2) The Freeport Tax Offer (Special Tax Sites)

2.1 Employer NIC relief (secondary Class 1)

To encourage hiring, qualifying new employments at a premises inside a Freeport special tax site can attract a zero rate of secondary Class 1 National Insurance Contributions up to a defined earnings threshold for 36 months per eligible employee. Typical conditions include:

- The employment begins within the government’s qualifying window for your nation (England, Scotland, Wales).

- The employee is new (no employment by you or a connected employer in the prior 24 months).

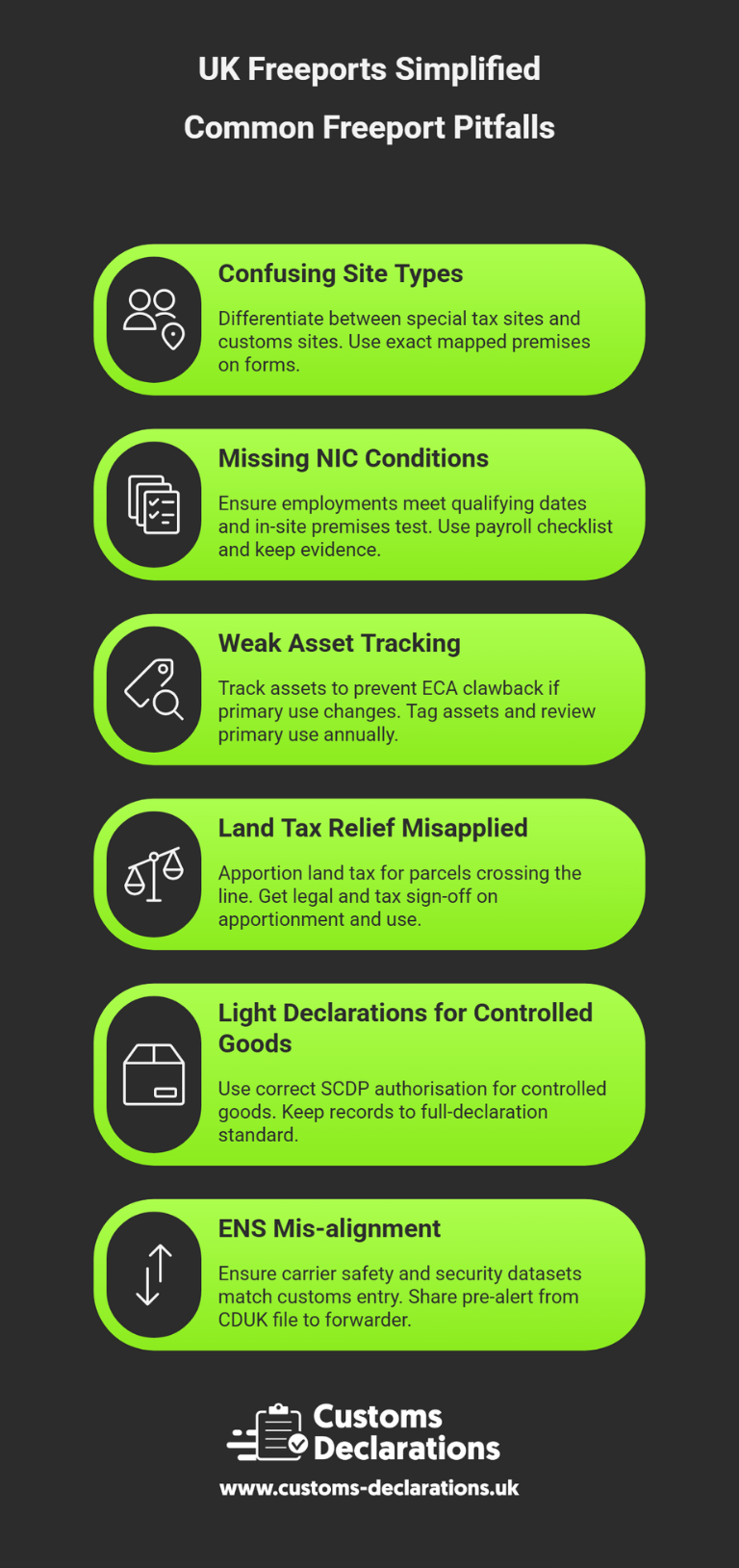

- You reasonably expect the employee to spend at least 60% of their working time at a single premises you occupy inside the special tax site.

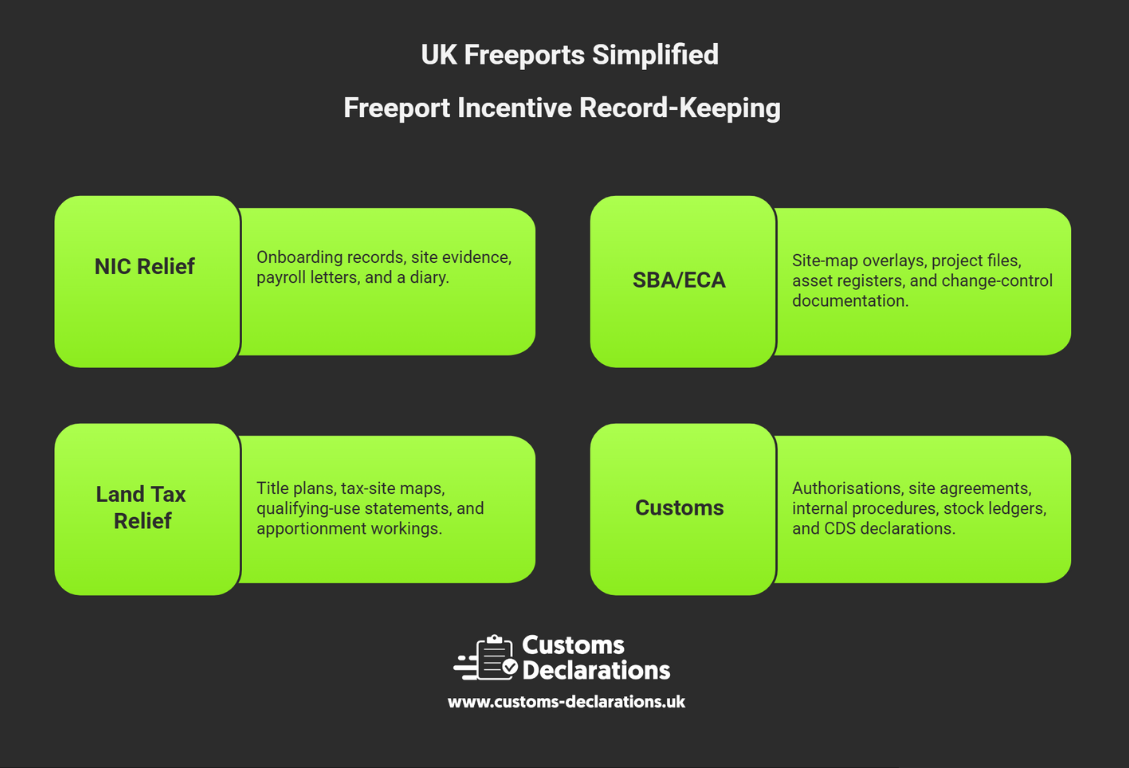

In practice, configure payroll to use the correct Freeport NIC category letters; collect and keep evidence supporting the 60% expectation (e.g., rosters, access logs, desk bookings), and calendar the 36-month stop so the relief ends on time. Build this as a documented checklist at onboarding so the evidence exists if HMRC asks you to “show, not tell.”

2.2 Enhanced Structures and Buildings Allowance (SBA)

Capital expenditure on non-residential buildings and structures used in a Freeport special tax site can qualify for enhanced SBA, accelerating the tax deduction on eligible construction, renovation, or conversion costs. Because buildings and plant are treated differently in tax, your project accounting should separate structures/buildings from plant and machinery at design stage. Keep:

- Site-map extracts proving the project sits in the special tax site,

- A cost schedule that cleanly separates building works from plant,

- Evidence of qualifying business use in the site across time.

This protects against “double counting” (claiming the same spend twice) and readies you for any later review.

2.3 Enhanced Capital Allowances (ECA) for Plant & Machinery

Companies within the charge to Corporation Tax investing in new and unused qualifying plant and machinery primarily for use in a special tax site may claim a 100% first-year allowance. This can be more valuable than general full-expensing regimes in specific scenarios but comes with site-use conditions:

- The asset must be new and primarily used in the special tax site.

- Subsequent change of primary use outside the site can trigger clawback; implement a control (e.g., an annual asset-use review) to catch moves and amend returns within statutory time limits.

- Assets made available for leasing are usually excluded (narrow exceptions exist where service is provided with an operator).

A practical tip: mark Freeport-qualifying assets in your fixed-asset register and require finance sign-off before relocation.

2.4 Land Transaction Tax Relief (SDLT/LBTT/LTT)

Acquisitions or leases of land inside a special tax site may qualify for relief from stamp-type land taxes (SDLT in England and Northern Ireland; LBTT in Scotland; LTT in Wales), subject to eligibility windows and qualifying use. If your site straddles the red line, apportion on a “just and reasonable” basis and document it. Keep title plans, site-map overlays, and a written statement of intended qualifying use through the control period. Ensure your solicitor applies the correct relief code on the return and calendars any deadlines for later evidencing.

2.5 Business Rates Relief

Local authorities can grant rates relief for qualifying premises in special tax sites, typically for a multi-year period starting from first occupation. This is highly place-specific: confirm the site’s rules and durations with the Freeport authority and your local billing authority. Keep award letters and proof of occupation.

Putting the tax offer together. In an exemplary build-out, a manufacturer acquires/leases land with Land Tax relief, constructs a building with enhanced SBA, equips the line with ECA-qualifying plant, and recruits new employees on the NIC relief—stacking incentives in a single location. The common thread is evidence. For each relief: confirm the mapped site, capture the qualifying condition in writing, and store artefacts (maps, schedules, payroll letters, invoices, fixed-asset entries) in a “Freeport file.”