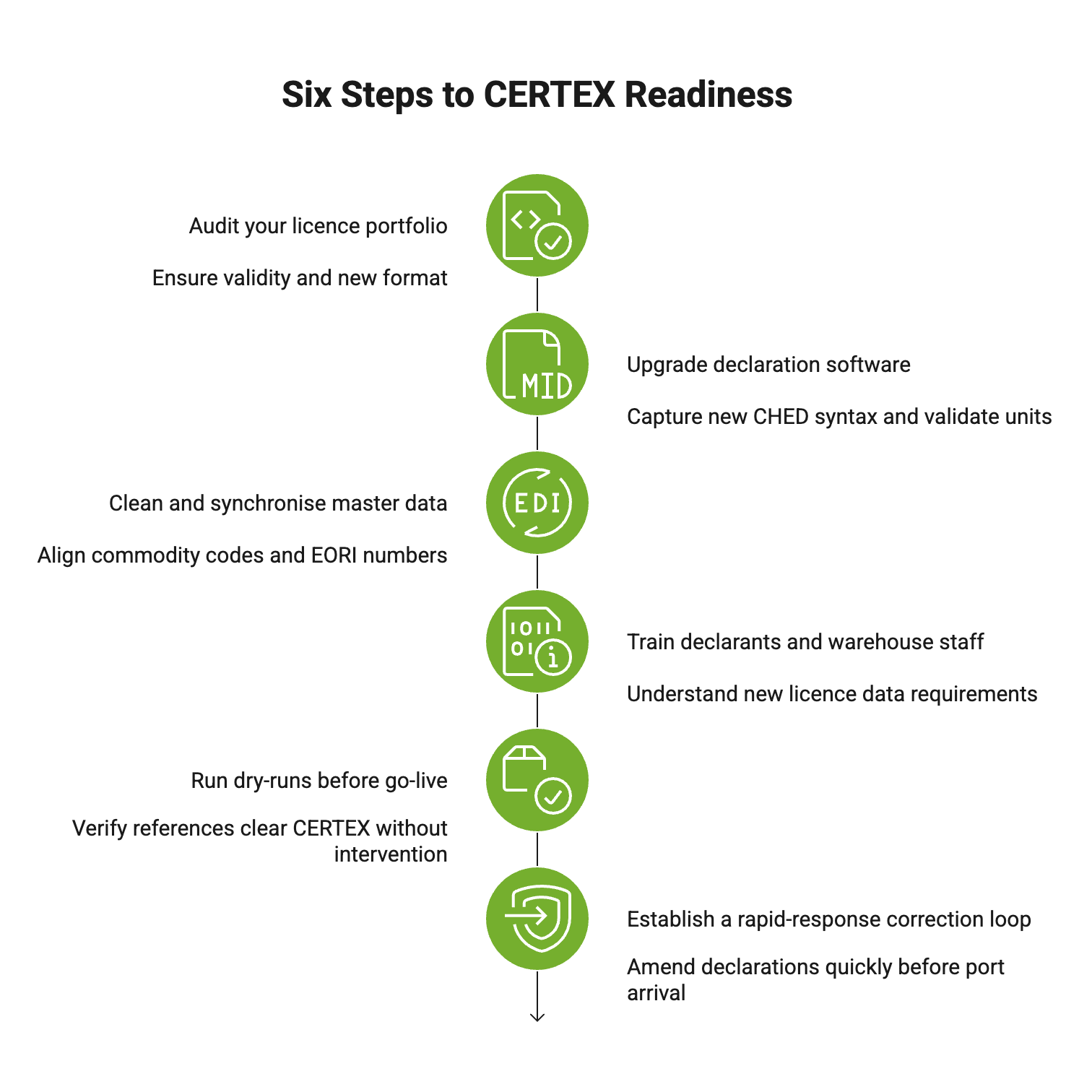

Industry bulletins suggest that the postponement stems from technical and operational readiness challenges within the Customs Declaration Service (CDS) and trader software systems. These problems made it difficult to ensure reliable validation of licence data—such as CHED, COI, ODS, or FGAS references—against the new format and stricter matching rules. With little notice, HMRC concluded that launching without full stability risked massive disruption at the border.

What Does This Mean for Traders?

1. Moving Goods from Great Britain to Northern Ireland

There is no requirement yet to switch to the new CHED reference format (CHEDA.XI.2025.1234567). Traders can continue using the current format (GBCHD2025.1234567) for now, though HMRC still encourages early adoption in anticipation of the eventual implementation. As the new CERTEX checks are not active, no system-generated messages related to licence validation will be issued. Use normal GVMS or other inventory systems as before.

2. Moving Goods from the Rest of the World to Northern Ireland

Traders must continue using the old CHED format for declarations, regardless of whether they are pre-lodged after 28 June. In cases where new-format CHED references were already used, those declarations must be amended before arrival to avoid rejection, holds, or delays.

3. What Should Traders Do Now?

- Continue following existing licence processes in CDS, GVMS and DAERA systems, as before the proposed change.

- Use the current CHED reference format, unless ready to switch under the old timetable.

- Monitor your pre-lodged declarations closely—if they include the new format, edit them to revert to the old format before the vehicle arrives.

- Avoid invoicing or making operational changes based on the arrival of CERTEX until HMRC confirms a new implementation date.

Why Immediate Action Matters

Although the delay gives short-term relief, it also adds uncertainty. Traders who prematurely adopt the new CHED format risk having their documents rejected by CDS when the system is not yet active. Conversely, delaying internal system updates too long will leave them vulnerable once CERTEX is finally launched.

Looking Ahead

HMRC has not provided a new timeline for roll-out. Industry guidance suggests that once technical issues are resolved, there will likely be a renewed notice period, followed by reactivation of the original transition plan:

- CHED updates on declarations for both GB→NI and RoW→NI movements.

- Licence-data validation in real time via CDS.

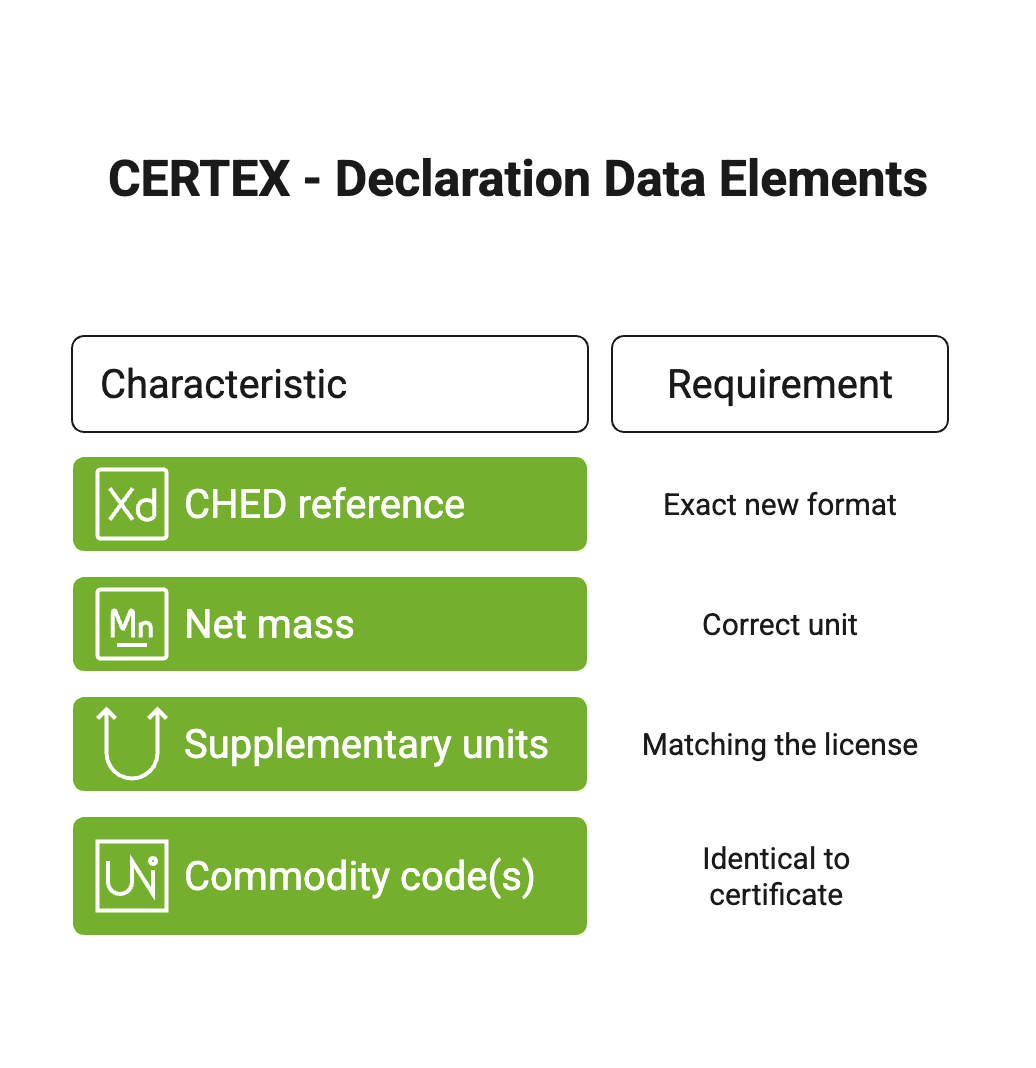

- Rejecting or holding declarations with mismatches in CHED, net mass, supplementary units, or commodity codes.

Traders should stay alert for formal guidance through GOV.UK, the Trader Support Service, or software vendor updates. Early preparations—such as tracking licence formats and data consistency—remain essential.