Introduction

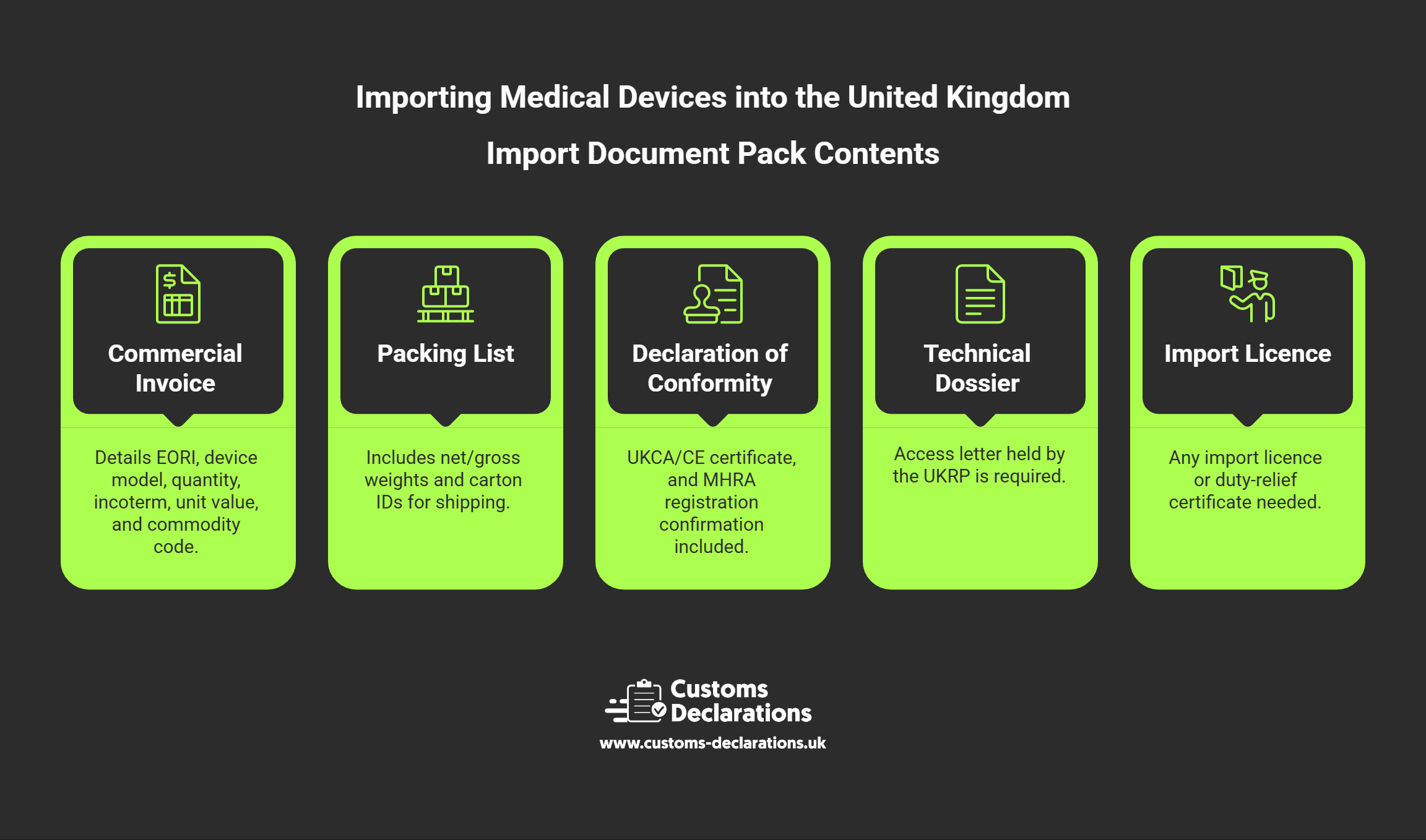

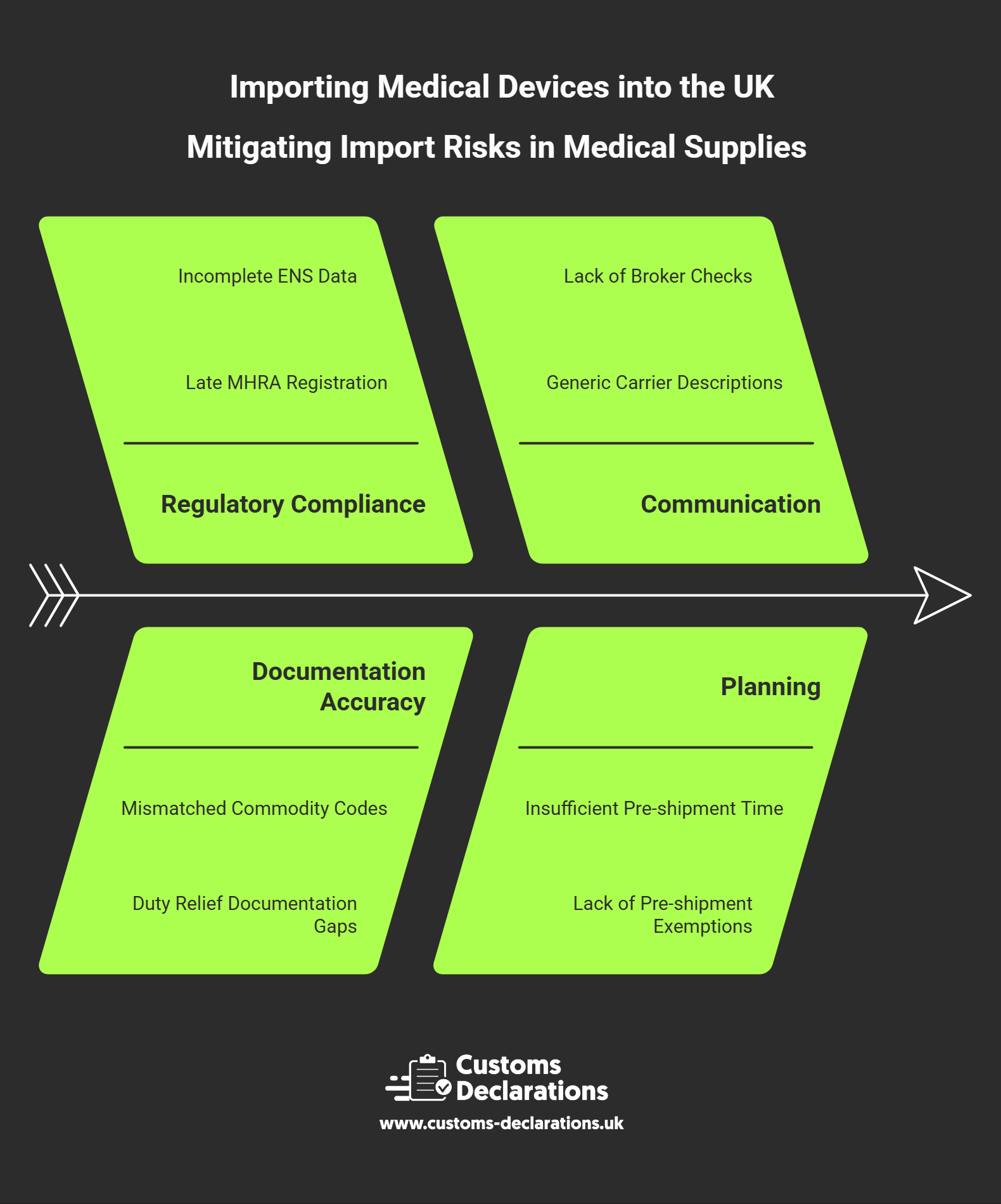

Scanners, prosthetic joints, diagnostic test kits, and surgical instruments cross the United Kingdom’s borders every day—yet the journey from factory floor to operating theatre is governed by one of the most exacting compliance regimes in global trade. Importers must demonstrate that a device satisfies the UK’s health-regulation framework and clear it through HMRC’s customs channels with an accurate, timely customs declaration. Failure on either front can delay lifesaving equipment, inflate costs, or expose firms to civil penalties. This guide synthesises current Medicines and Healthcare products Regulatory Agency (MHRA) rules, post-Brexit product-marking policy, and HMRC import practice, offering an intuitive roadmap from product registration to release into free circulation.