Importing office machinery—such as printers, servers, and peripherals—from the Netherlands to the United Kingdom is a routine yet technically regulated process. Since Brexit, goods arriving from the EU are treated as imports, meaning importers must comply with UK customs, safety, and VAT rules. Although trade with the EU is tariff-free under the UK-EU Trade and Cooperation Agreement (TCA), correct classification, conformity marking, and accurate customs valuation—especially for items bundled with software—remain critical to avoid costly delays or HMRC enquiries.

Establishing the Framework for Importing Office Machinery

Office machinery encompasses products such as multifunction printers, network servers, storage systems, and related peripherals. These are high-value goods often purchased from EU-based suppliers and shipped to the UK for installation or resale.

Post-Brexit, shipments from the Netherlands into Great Britain (England, Scotland, and Wales) are now classified as imports. Importers must possess a valid Economic Operators Registration and Identification (EORI) number and must submit a customs declaration to HMRC via the Customs Declaration Service (CDS)—either directly or through a customs broker.

While the TCA ensures zero tariffs for EU-origin goods, it does not exempt importers from documentation and compliance obligations. Origin proofs must demonstrate that the goods were manufactured in the EU to qualify for duty-free treatment.

Correct Customs Classification and Tariff Coding

Accurate tariff classification underpins every compliant customs entry. It determines duty rates, import controls, and applicable product regulations. Office machinery and components typically fall under Chapters 84 and 85 of the UK Integrated Tariff.

- Printers and Multi-Function Devices (MFDs) generally fall under heading 8443, covering printing and copying machinery.

- Servers and Network Equipment are commonly classified under heading 8471, for automatic data processing machines.

- Peripherals such as monitors, keyboards, and external storage devices may fall under headings 8471, 8528, or 8473 depending on function.

When equipment includes multiple components, classification is generally based on the principal function (for example, “printing” for a multifunction machine). Importers should use HMRC’s UK Integrated Online Tariff Tool or request a Binding Tariff Information (BTI) ruling for legal certainty.

Common errors in classification—such as describing goods too generically or misidentifying the principal component—can trigger delays, post-clearance assessments, and penalties. Maintaining a clear audit trail of technical specifications and commercial descriptions ensures consistency and defensibility.

Conformity Marking: CE and UKCA for the UK Market

All electrical and electronic equipment sold in the UK must demonstrate compliance with relevant health, safety, and environmental regulations. This is shown through conformity marking.

CE and UKCA Markings

The CE Mark (Conformité Européenne) demonstrates conformity with EU legislation, while the UKCA Mark (UK Conformity Assessed) shows compliance with UK regulations.

The UK government currently recognises CE marking indefinitely for most goods placed on the GB market, including office machinery covered by the Low Voltage, EMC, and RoHS regulations. However, future divergence between UK and EU standards remains possible, and dual CE/UKCA marking is advisable for long-term flexibility.

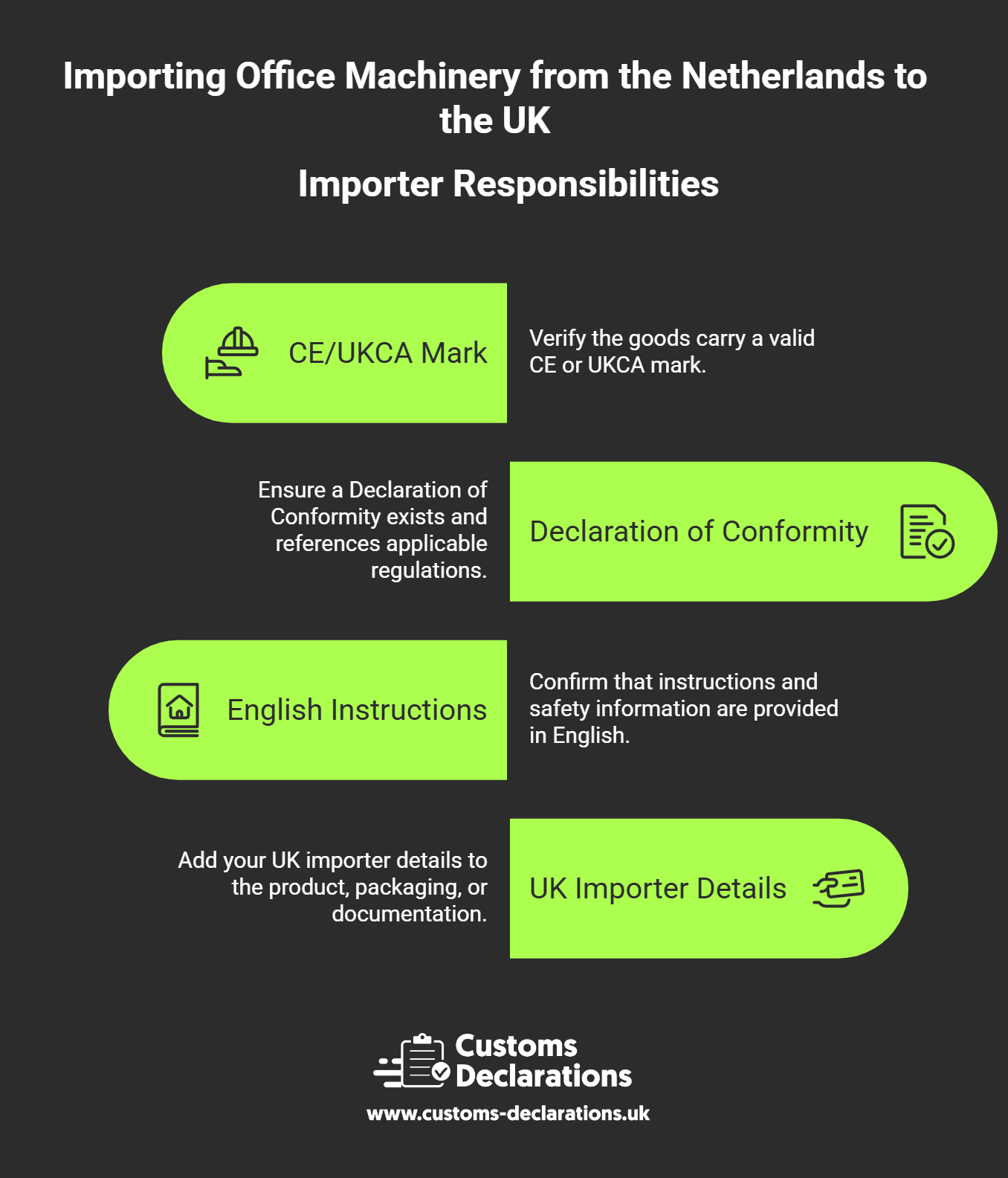

Importer Responsibilities

For products sourced from the Netherlands:

- Verify that the goods carry a valid CE or UKCA mark.

- Ensure that a Declaration of Conformity (DoC) exists and that it references applicable regulations.

- Confirm that instructions and safety information are provided in English.

- Add your UK importer details (name, trade name, address) to the product, packaging, or accompanying documentation.

Importers are legally responsible for ensuring compliance documentation is available to UK authorities. Failure to do so can result in enforcement action or the goods being denied entry to the market.

For additional reference, visit GOV.UK – Placing goods on the market in Great Britain.

Customs Valuation: The Challenge of Bundled Software

Valuing imported machinery accurately is crucial for both customs duty and import VAT. When hardware arrives with pre-installed or bundled software—such as operating systems, firmware, or proprietary control applications—importers must determine whether the software’s value forms part of the customs value.

Understanding Software in Customs Valuation

According to HMRC guidance, the value of software may be excluded from the customs value if:

- It is not integral to the functioning of the hardware, or

- It is supplied under a separate, optional licence.

However, if the software is essential for the equipment to operate—for example, firmware or an operating system installed before export—its value should generally be included in the declared customs value.

In practice:

- Pre-installed operating systems (e.g., Windows Server) are part of the hardware’s total value.

- Optional or bespoke software licences may be excluded, provided their cost is separately identified on the commercial invoice.

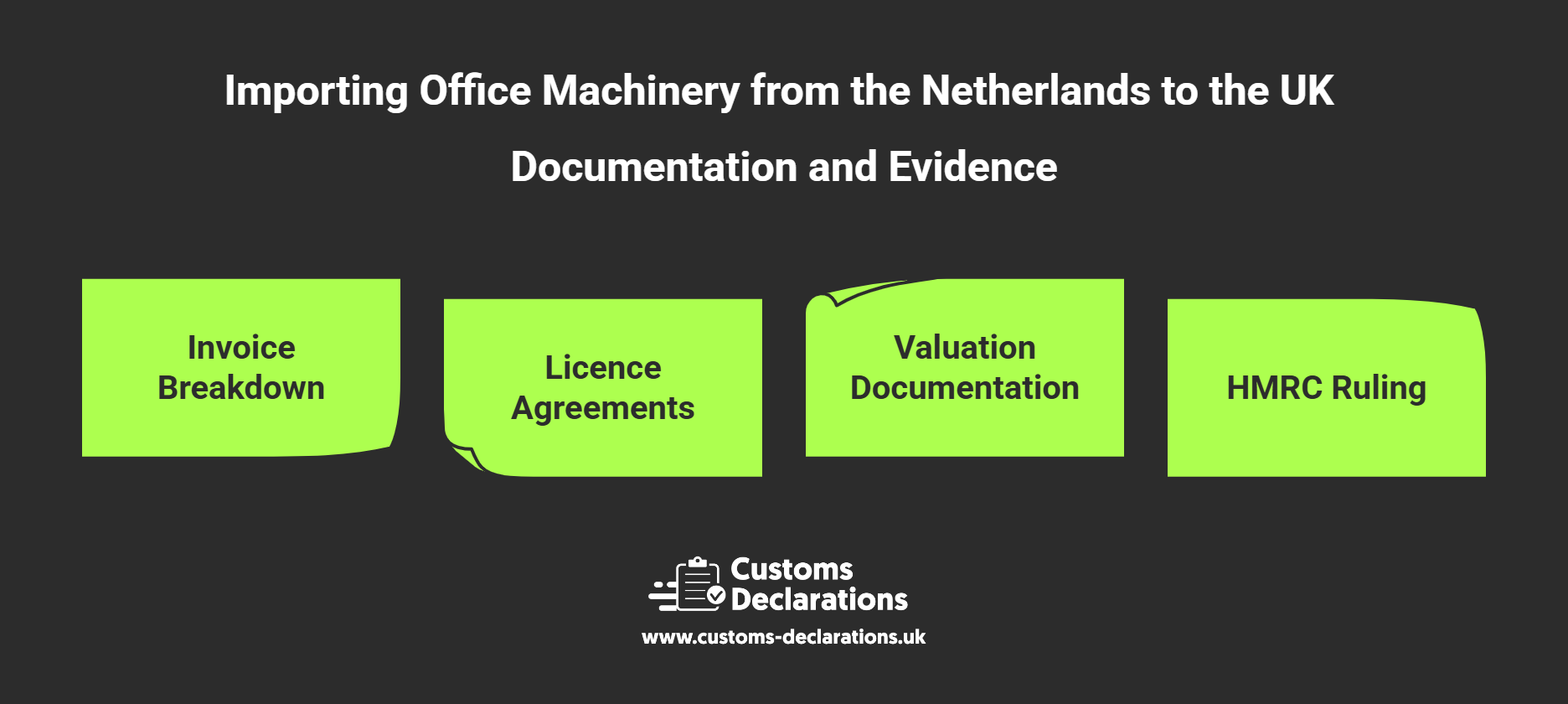

Managing Documentation and Evidence

- Ask the Dutch supplier to issue a clear invoice breakdown separating hardware and software values.

- Retain licence agreements and correspondence demonstrating whether the software is optional or integral.

- Keep transfer-pricing and valuation documentation, particularly if the supplier is a related entity.

- Consider applying for an HMRC Advance Valuation Ruling for complex or high-value transactions.

Incorrect valuation—particularly omitting software that should be included—can lead to HMRC revaluation, duty reassessment, and penalties.

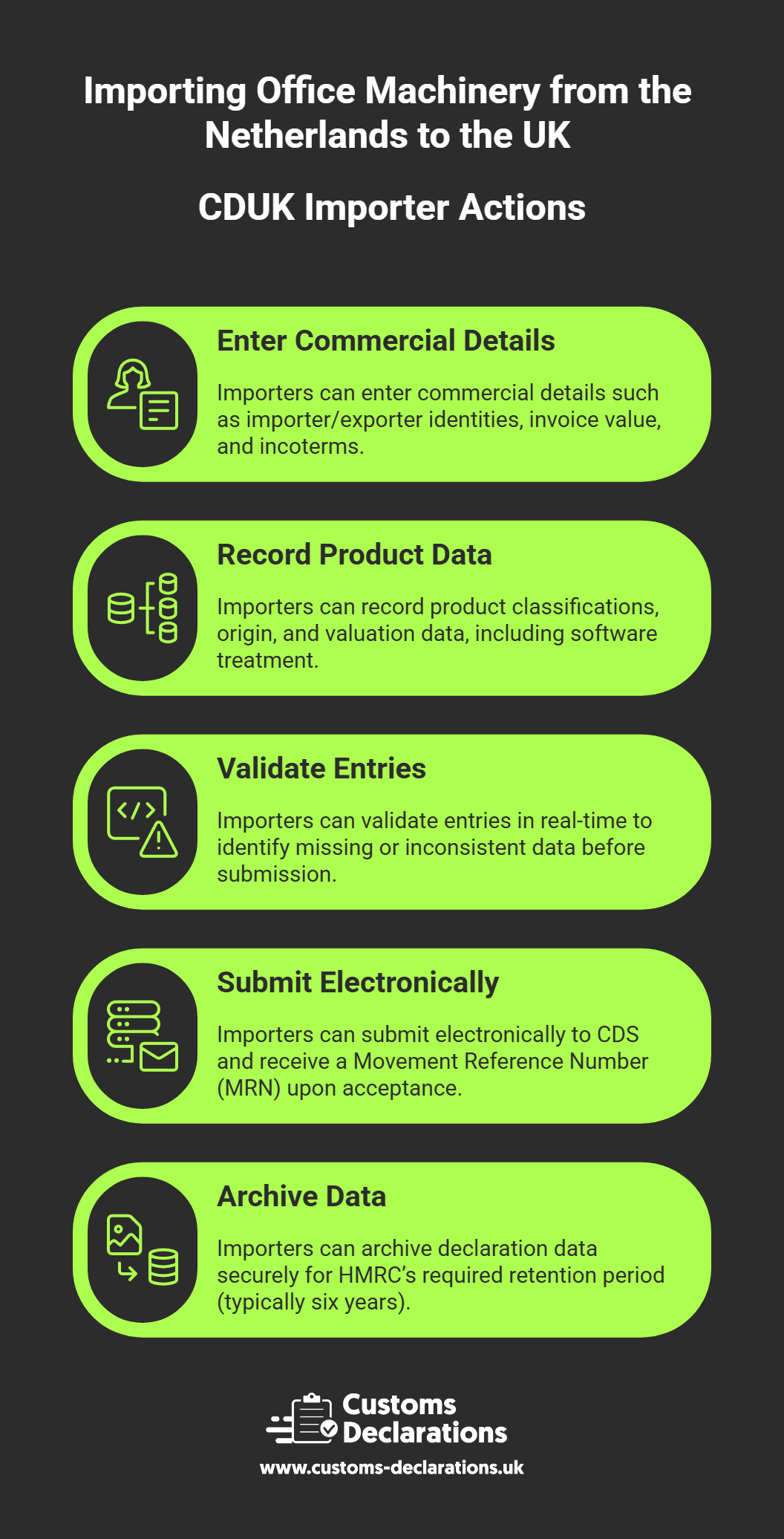

Filing Customs Declarations Using Customs Declarations UK

The Customs Declarations UK (CDUK) platform simplifies the filing of import declarations to HMRC’s Customs Declaration Service (CDS). The system provides structured, wizard-based entry screens tailored for importers of all experience levels.

Using CDUK, importers can:

- Enter commercial details such as importer/exporter identities, invoice value, and incoterms.

- Record product classifications, origin, and valuation data, including software treatment.

- Validate entries in real-time to identify missing or inconsistent data before submission.

- Submit electronically to CDS and receive a Movement Reference Number (MRN) upon acceptance.

- Archive declaration data securely for HMRC’s required retention period (typically six years).

Additionally, CDUK aligns declaration data with carrier safety and security (ENS) submissions to ensure consistency, helping prevent border delays.

Documentation and Record-Keeping

For every import, maintain a full documentary pack including:

- Commercial invoice and packing list.

- Transport documentation (airway bill or CMR).

- Declaration of Conformity and conformity marking evidence.

- Customs declaration copy (CDS entry and MRN).

- Software licence documentation and valuation notes.

Keep these records readily accessible for at least six years, as HMRC and market surveillance authorities may request evidence during audits or inspections.

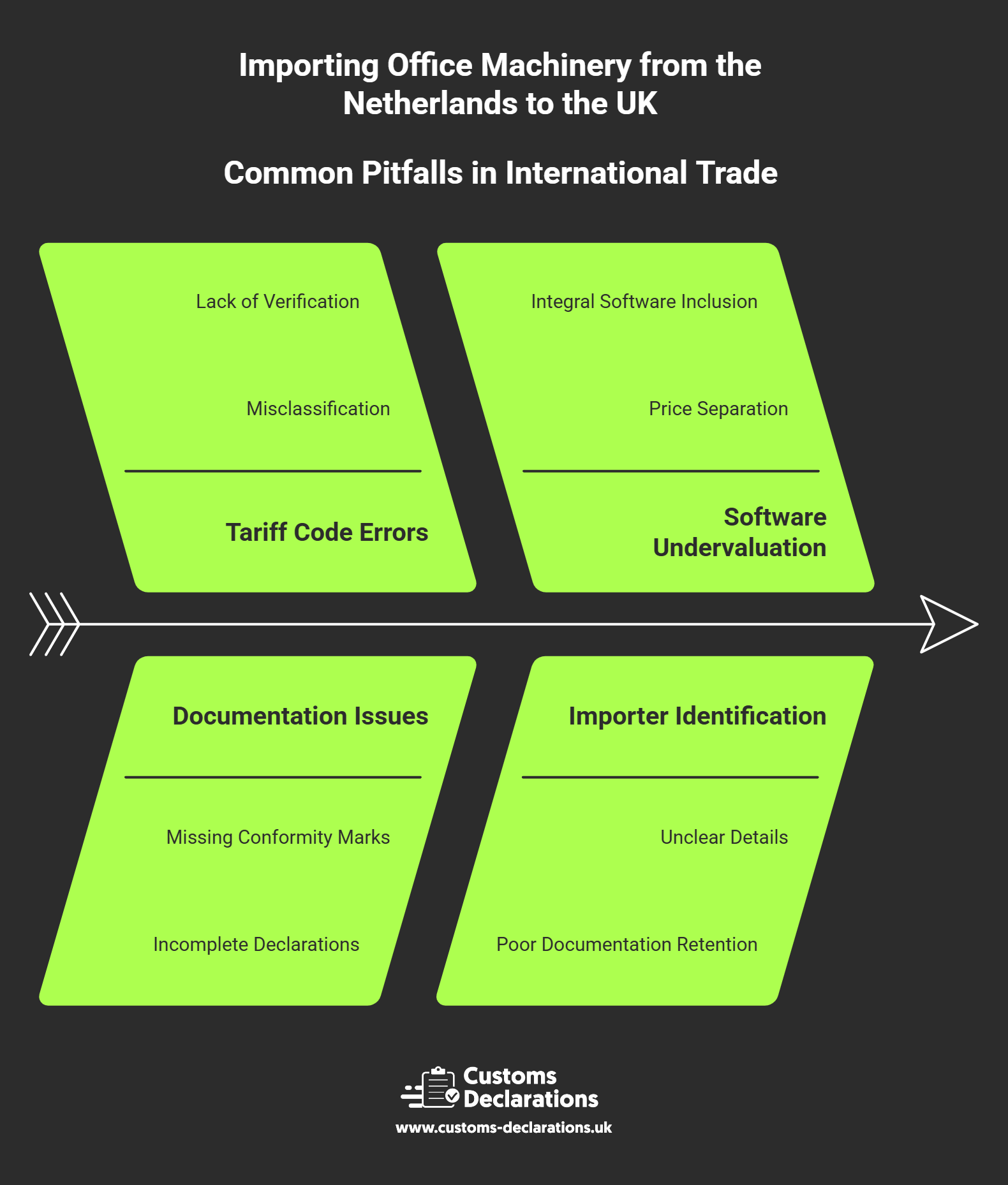

Common Pitfalls and How to Avoid Them

- Incorrect Tariff Code – Misclassification can cause delays or post-clearance adjustments. Verify using the Integrated Tariff or seek a BTI.

- Missing Conformity Documentation – Ensure all CE/UKCA marks and Declarations of Conformity are provided before shipment.

- Software Undervaluation – Clearly separate hardware and software prices. When software is integral, include it in the customs value.

- Inadequate Importer Identification – Ensure your UK importer details are clearly indicated on the product or documentation.

Poor Documentation Retention – Maintain full digital archives to respond quickly to any HMRC or regulatory query.

Conclusion: A Compliance-Centric Pathway for Smooth Imports

Importing office machinery from the Netherlands to the UK requires careful coordination across customs, valuation, and product safety disciplines. By confirming classification, ensuring conformity with CE/UKCA marking, and addressing bundled software valuation early, importers can avoid delays, reduce costs, and maintain regulatory integrity.

The process is streamlined when using the Customs Declarations UK platform, which ensures precise, validated filings into CDS while maintaining full documentation traceability. With these controls in place, UK importers can maintain confidence that their shipments from the Netherlands will clear efficiently, meet compliance standards, and sustain audit readiness.